The US hiked tariffs on USD 200bn of Chinese imports on Friday, and talks between the two countries ended without a resolution. No new talks are scheduled yet but both sides indicated their desire to keep negotiating, which likely contributed to equities ending Friday’s session higher. China has yet to to announce countermeasures in response to the US measures. The key issues appear to include China’s unwillingness to change its laws to implement the terms of any deal struck; the value of imports China will agree to buy from the US as part of a deal, and the US’ reluctance to remove the tariffs imposed since last year as part of the agreement.

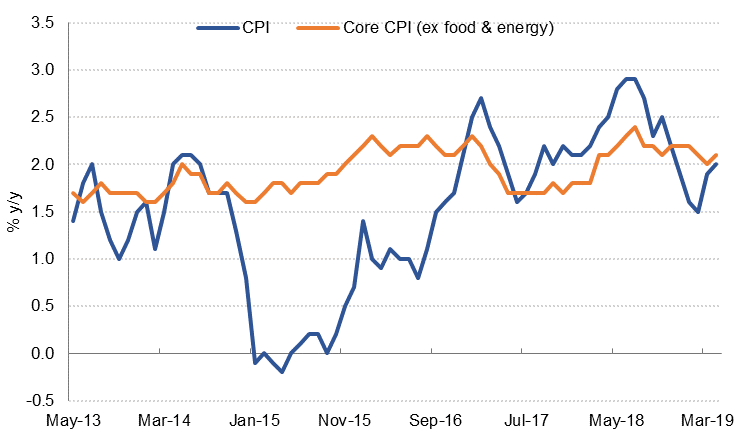

The US also indicated it was preparing to introduce tariffs on another USD 300bn of imports from China in four weeks time – effectively taxing everything imported from that country. With US inflation undershooting expectations again in April (data released on Friday), the administration may believe that the impact of higher tariffs on consumer prices isn’t cause for concern. However, higher tariffs are likely to be negative for growth in both countries.

UK GDP grew 0.5% q/q in Q1, in line with expectations and faster than Q4 growth. Both private consumption and government spending accelerated in Q1, as did business investment. However monthly data showed a -0.1% m/m contraction in March suggesting that the growth momentum may not be sustained in Q2.

Egypt saw a slowdown in inflation last month, despite seasonal Ramadan-related inflationary pressures, as the government boosted food supplies. The April print declined to 13.0% y/y, from 14.2% in March, while m/m inflation fell to 0.5%, from 0.8%. While this decline is encouraging, ongoing subsidy reform over the coming months will keep pressure on prices, meaning that a rate cut by the CBE at its May 23 meeting remains unlikely.

The Turkish central bank once again suspended its one-week repo auctions on Thursday, in a bid to shore up the lira. While this had little material impact on the currency, a blitz of selling dollars for lira by Turkish banks in early Asia trading saw the currency close 3.4% stronger against the US dollar on Friday. The ongoing pressure on the currency makes the prospect of rate-cutting in Turkey increasingly distant.

Pakistan and the IMF have a agreed a 3-year USD 6bn programme to tackle the country’s twin deficits and support implementation of structural reforms. The IMF Board will approve the programme once prior actions have been completed.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Fixed Income

Treasuries closed higher amid reversal in risk-on investor sentiment following stalling of trade talks between the US and China. A softer US CPI print also supported USTs. Overall, yields on the 2y UST, 5y UST and 10y UST ended the week at 2.27% (-7 bps w-o-w), 2.26% (-6 bps w-o-w) and 2.46% (-6 bps w-o-w) respectively.

Regional bonds ended the week flat despite moves in benchmark yields. The YTW on Bloomberg Barclays GCC Credit and High Yield index at the end of last week was unchanged at 3.95%. However, credit spreads widened 8 bps w-o-w to 161 bps. The move in regional bonds was also in contrast with those in emerging markets. The YTW on Bloomberg Barclays EM USD Aggregate index dropped -2 bps w-o-w to 5.31% while credit spreads widened -6 bps to 291 bps.

FX

The dollar index declined last week on the escalation of the US-China trade dispute. However, movements suggest that investors’ at the moment are only pricing in tensions and not a full trade war. In fact, data from CFTC indicated that there was limited change in position of hedge funds and speculators. For week ended May 7, traders pared bullish USD bets by 6,531 contracts while net-short EUR contracts grew by 561 contracts. Overall, the Bloomberg Dollar index (DXY) dropped -0.2% 5d and the JP Morgan Emerging Market Currency index ended the week flat.

The Chinese renminbi has depreciated nearly 2% against the USD since the start of May, also in response to developments on the trade front. CNY has reversed most of the gains made since the latest round of talks started in early December 2018.

Equities

Regional equities started the week on a negative note. The DFM index and the KWSE PM index dropped -1.6% and -2.2%. The Tadawul also closed lower amid speculation that state-owned institutions are looking to sell stocks into the MSCI rally. In terms of stocks, Emaar Properties lost -1.8% while Arabtec declined -2.6%.

Commodities

Both oil benchmarks closed down on the week, as concerns over renewed US-China trade wars stifling demand outweighed a greater-than expected decline in US inventories and any jitters around geopolitical risk in the Gulf. Brent futures closed down 0.3% at USD 70.6/b, while WTI declined 0.5% to USD 61.7/b, making the third week in a row prices have fallen.