Dubai’s Executive Council has approved a number of measures to boost growth and attract investment, including reducing municipal taxes on businesses; waiving some fees on the aviation industry and fines on late property registration; and freezing private school fees for the coming academic year. The measures were broader in scope than we had expected following the instructions by the ruler Sheikh Mohammed bin Rashid last month for the government to reduce the cost of doing business in the emirate and take steps to accelerate economic growth. The new measures should offer some relief for businesses across all sectors as well as providing a boost to the key transport and logistics sector. The freeze on school fees will be welcomed by households and help to offset the impact of VAT and higher fuel costs this year. We retain our 3.8% growth forecast for Dubai this year, up from 2.8% in 2017.

In a surprise move, the Reserve Bank of India (RBI) hiked repo rate by 25 bps to 6.25% even as it retained a ‘neutral stance’. The decision was unanimous with the central bank highlighting upside risks to inflation even after accounting for the recent increase in oil prices, and upbeat growth prospects, saying that the output gap has almost closed. The RBI also raised its inflation forecast slightly to 4.8% - 4.9% (versus the earlier estimate of 4.7% - 5.1%) for H1 FY 2019. The rate decision appears to be a pre-emptive move and the neutral stance leaves the RBI with the option of staying put should further upside risks to inflation not materialize.

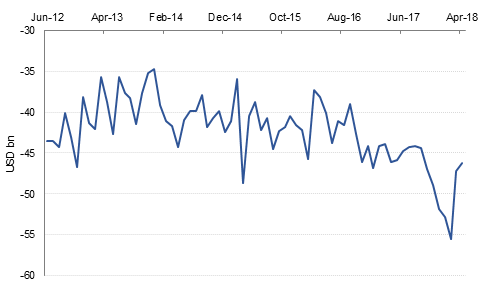

Eurozone bonds sold off and the euro rallied on comments by the ECB’s Chief Economist that the bank would formally discuss ending the QE program soon, most likely at next week’s meeting. The market had been expecting this discussion to take place later this year, and there had also been some concern that the ECB may delay even further on the back of the political developments in Italy. Finally, the US’s April trade deficit was smaller than forecast at USD 46.2bn, the lowest in 7 months. However, the trade deficit with China widened to USD 388bn, and the US’s deficit with Germany, Mexico and Japan also widened. G7 leaders meet in Canada tomorrow, with trade policy likely to dominate the discussion.

Treasuries continued to take cues from moves in European bond markets. Treasuries followed European bonds lower as ECB speakers including Praet and Hansson sounded hawkish ahead of the ECB meeting next week. Yields on the 2y UST, 5y UST and 10y UST closed at 2.51% (+2 bps), 2.80% (+4 bps) and 2.97% (+5 bps). Yield on 10y bunds rose +8 bps to 0.465% and +11 bps on 10y France bond yield to 0.80%.

Regional bonds drifted lower following move in benchmark yields. The YTW on the Bloomberg Barclays GCC Credit and High Yield index rose +2 bps to 4.62% but credit spreads tightened 3 bps to 185 bps.

The 5y Bahrain CDS rose 12 bps to close above 400 for the first time since July 2016. The Bahrain 29s closed at USD 84.88, nearly 1 point lower since the start of June 2018.

AUD was Wednesday’s top performer, advancing in the aftermath of stronger than expected growth data. A report from the Australian Bureau of Statistics showed that economy grew at a faster than expected 1.0% q/q (3.1% y/y) in Q1 2018, up from 0.5% q/q (2.4% y/y), the previous quarter. The gains meant that AUDUSD closed above the 50 day moving average (0.7606) for a third consecutive day. The next level of resistance can be expected at 0.7690, not far from the 38.2% one year Fibonacci retracement (0.7689). However, softer than expected trade data has resulted in some of these gains being pared. A report from the Australian Bureau of Statistics showed that Australia’s trade balance narrowed from AUD 1731mn in March to AUD 977mn in April. As we go to print, AUDUSD is trading 0.13% lower at 0.76565 during the Asia session. Should we see a fourth consecutive close above the 50 day moving average, the risk of a break of the 38.2% one year Fibonacci retracement and an advance towards the 100 day moving average (0.7731) will increase.

Developed market equities closed higher as economic data in the US continued to remain strong. The S&P 500 index added +0.9% while the Euro Stoxx 600 index closed flat.

Regional equities closed mixed with the DFM index adding +0.4% and the Tadawul losing -0.3%. Consumer sector stocks in Saudi Arabia outperformed the broader index with Sadafco adding +6.1% and Savola +1.2%. The announcement of fiscal stimulus by Abu Dhabi helped stocks in the UAE. First Abu Dhabi Bank added +0.4% and Emaar Development gained +1.3%.

A bearish EIA report weighed on crude prices yesterday and put more downward pressure on the WTI/Brent spread. Brent futures closed nearly flat while WTI lost more than 1.2% to end the day at USD 64.73/b. The spread between the two benchmarks widened to USD 10.63/b and is now trading even wider. Total petroleum stocks rose by more than 15m bbl last week, including a build in crude stocks. Meanwhile US production rose to 10.8m b/d, up nearly 1.5m b/d y/y.