The dollar fell last week as global equities unwound, with anxiety over political events dominating sentiment. The coming week will be a holiday shortened one in the US, with Thanksgiving approaching on Thursday, leaving markets to ponder the possibility of tax reform being passed before the end of the year. The passage of the House’s tax plan through Congress last week puts the onus on the Senate to pass its version of the bill, before the two Houses are able to start the process of reconciliation between the two proposals. This may not be finalized until 2018 which could keep the last few weeks’ of the year a little tense. Other parts of the world also have political risks to contend with, however, so dollar softness may not extend too much further on this issue alone. An interest rate rise in December is after all largely built in, especially with US economic data continuing to print positively, with the question increasingly turning to how much further they can rise next year. This contrasts with the situation elsewhere, where despite continuing evidence of improving global growth, few expectations exist for other central banks to follow the Fed in hiking in 2018.

The dollar continued lower last week even as the economic picture continued to brighten in the US. Inflationary pressures resurfaced a little with October producer prices growing 0.4% m/m, while core CPI inflation picked up to 1.8% y/y from 1.7%. Retail sales were also up a firm 0.2% m/m in October, after an upward revised 1.9% growth rate in September. Although the hurricanes had the effect of lifting auto sales, overall the report showed that the pace of consumer spending remains supportive of further expansion in the economy. Elsewhere there was also strength in industrial production (0.9%) and housing starts which rose a hefty 13.7% m/m in October. That the dollar fell back against such a backdrop was something of a surprise, with even the passage of the House’s tax bill failing to arrest its decline. However, a December rate hike is now fully priced in at 92%, suggesting that it is less this that markets are concerned about but more the trajectory for rates next year that matters.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Currently there is only one rate hike priced in, while the potential would seem to be for much more dependent on how much taxes are cut by and how quickly. As such the scope would seem to exist for the dollar to gyrate quite a lot as the news flow over this issue develops over the rest of the year. For this reason we doubt if its current weakness is necessarily the beginning of a new downtrend but more likely the onset of a more volatile period, with its direction likely to be headline and news driven as well as by seasonal flows. Interest differentials remain a source of fundamental underpinning for the dollar, however, and a counterweight to political uncertainty and policy risks. The coming week will be a relatively quiet one with only existing home sales and durable goods for October of any note. The FOMC minutes from the November meeting are also released but these should not add much colour to a debate that already has a December hike look almost certain. At the very least a holiday shortened week should provide the dollar with a chance to consolidate.

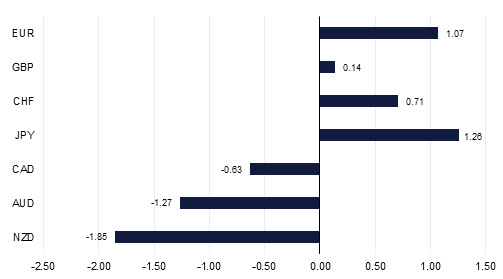

The Euro was a particular beneficiary of dollar softness last week as Eurozone data showed the economy continuing to power ahead, with Q3 GDP for the region rising by 0.6% q/q, and with Germany leading the way at 0.8%. ZEW surveys were also encouraging and supportive of strong growth. The coming week sees the second reading of German Q3 GDP with the breakdown likely to show ongoing strong domestic demand as well as contribution from net exports amid a strengthening world economy. Preliminary November PMI readings and the German Ifo index are also expected to remain at high levels, consistent with Q4 growth continuing where Q3 left off. Speeches by ECB President Draghi and Vice President Constancio are expected to argue the need for caution when it comes to normalizing monetary policy, however, a message that may take some of the impetus from the EUR’s rally. Political risks have not gone away either with Spanish election polls suggesting that the ousted Catalan leaders still have a chance in the December elections, while in Germany Chancellor Merkel still does not have a new government with an eventual coalition likely to have four members reducing its ability to provide stability.

Brexit risks also remain to the fore, for both the Euro and for sterling, with the clock counting down towards the December EU leaders' summit but with little sign that the terms of a final divorce terms will be reached. This is not just over the financial settlement but also the Northern Ireland border issue, which is starting to look like a major sticking point, with Ireland threatening to block the Brexit process entirely. Sterling underperformed last week against other major currencies in part because of this background but also because softer than expected inflation (unchanged at 3.0% in October) dampened expectations of further Bank of England rate hikes. The focus in the UK in the coming week will be on the Chancellor’s autumn budget, which in the past have not been met with great success, but with the May government needing to produce some populist measures to assuage Conservative party unrest. The pound will remain vulnerable against such a background especially if the dollar manages to stage a recovery.

The JPY strengthened the most last week as global uncertainties returned, and even as Japanese Q3 GDP slowed to 1.4% y/y from 2.6% in Q2. The coming week will also be a quiet week in Japan, with the only major release being the October trade report, ahead of Thursday's Labor Thanksgiving Day. An absence of key economic data from China too should also make for relatively quiet markets in Asia overall. Speeches from RBA officials will be a focus for the AUD, while the NZD could be pressured again if NZ retail sales fall sharply which seems likely.

Moody’s upgraded India’s long term sovereign rating to Baa2 from Baa3 and changed outlook on the rating to stable from positive. The last rating upgrade for India was in 2004. The rating agency attributed the upgrade to – 1. Reforms by the government to strengthen institutional framework, 2. Government’s support to public sector banks and 3. Government’s adherence to fiscal deficit framework. The rating action confirms our view that India remains one of the bright spots within emerging markets. Having said that, near term concerns do remain over low credit offtake, rising inflation trajectory and stabilization of the GST system. The INR strengthened sharply on the news, however, and remains on track to finish the year around our 65.0 December forecast.