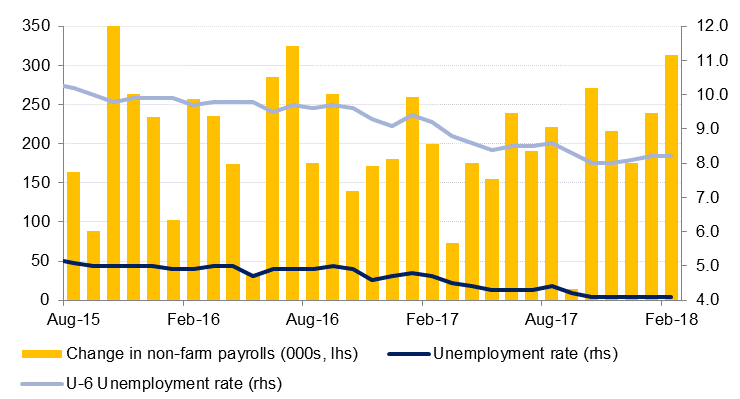

US non-farm payrolls increased the most in a year-and-a-half last month, with 313k new jobs added; much higher than the consensus forecast of 200k. The December and January employment numbers were also revised higher by a cumulative 54k. The increase in jobs last month was broad-based, with retail, construction, manufacturing and professional services sectors all posting strong increases. The unemployment rate was unchanged at 4.1% as the labour force participation rate increased to a five-month high of 63.0%. Importantly, despite the sharp rise in the headline employment figure, average hourly earnings growth slowed to 0.1% m/m (2.6% y/y) from 0.3% m/m (2.8% y/y) in January, easing fears that the Fed is behind the curve in terms of rate hikes. February’s inflation reading (due tomorrow) will be the next key indicator for Fed watchers.

President Trump finally signed off on steel and aluminium import tariffs on Thursday but the policy was more flexible than had been feared, with Canada and Mexico exempted pending the outcome of the NAFTA negotiations, and the door left open for other countries, and specific products, to be exempted as well.

The ECB removed the ‘loosening’ bias from its monetary policy statement last Thursday, in another gradual step towards monetary policy normalisation. Nevertheless, the ECB indicated that asset purchases of EUR30bn per month would continue until at least September, and possibly beyond then, depending on inflation data. Overall, the ECB was upbeat about growth prospects, revising its GDP forecast for 2018 up slightly to 2.4% (from 2.3% previously), with risks to the outlook deemed to be balanced. However, President Draghi highlighted the downside risk to growth from increased protectionism.

Finally, China’s parliament yesterday voted to repeal presidential term limits that had been enshrined in the constitution, opening the way for President Xi to remain in power indefinitely.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research