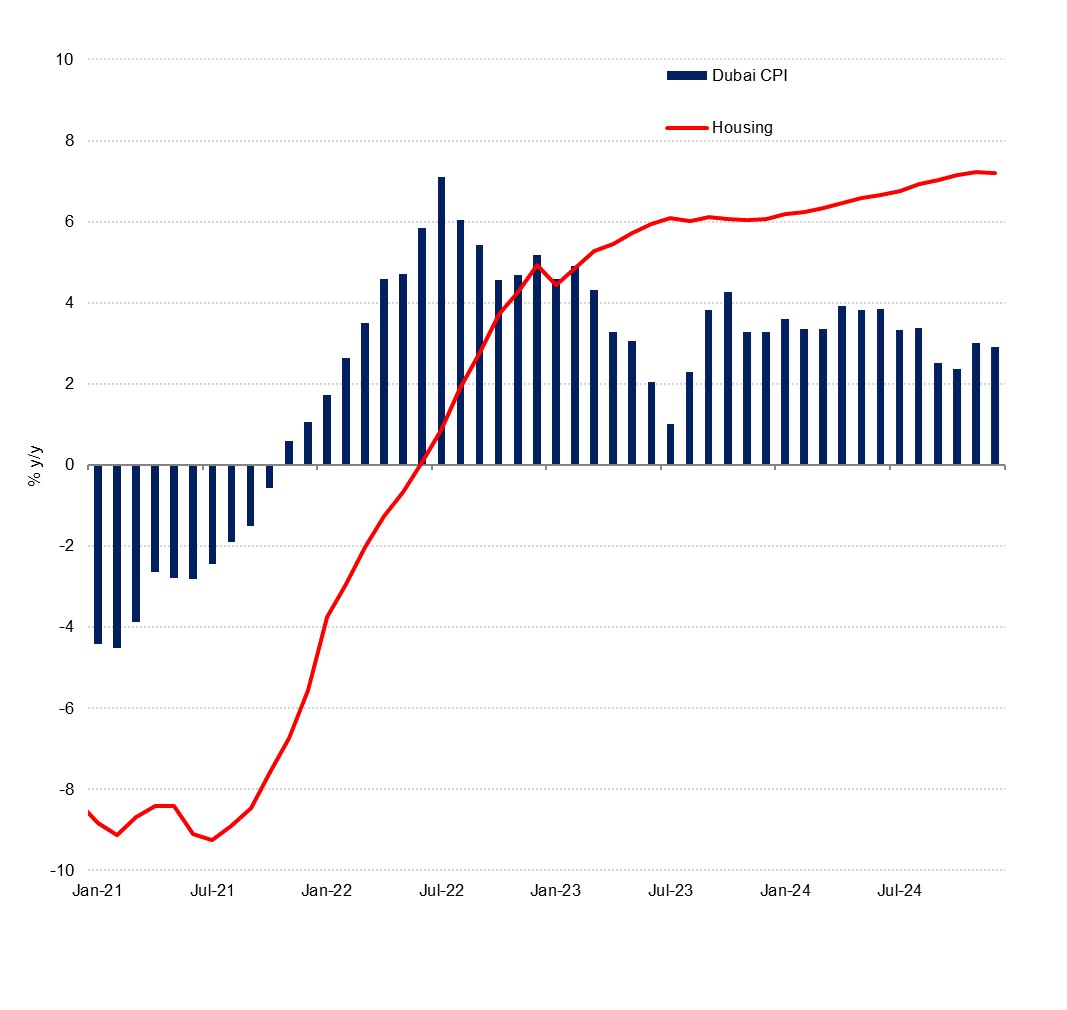

Dubai CPI inflation slowed to 2.9% y/y in December, down from 3.0% in November. This puts the 2024 average at 3.3%, unchanged from 2023 and compared with 4.7% in 2023. This year we forecast that annual inflation will slow to an average 2.8% y/y; transport is set to remain a drag on the headline measure and a strong dollar will be supportive of lower price pressures in other components of the basket, though this will be offset to a degree by ongoing upwards pressure from housing.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD ResearchTransport, which accounts for around 10% of the CPI basket, continued to pull headline annual inflation lower in December as prices were down 4.9% y/y, compared with a 4.3% drop in November. The drag is not as sizeable as it had been earlier in Q4 2024 (transport prices were 10.6% lower y/y in October) as the base effects around lower oil prices, and by extension petrol prices, were not as large. Nevertheless, the price of Super 98 petrol in December was down 11.8% y/y in December and in January this year autos fuel prices were left unchanged with Super 98 at AED 2.61/litre, 7.5% lower than in January 2024. We forecast that Brent crude will average USD 73/b this year, down from USD 80/b in 2024, meaning that the transport component of CPI should continue to exert downwards pressure on the headline measure.

Aside from transport, most other components of the CPI basket also remained soft in December. Food and beverage prices were up 1.3% y/y, up from 1.1% in November, but tobacco, restaurants and accommodation, information and communication, and clothing and footwear were all in deflationary territory once again. There are a number of factors supporting the soft price rises, not least ongoing dollar strength with the greenback recording a remarkable run through the final quarter of 2024, hitting multi-year highs against a number of key peer currencies over the past several months. Given expected interest rate differentials, the stronger growth story in the US, and ongoing political uncertainties in many countries we anticipate that dollar strength will persist in 2025, which will help to keep price pressures down.

Another factor that has kept prices pressures soft has been ongoing competitiveness in Dubai business which has kept firms from raising prices even in many cases as their margins have been squeezed. The latest PMI survey for December showed that firms did raise their output prices but this was for the first time in three months and was only at a modest pace. Meanwhile, the disruption to Red Sea shipping and the impact it had on shipping costs has already diminished and is likely to be less of a salient factor in firms’ input costs in 2025.

While most components of the CPI basket are seeing only modest rises or are outright deflationary, housing will likely continue to keep the headline measure in positive territory through 2025, especially as it is the largest component of the basket, accounting for around 40%. In December, housing prices were up 7.2% y/y, a consistent pace from October and November. The housing component of Dubai’s index recorded average growth of 6.7% y/y in 2024. Rental and purchase costs for housing continue to rise in Dubai and when compared to December 2020, average prices across apartments are now 65% higher while villa/townhouse average rates/sq. ft. have more than doubled.