Dollar benefits from strong payrolls

After a turbulent week dominated by regional and geopolitical risks as well as trade tensions, the markets received a boost from strong U.S. employment figures. With the political uncertainties in Italy and Spain also being resolved for the time being at least, the concerns over tariffs are perhaps the only reason for caution. These will likely exert some strain as the G7 meeting approaches on the 8-9th of June, with G7 finance ministers already expressing their frustration over these as likely to ‘undermine open trade and confidence in the global economy’. However, their consequences are largely for the future, whereas the current economic environment appears strong enough for markets to withstand these risks. Also the G7 summit will likely be eclipsed by expectations over the U.S - North Korea summit which President Trump has confirmed will go ahead a few days later on the 12th, and which conveys a more optimistic mood.

European political risks recede for now

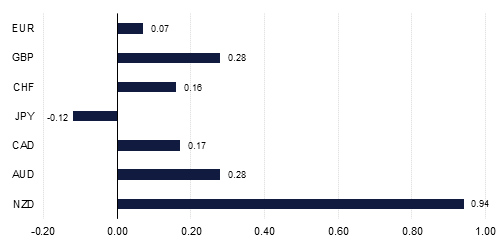

With Italy’s political problems being put to rest for the moment, with a coalition government between the 5 Star Movement and the League finally being formed, the sense of relief was also reinforced by strong U.S. economic data. The May labour market report saw jobs growth of 223k in excess of expectations, the unemployment rate falling to an 18-year low of 3.8% and wages rising by a firm 0.3%. Other data points over the week were also constructive including ISM manufacturing data, which rose to 58.7 from 57.3, and personal income and sales data which were up 0.3% and 0.6% respectively. Collectively they help to cement the case for a June rate hike by the Fed, and increased the chances of two further rate hikes before the end of the year. The dollar therefore remained firm, rising strongly against the JPY, although the news from Italy prevented it from making further gains against the single currency.

Source: Emirates NBD Research

Source: Emirates NBD Research