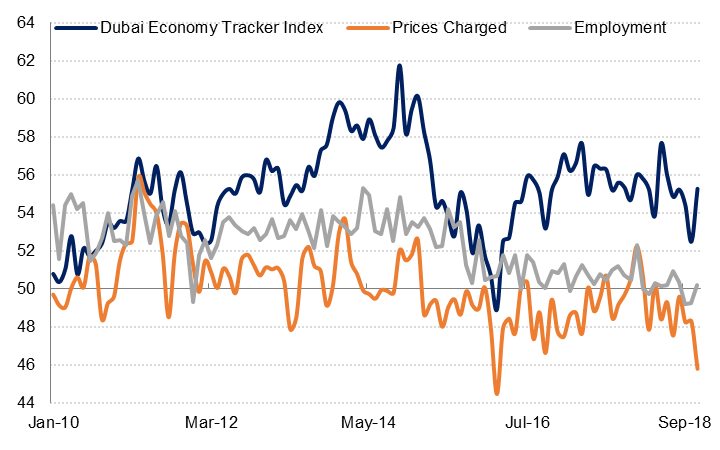

The headline Dubai Economy Tracker Index recovered from a two-and-a-half year low recorded in October, to 55.3 in November. The recovery was underpinned by a strong performance in the construction sector, although the wholesale & retail trade and travel & tourism indices also improved in November.

In the whole of Dubai survey, output and new work increased at a markedly faster rate in November, although this was likely due to aggressive price discounting: selling prices declined the most since February 2016 as nearly 17% of firms reported cutting selling prices last month. The price discounting was recorded even as input costs rose at a faster rate than in October, increasing the margin squeeze on businesses, particularly in the wholesale & retail trade sector.

Employment in Dubai’s private sector was broadly unchanged in November, after declining in the prior two months. Firms increased their pre-production inventory in November but only modestly.

The average value of the Dubai Economy Tracker Index in the year to November is 55.2, slightly lower than the average for the same period last year. Last month, we adjusted our forecast for the UAE non-oil sector growth down, and revised our oil sector growth forecast higher to take into account the recent data. The overall forecast for the UAE remains unchanged at 2.2%. However, as Dubai’s economy is almost entirely non-oil, our growth forecast for the emirate was revised lower to 2.8%, the same growth rate recorded in 2017.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research