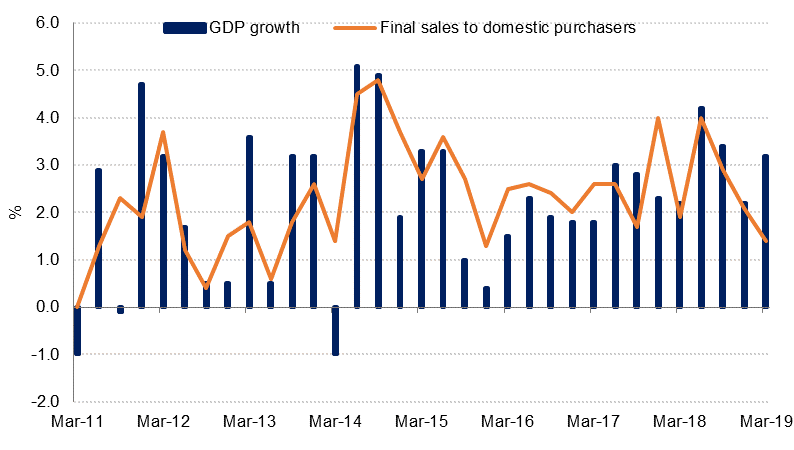

The US economy grew at a faster than expected 3.2% annualised in Q1 2019, against consensus expectations of 2.0%. While equities closed the session higher on Friday, 10Y treasury yields declined as the detail of the GDP release was less positive than the headline growth figure implied. A build up in inventories and net trade were key drivers of first quarter growth but both these factors are likely to prove temporary. Domestic demand expanded at just 1.4%, the slowest since Q4 2015, reflecting weaker consumption and business investment growth.

Where most analysts were expecting a soft start to the year, it now appears as if Q2 growth may be weaker than Q1, as inventories and the trade deficit normalise. This is likely to weigh on the minds of FOMC members as they meet this week. While there is little likelihood of a change in the federal funds rate on Wednesday, the post-meeting statement and Chairman Powell’s comments will be scrutinised for clues about how the Fed views the outlook for the US economy and potential risks.

Eurozone GDP data for Q1 2019 is due to be released this week, with the market expecting growth of 1.1% y/y, unchanged from Q4 2018. In China, April PMI data is due on Tuesday. The US calendar is also fairly busy, with pending home sales, consumer confidence and some manufacturing survey data scheduled, but the focus following the Fed meeting will be on Friday’s non-farm payrolls data, where the consensus expectation is for 185k new jobs in April.

The Turkish central bank left its benchmark key repo rate unchanged at 24.0% at its meeting last week, an outcome which was widely anticipated. However, the language within the communiqué took a more dovish tone, removing an earlier pledge that ‘further monetary tightening will be delivered’ if necessary, and partly attributing the slow pace of economic activity currently to ‘tight financial conditions.’ The message was poorly received by investors, and the lira weakened further against the USD.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Fixed Income

Notwithstanding strong US GDP data, Treasuries ended the week higher. Yields dropped across the curve with the near-term closing at its lowest level since the start of the month. Yields on the 2y UST, 5y UST and 10y UST closed at 2.28% (-10 bps w-o-w), 2.28% (-9 bps w-o-w) and 2.49% (-6 bps w-o-w).

Investors are expecting little change from the Federal Reserve when they meeting later this week. Most analysts’ expect the Fed to start discussing a possible tweak to the IOER rate at this meeting.

Regional bonds continued their positive run. The move was broadly in line with the changes in benchmark yields. The YTW on Bloomberg Barclays GCC Credit and High Yield index ended the week at 3.99% (-5 bps w-o-w) while credit spreads tightened marginally to 160 bps.

In terms of ratings, S&P revised the outlook on Oman Electricity to negative from stable.

FX

The USD rallied against most major currencies last week, with the exception of the JPY which eked out a small 0.3% gain. In a quiet holiday affected week the USD benefited from growing anticipation of firm Q1 GDP figures, as well as the aftereffects of soft Eurozone PMI activity data. A dovish Bank of Canada and weak Australian inflation data added to the bullish USD mood.

In the event the strong US GDP report at the end of the week exceeded market expectations, but this was the catalyst for profit-taking on long USD positions, seeing the USD finish the week off its earlier highs. Safe haven demand underpinned the JPY meanwhile, following signals from China that the pace of stimulus measures will be tempered, and with the BOJ signaling that it will keep rates accommodative at least through to the spring of 2020.

Equities

Regional markets started the week on a negative note. The DFM index dropped -0.4% while the KWSE PM index declined -1.4%. In terms of stocks, Sabic closed higher despite reporting weaker than expected corporate earnings. The profit for the company for Q1 2019 came in at SAR 3.41bn (-38.0% y/y), missing analysts’ estimates of SAR 4.04bn. The company cited lower average selling prices for the decline.

Commodities

Oil markets cooled off last week, as Brent futures climbed just 0.3% to USD 72.2/b, while WTI lost 1.1% to USD 63.3/b, bringing to an end an eight-week run of gains. Brent lost 3.0% on Friday, the biggest decline in two months as US President Donald Trump said that he’d demanded lower prices from OPEC. Nevertheless, the two benchmarks have both seen remarkable ytd advances of 34.1% and 39.4% respectively, boosted by Trump’s decision not to extend waivers for those countries previously allowed to import crude from Iran despite sanctions.

Click here to download the full report.