The holiday shortened week will give investors some time to reflect about where things stand looking ahead towards the middle of the year. Certainly there is a much better mood compared to the start of the year, with concerns about global recession having faded as growth appears to have stabilised in the U.S. and China in particular. Dovish messages from central banks have obviously played their part here, so much so that we would not be surprised if markets begin to think that policymakers might have been premature in reversing their earlier hawkishness by so much. Some of the gains in equities and bond yields also reflect the markets discounting that a trade deal will be completed between the U.S. and China. Q1 earnings data which are now in full swing will also play a a role in whether market rallies will extend. The early indications paint a mixed picture. With nearly 15% of S&P 500 companies having reported earnings, the blended Q1 2019 earnings, according to FactSet, have dropped -3.9%.

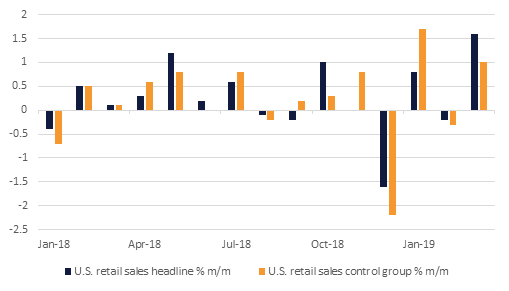

In the coming week the first estimate of Q1 U.S. GDP will likely take center stage on Friday. Growth estimates have improved substantially through Q1 following the soft patch over the turn of the year. Retail sales which rose by 1.6% in March lend further support to these more positive expectations, with the consensus expectation now seeing growth of 2.2%, following the same growth rate in Q4. Furthermore the increase in activity through Q1 will likely provide a strong start for Q2.

Dubai’s Economic Department is forecasting GDP growth of 2.1% in the emirate this year following growth of 1.9% last year, with growth accelerating further to 3.8% in 2020. We share the department’s optimism that the Dubai economy will expand faster this year than last year, and we have actually had a more positive forecast for this year than the DED driven by Expo projects being completed and on the back of increased government spending. However, our 3.1% forecast is probably a bit on the high side and may be subject to a downward revision pending the release of full UAE GDP data for 2018.

The latest data from STR global show that hotel occupancy in Dubai eased to 83.1% in Q1 2019, lower than the 85.9% recorded in Q1 2018. Revenue per available room declined -15.8% y/y in Q1 2019, as supply growth of nearly 10% y/y exceeded demand growth.

Source: EIKON, Emirates NBD Research

Source: EIKON, Emirates NBD Research

US treasuries spent the last week in a tight range. Yields on 2yr, 5yr, 10yr and 30yrs USTs closed the at 2.38% (-1bp, w/w), 2.37% (unchg), 2.56% (+1bp) and 2.96% (-1bp) respectively. Across the Atlantic, sovereign bonds added to their previous gains with yield on 10yr Gilts and Bunds closing the week lower at 1.20% (-2bps) and 0.02% (-3bps) respectively. Credit spreads inched a bp up on both US IG as well as the Euro Mian to 58bps each respectively.

There was no catalyst for GCC bonds to change. Yield on Barclays GCC index was unchanged at 4.05% on and credit spreads closed at their opening level of 159bps.

Adding to the continuing negative sentiment, S&P changed the outlook on Oman’s BB rating to negative from stable. On the positive front, Moody’s upgraded Egypt to B2/stable.

The dollar was firmer last week rising against most major currencies with the exception of the JPY and the CAD. Further signs of recovery in the US economy helped to buoy the USD, where concerns about a recession have faded whilst worries about the other economies remain. Strong retail sales and low jobless claims figures supported the USD, following weaker EU PMI figures which weighed on the Euro. USDJPY was supported by risk-on conditions, though continued to struggle over the 112 mark.

Global equity markets saw a mixed performance with gains in the US offset by declines in the UK. The S&P 500 added 0.2% thanks to solid result announcements while in the UK FTSE 100 fell by -0.15%. Euro Stoxx remained in the green adding 0.6% on Friday. Early this morning, shares in Asia are fluctuating sideways with Nikkei up 0.1% and Shanghai composite down 0.5%.

Regionally markets were mostly positive yesterday. Abu Dhabi exchange gained over 1% on the back of rising banking sector shares, Tadawul was up 0.43% and Dubai Exchange added 0.23%.

Oil markets extended their gains last week. Brent futures rose 0.6% to close the week just below USD 72/b while WTI was marginally higher and closed at USD 64/b, its seventh week in a row of gains. With few negative surprises from major economies demand concerns are receding and helping with supply constraints to propel oil higher. Brent is up 31% ytd while WTI is nearly 41% higher since the start of the year.

Reports that the US will not extend waivers to importers of Iranian crude next month have pushed prices up strongly in early trading today. Brent is up 2.5% while WTI has gained 2.3%. If confirmed by the US State department, the full enforcement of sanctions on Iran would tighten markets more considerably over the next few months.

Tightening supplies are still very much a story for Brent curves rather than WTI. Spreads in front month (1-2 month) Brent widened their backwardation last week, closing at USD 0.54/b while the same spread in WTI closed at just under neutral but still in contango. Longer spreads reflect a generally tighter market with Dec backwardated spreads in both contracts widening last week.

Click here to Download Full article