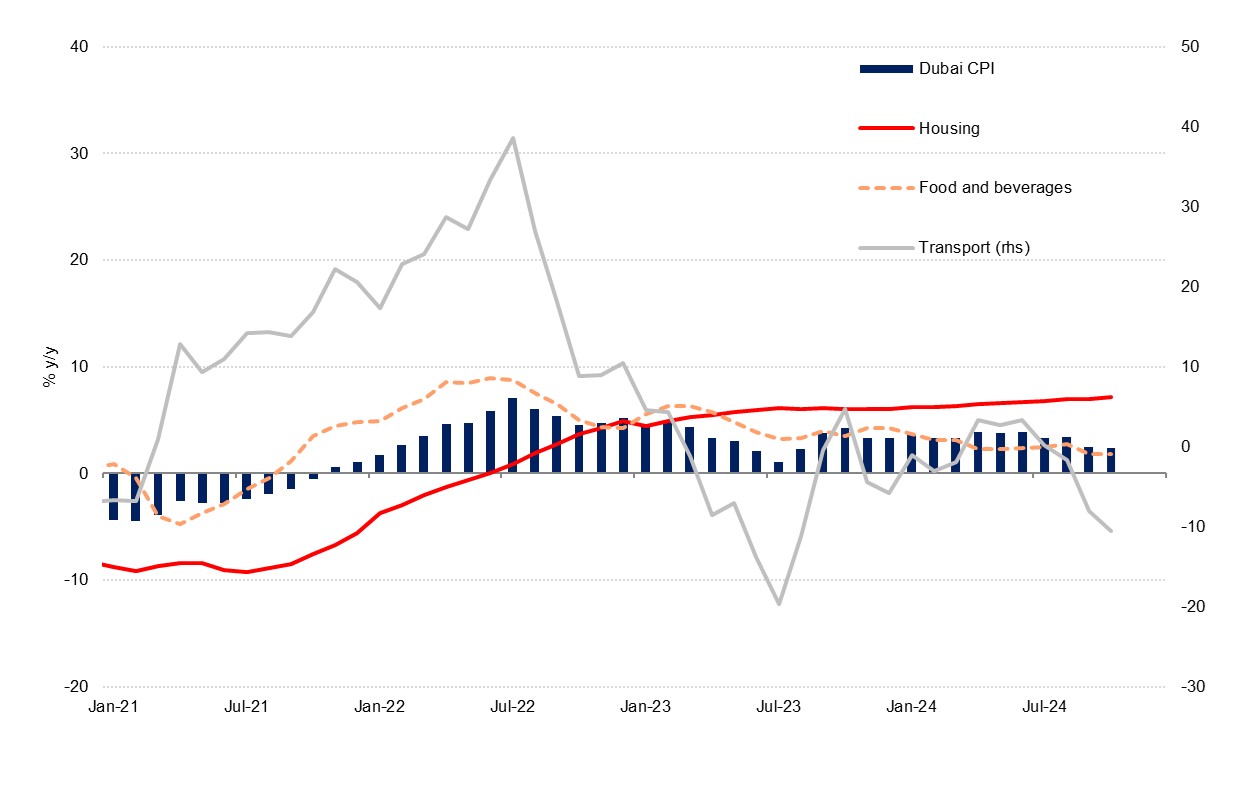

Dubai’s headline CPI inflation slowed to 2.4% y/y in October, from 2.5% in September. This was the slowest pace of annual pace growth since August 2023. Prices were 0.2% higher in October than the previous month, compared with a flat monthly print in September. Over the year-to-date, annual inflation has averaged 3.3% y/y, and we have made a modest downward adjustment to our full-year forecasts for 2024 and 2025 as the drags on inflation over the past several months are likely to persist through the remainder of this year and into the next. We now project an annual average of 3.3% and 2.8% respectively, compared with 3.5% and 3.0% previously. Easing inflation should be supportive of greater spending by households and businesses, thereby boosting real GDP growth.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research A notable drag on price growth over the past couple of months has been the transport component of the basket, which accounts for nearly 10% of the total. In October, transport prices were down -10.6% y/y, following the -8.0% registered in September. A major driver of this has been the fall in global oil prices which are reflected in prices at the pump, which account for a substantial share of the transport component. In October, the price of a litre of Super 98 petrol was AED 2.66, down 22.7% y/y, following a 15.2% y/y decline in September. Looking ahead to the November inflation print, the drag from transport has likely softened as petrol prices rose m/m for the first time since August. Nevertheless, they remain 9.6% lower than the previous year, so the annual decline will still be sizeable. Next year we forecast that Brent futures will average USD 73/b, compared with a projected USD 80/b in 2024, meaning that transport will likely continue to exert downward pressure on inflation in 2025.

There has been a notable slowdown in other components of the basket this year also as some of the spike in global prices seen in 2022 and 2023 has passed through the base and worldwide disruptions have eased. Household durables and maintenance prices were up just 0.5% y/y in October and have averaged 0.5% ytd compared with 8.3% over the corresponding period last year. Similarly, food and beverages prices were up 1.8% y/y in October and have averaged 2.6% ytd, compared with an average 4.6% over January to October last year. Trends revealed by the S&P Global PMI survey for Dubai suggest that price growth will remain low in these components as respondents from the travel & tourism and the wholesale & retail trade sectors have been cutting their prices charged to customers for most of this year as they seek to remain competitive. This largely continued even when disruptions from Red Sea shipping routes contributed to higher input costs for businesses earlier this year, and with these having now eased firms will have even greater room in which to discount.

Source: S&P Global, Emirates NBD Research

Source: S&P Global, Emirates NBD Research

As has been the case through the rest of the year, the primary force behind inflation in Dubai in October was the housing component, with prices up 0.7% m/m for the third month running and 7.2% y/y. This was a modest acceleration on the 7.0% in September and marks the fastest pace of inflation in housing in Dubai since mid-2015 as the index is increasingly reflecting capital and rental costs over the past several years. In October, capital values for apartments were on average 19.8% higher y/y while average villa prices were up by 20.24% y/y across the city (see Residential Market Monthly - November). Rental prices across villas and apartments meanwhile were up 17.3% y/y. The pace of growth will likely slow eventually but for now housing will continue to underpin headline inflation in Dubai.