The Dubai government announced a third fiscal stimulus package worth AED 1.6bn on Sunday to support businesses in the emirate. The latest measures waive penalties owned by some businesses as well as releasing construction sector deposits/ guarantees and customs clearance deposits back to businesses. The latter measure should provide a cash boost to businesses, improving their liquidity positions. In addition, hotels will be allowed to retain 50% of the municipality tax and tourism fee they collect on behalf of the government. Private schools will also be able to renew their licenses at no cost this year.

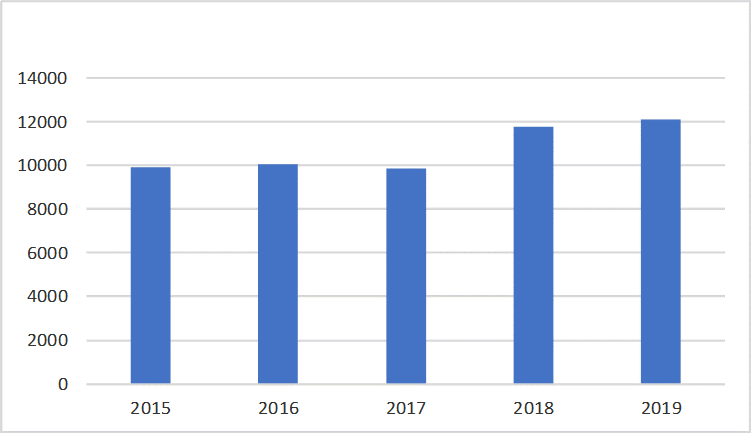

Kuwait’s government has submitted a public debt law to parliament, asking it to approve borrowing of KHD 20bn (USD 65bn) over thirty years, including KWD 8bn to finance this year’s budget deficit, which we estimate could exceed -20% of GDP. If parliament fails to approve the debt law, the government is reportedly considering selling assets held by the General Reserve Fund to the Future Generations Fund to finance the budget deficit. Separately, data from CBK showed the current account registered the highest surplus in the last five years at KWD 6.7bn, or 16% of GDP in 2019, compared to a surplus of KWD 6.0bn in 2018. The data also showed that CBK’s official reserves increased by KWD 0.8 billion in 2019 to KWD 12.1bn.

Data released by the People's Bank of China (PBOC) on Friday showed new bank lending in China rose 22.3% m/m in June, as Chinese authorities continued to boost credit and ease policy to get the world's second-largest economy engine started again after the coronavirus-induced downturn. Chinese banks lent out CNY 1.81tn in new yuan loans in June, up from CNY 1.48tn in May. This brings bank lending in the first half of this year to a record CNY 12.09tn, beating a previous peak of CNY 9.67tn yuan in the first half of 2019. The PBOC has rolled out a numerous measures since early February, including cuts in lending rates and banks' reserve requirements and extending targeted lending support for virus-impacted firms. However unlike many central banks, it has not slashed interest rates to zero or embarked on huge bond buying sprees. PBOC Governor Yi Gang said last month new loans could reach nearly 20 trillion yuan for the full year.

Source: Central Bank of Kuwait, Emirates NBD Research

Source: Central Bank of Kuwait, Emirates NBD Research

Fixed Income

Treasury markets continued to hold on to the narrow range they’ve moved in for most of the past three weeks with yields on 2yrs Treasuries oscillating between 0.15% and 0.2% and 10yr Treasuries trading a range from 0.6%-0.7%. Hope that a Covid-19 treatment would be highly successful helped to push yields on 10yr USTs up at the end of the week, closing at 0.645% although the still closed lower over the five days. As the number of Covid-19 cases continues to move higher in the US—and is accelerating sharply in some states—investors will maintain a healthy appetite for risk-free assets, even as equities keep testing higher.

EM bonds extended their gains, rallying for an 11th consecutive week despite the virus taking hold firmly in some emerging markets. Brazil, India, Russia and several Latin American countries all have elevated case levels and the gains in EM bonds look to us more of a reflection of the improvement in oil prices rather than strength in the underling economies. Local bonds denominated in USD also extended their gains with the BUAEUL index up by 0.2% last week. Spreads were marginally higher but have stabilized at around 225bps.

At the end of last week, ratings agency S&P downgraded the credit ratings of Emaar, subsidiary Emaar Malls and DIFC Investments Ltd to BB+ from BBB-, citing subdued demand for property and a sharp contraction in the economy this year. S&P retained a negative outlook for Emaar and Emaar Malls, and a stable outlook for DIFC Investments Ltd.

FX

Last week saw the dollar continue to operate in a downwards trend. The DXY index declined by over -0.53% overall and closed at 96.656. A break below the weekly low of 96.235 in the upcoming days would be a clear indicator that the trend is set to continue. USDJPY followed a similar pattern, with the pairing slipping -0.54% overall to finish the week at 106.92.

The euro continued its positive form, recording modest gains of +0.54%. Thursday saw the currency reach a weekly high of 1.1370 before meeting resistance, but still continues to operate around the 1.1300 level. Sterling rallied by over +1.20% to trade at 1.2622 as market mood in the U.K. improves, even after comments on Friday from British Prime Minister Boris Johnson stating that they cannot be certain about a V-shaped recovery. The AUD experienced very erratic movement over the week, touching highs of 0.6997 on Thursday, but was met with resistance and has consolidated some modest gains at 0.6949. The NZD was more positive, increasing over +0.95% to finish the week at 0.6574.

Equities

U.S. stocks finished higher Friday, closing the week with gains, as investors turned a blind eye to worries about a fresh wave of coronavirus infections and its impact on the economic recovery. The Dow Jones Industrial Average advanced 369.21 points, or 1.4%, to 26075.30. The S&P 500 rose 32.99 points, or 1%, to 3185.04. The Nasdaq Composite climbed 69.69 points, or 0.7%, to 10617.44, a fresh record for the technology-heavy index. Financial stocks were the S&P 500’s best performers Friday, rising 3.5% in a sign that risk-seeking investors were snapping up economically sensitive stocks. Energy stocks also outperformed, boosted by an uptick in oil prices. Technology and health-care stocks in the S&P 500, were the only sectors to close in negative territory. European stocks posted gains, with the Stoxx Europe 600 index rising 0.9%. Asian markets ended mostly lower as China’s recent market rally lost steam.

Commodities

Oil markets recorded a mixed performance last week with Brent managing to extend gains by 1%, settling at USD 43.24/b, while WTI was marginally lower over the week, closing at USD 40.55/b. Both contracts got a boost on Friday in line with most other markets on hope that a new treatment would be effective in treating Covid-19.

Oil curves turned decidedly downward last week with the contango in both the Brent and WTI markets widening across the curve. Front-month spreads both settled at around USD 0.22/b for 1-2 month contracts while December spreads are pushing back to a USD 2/b contango.