.jpg?h=457&w=800&la=en&hash=87D1771E6539B6DB3E708753BE0DF840)

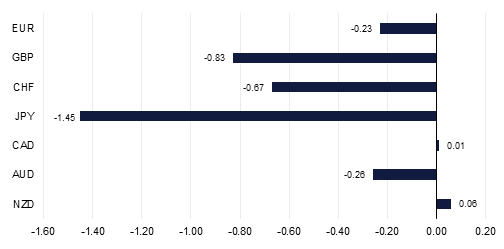

Holidays in the UK, Europe and many other parts of the world will dominate at the start of the week, reducing activity and liquidity across markets. The dollar had a stronger end to last week than at the start, recovering from its early week lows as the quarter-end helped sentiment, even as the Chicago PMI data and the Michigan consumer sentiment data were disappointing. In particular GBPUSD dropped sharply back to 1.40 from highs of 1.4250 seen at the beginning of last week. However, over the quarter as a whole the USD lost value, marking its fifth quarterly decline. Beyond the holidays the short term macro focus in the week ahead will be on PMI activity indicators, while US payrolls figures at the end of the week will be the highlight and inflation data will also feature. However, FX market reactions may be driven more by policy messages and politics rather than specific data points, with the overhang from weak equities and bond markets during the quarter also a likely factor, especially with technology companies still under a cloud. The Q1 earnings season looms next week as a near-term influence, with Fed Chair Powell due to speak on the economic outlook towards the end of this week and central bank decisions due in India and Australia.

EURUSD ended the quarter at 1.2324, down from early week highs close to 1.25, and only a little above our 1.22 end-Q1 forecast. Quarter-end dollar repatriation was rumored to have been a factor, and suggests that the EUR will face more consolidation before being able to break out of its current 1.20-1.25 range. The ECB has started to signal a rate hike for next year, which suggests that asset purchases will be phased out later this year, although Draghi may wait until July before indicating this. This week's data highlight is the preliminary Eurozone HICP inflation reading for March (Wednesday), where an acceleration in the headline rate to 1.4% y/y is expected from 1.2% y/y in the previous month, and nudge higher in core CPI to 1.1% from 1.0%. Meanwhile final PMI readings are likely to confirm the marked dip in confidence seen in recent weeks on the back of heightened trade tensions and geopolitical uncertainty.

Source: Emirates NBD Research

Source: Emirates NBD Research

Currently, the Dollar Index is trading at 89.974, after posting a 0.60% gain last week and breaking back above the 50 day moving average (89.74). This appreciation in the index has nullified most of the losses of the previous week and leaves the price testing the resistive trend line that has halted advances since 15 December 2017. A sustained break of this level (90.01) is required in order for USD to realize and hold onto further gains.