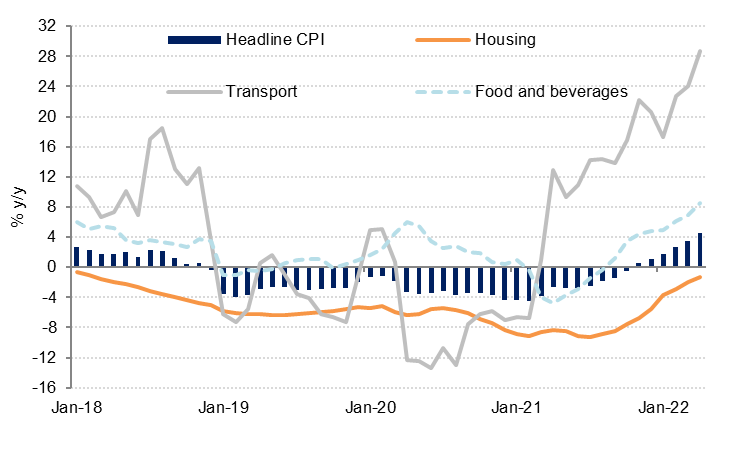

Consumer inflation in Dubai accelerated to 4.6% y/y in April according to new data from the Dubai Statistics Centre, the highest reading since May 2015. Consumer prices rose 1.2% m/m in April, the biggest monthly increase since January 2018.

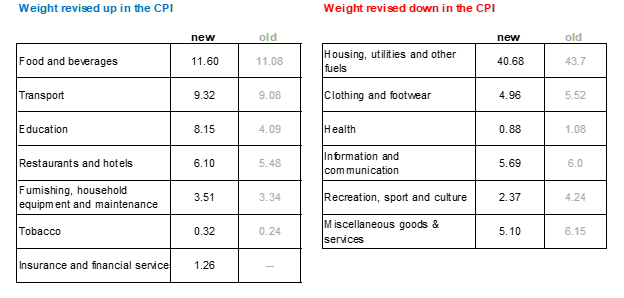

The statistics agency has re-based the time series to 2021 (from 2014 previously) and as a result, the weights of the components making up the consumer price index have changed. The biggest revisions were to the weights of housing (down) and education (up). Housing now accounts for 40.68% of the CPI basket, down from 43.70% previously. Education now accounts for more than 8% of CPI, double what it did before. Changes to the weights of other components are shown in the tables below. A new category for “insurance and financial services” has been introduced into the CPI basket, which was likely previously included in “miscellaneous goods and services”, with a weight of 1.26%.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

The main driver of inflation in Dubai in recent months has been transport costs, which were up 28.8% y/y in April, accounting for around half of headline inflation. Food prices (8.6% y/y) were the second biggest driver of inflation in April, followed by recreation & culture costs and restaurant & hotel prices. The only component of the CPI basket which declined on annual basis in April was housing & utilities, but even here the rate of decline has slowed and we expect housing inflation in the CPI to turn positive in the coming months.

We maintain our forecast for UAE inflation to average 4.3% in 2022 as higher food, housing and services costs feed through to the CPI, even as a stronger dollar helps to keep goods inflation contained.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research