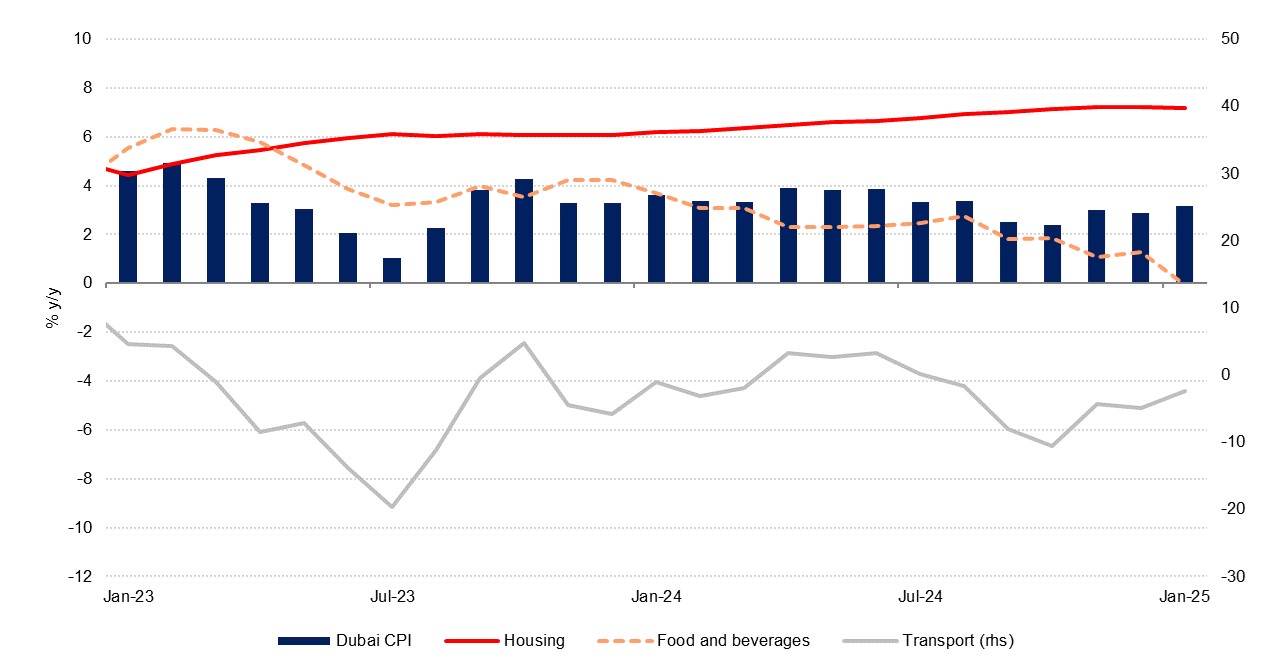

Headline CPI inflation in Dubai accelerated to 3.15% y/y in January, up from 2.89% in January. On the monthly measure, prices were unchanged. Despite the pick-up in price growth at the start of the year we anticipate that inflation will trend lower this year, forecasting an average 2.8% compared with the average of 3.3% over the previous two years. Persistent dollar strength and lower oil prices should be supportive of slower price growth, although robust economic growth, global trade war risks, and ongoing upwards pressure from housing pose upside risks to this outlook.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

The housing & utilities component of the CPI basket remains the primary inflationary driver in Dubai, with y/y inflation of 7.2% in January. This marked the fourth month in a row that this pace has been maintained, the fastest since mid-2015, with prices for the component posting a 0.5% m/m gain. This is reflective of ongoing growth in the housing sector generally, with prices across the villa/townhouse segment increasing by 3% m/m on average in January and 21% y/y (see https://www.emiratesnbdresearch.com/en/articles/residential-market-monthly-january-2025). As the largest component of the basket (41%) housing & utilities keeps the headline inflation rate higher than it might otherwise have been given that most other components are seeing either soft price increases or outright deflation.

The second-largest component of the basket is food & beverages, and here prices were down 0.1% y/y compared to 1.3% inflation in December. Prices were down 0.5% m/m. We would expect food price rises to remain moderate given the recent launch of a digital platform price tracker by the UAE’s Ministry of Economy which will enable government officials to monitor the prices of a range of essential commodities including food staples eggs, rice, sugar, poultry, bread, and wheat across different retailers.

Meanwhile transport, the third-largest component of the price basket (9%) remained in deflationary territory as prices were down 2.4% y/y even as they rose 1.2% m/m. The diminished drag from transport was the key driver of change in the headline y/y measure in January and is reflective of the petrol prices at the pump at the start of the year. Premium petrol prices were unchanged in January at AED 2.61/litre, 7.5% lower than in January 2024. In February the price went up 5.0% m/m to 2.71/litre, but this is still 5.9% lower than one year earlier. We forecast that Brent crude will average USD 73/b in this year, compared with USD 80/b in 2024, meaning that this drag from transport prices will likely persist to some degree throughout the year.

General dollar strength and a competitive market for businesses has helped keep price growth in the other components of Dubai’s CPI basket soft through the past 12 months and we would expect this trend to be maintained through the rest of the year. There are some upside risks to the outlook, however, not least from global developments in trade that could prompt an uptick in global inflation from which the UAE would not be immune. Robust economic growth – we forecast real GDP growth of 3.7% in Dubai this year, up from an estimated 3.2% in 2024 – could also generate upwards momentum in prices as demand accelerates, and the S&P Global PMI survey for January showed businesses raising their output prices for the second month running, bucking a recent trend for cutting prices charged.