The US dollar has swung higher against all peer currencies in the third quarter of the year and there looks to be little near-term resistance to it testing higher levels. The strength in the dollar looks to be a function of a revaluation of the prospects for the US economy and in particular an expectation that the Federal Reserve could extend its rate hiking cycle or at the very least keep rates at an elevated level for an extended period. We expect that dollar strength to persist until the end of the year while the outlook for 2024 will see some modest moves lower for the dollar.

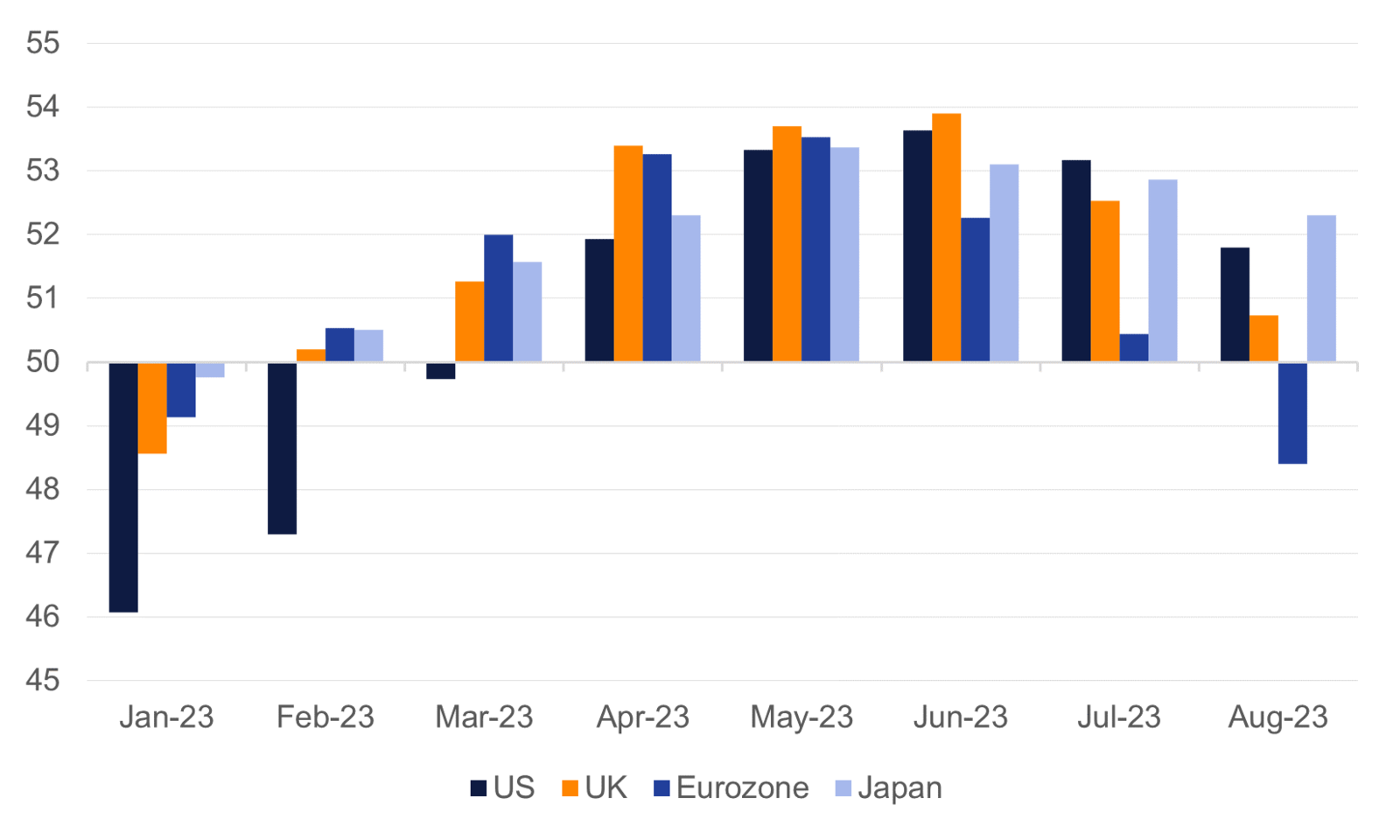

Despite the salient threat of a recession, the US economy has been an outperformer compared with peer developed markets. Near-term indicators like PMI surveys have shown the US not necessarily being an outperformer compared with markets like the Eurozone or UK but showing a much wider swing from weaker performance at the start of the year to healthier reading in more recent prints. On a rolling three-month average, the US composite PMI of 51.8 as of August compares favourably with the 50.7 level in the UK or 48.4 in the Eurozone where the beleaguered German economy is dragging down performance.

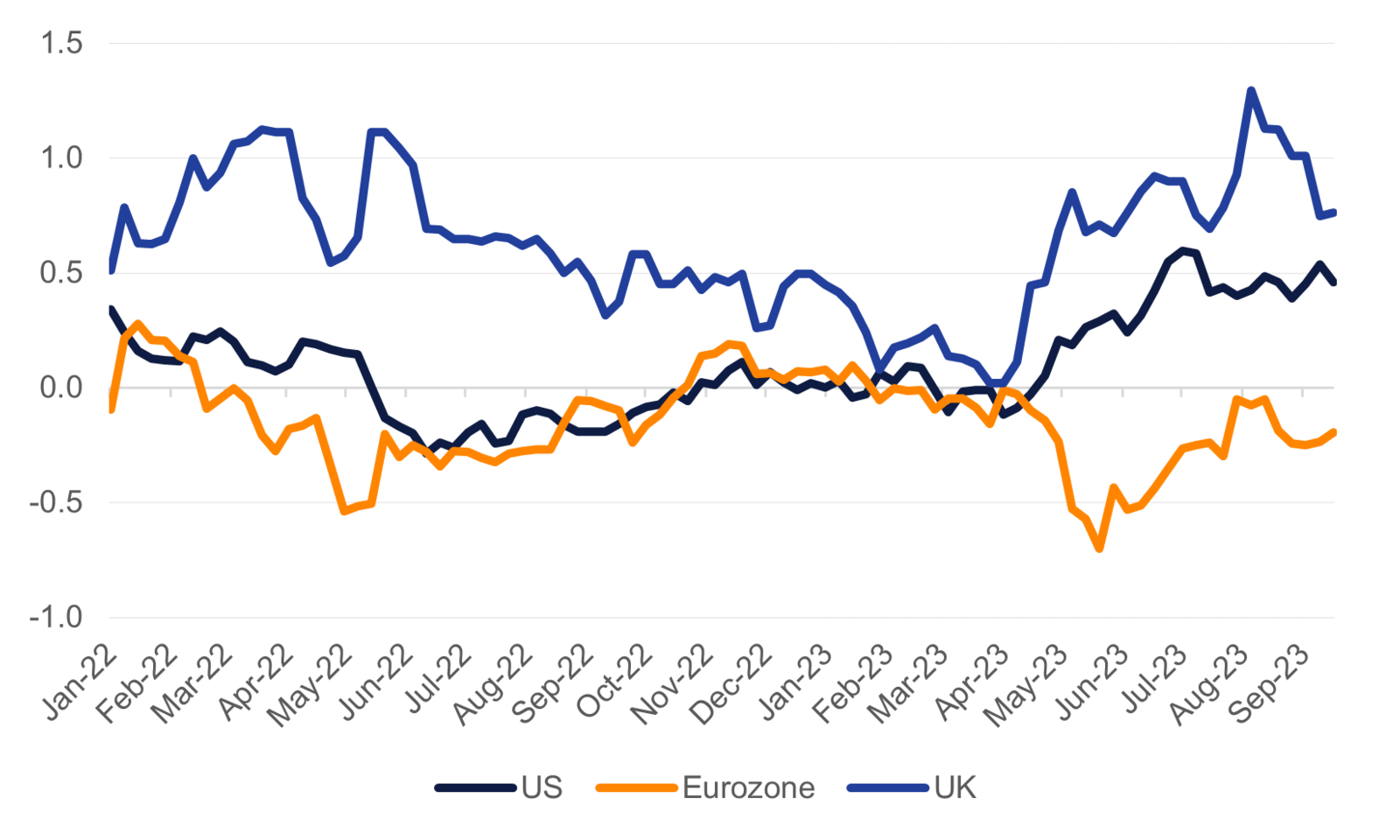

Other data signals from the US point to an economy seemingly more resilient to how high rates have moved and to high, if slowing inflation. US data has surprised to the upside throughout the last several months, outpacing negative surprises from the Eurozone data as measured by Bloomberg surprise indexes.

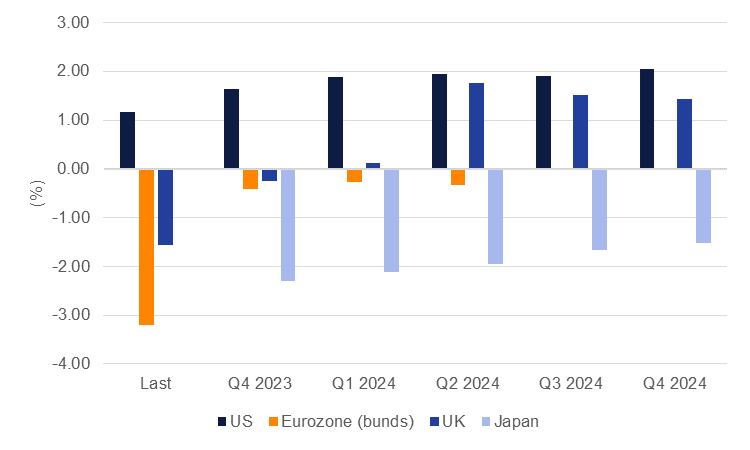

The better-than-expected performance of the US economy has cut the probability of a recession in the next 12 months to 55% based on consensus expectations, down from 65% earlier in Q2. That has also raised expectations that the Fed could continue to hike rates—we expect that it has brought its rate hiking cycle to an end—and pushed back pricing of rate cuts into later in 2024. On a nominal basis, the Federal Reserve stands ahead of the European Central Bank and Bank of England with the Fed funds rate at 5.5% on the upper bound compared with policy rates of 4% in the Eurozone (ECB Deposit Facility) and 5.25% for the UK (Bank of England Bank Rate). We expect rate cuts from the Fed to begin at the end of H1 2024 with a 25bps expected for the June 2024 FOMC, narrowing the nominal differential between the Fed and its peers. However, the cut will be brought about by the Fed moving to normalize real policy rates, rather than switching to an accommodative policy stance.

Real policy rates in the US switched into positive territory (based on headline CPI) in April this year and are set to end September at close to 2% if inflation slows as expected. Provided the current disinflation trend in the US holds true, policy rates will move higher in real terms over H1 next year, approaching 3% based on current market expectations. Headline CPI is set to trend lower in the months ahead, though likely at a slower pace than we’ve seen for most of this year as many of the easy inflation wins, like goods disinflation, won’t be repeated. However, housing costs are set to decline as the rental market cools and will help to take some of the strength out of services inflation.

Inflation-adjusted yields in the US have also turned positive for the first time since 2019 and are higher than inflation-adjusted 2yr yields in the Eurozone or UK which remain substantially negative. On an implied yield basis, inflation adjusted yields will still appear favourable for the US over 2024, particularly against JPY and EUR. Based on consensus inflation expectations for the UK, gilt yields should switch to meaningfully positive in real terms by Q2 2024 though the starting point for UK inflation remains high.

There seems to be little in the way of the dollar testing stronger levels, at least over the next several months, as data and market tone appears to favour the US dollar. We are adjusting our currency assumptions to reflect continued US dollar strength until the end of 2023. For 2024, the US data has more room to disappoint while the threat of a recession will cap upside potential for yields. The swing in real yields should also provide support for GBPUSD in particular, provided inflation does indeed move lower. A recovery in EURUSD will take longer but provided global growth and risk sentiment improves later in the year, it may stand to benefit. USDJPY looks set to remain at historically weak levels until there is a switch to anything approximating tighter monetary policy.