The last bits of economic data before the Fed’s FOMC meeting which starts today were on the weak side of expectations with the US Empire State manufacturing index plunging to -8.6 in June, its worst reading since Oct 2016, from a 6-month high of 17.8 in May. Meanwhile the NAHB Housing Market Index slipped 2 points to 64 in June after rising 3 points to 66 in May. This is the first decline of the year and follows the highest reading since October, with the index off 4 points from the 68 mark a year ago. This data is unlikely to be decisive in terms of this week’s Fed meeting, which is expected to leave interest rates unchanged, but it does continue to illustrate the increasing uncertainty in the US economy right now which is weighing on policymakers.

It is not only the Fed that is eyeing renewed stimulus steps. ECB officials who are meeting in Portugal this week are also hinting at an easing bias and preparing the ground for additional steps, should inflation and the global backdrop not improve. In an interview with the FT ECB Executive Board member Benoit Coeure repeated President Draghi's line that the central bank will act to boost the economy if necessary and that officials are already ‘talking about contingency planning’, adding that the ECB might well soon face ‘a situation where risks have materialised’. He also hinted that the ECB could revisit the issue of a tiered deposit rate. This overall message is helping to keep a lid on the EUR which has reversed the gains seen last week amidst rising geopolitical tensions.

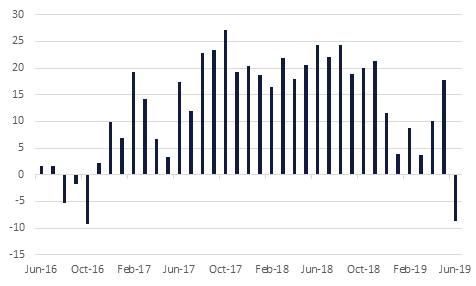

Turkish unemployment fell to 14.1% in March, from 14.7% the previous month. Nevertheless, it remains substantially higher than the 10.1% recorded in March 2018, reflecting the hard times the Turkish economy has fallen on over the past 12 months. Youth unemployment is particularly high, having climbed from 17.7% in March 2018 to 25.2% in the latest print.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasuries were mixed ahead of the FOMC statement and the press conference tomorrow. With markets having priced in a rate cut as early as July, investors would be looking for clues from the Fed to affirm that view. The curve flattened with yield on the 2y UST, 5y UST and 10y UST closing at 1.86%, 1.85% and 2.09% respectively.

Regional bonds continued to trade in a tight range. The YTW on Bloomberg Barclays GCC Credit and High Yield index remained unchanged at 3.73% and credit spreads remained flat at 175 bps.

AUD has fallen to a near five and a half month low in the aftermath of the RBA minutes from the June 4th meeting. The minutes communicated that members agreed it was “more likely than not” that further easing of monetary policy would be required. Currently AUDUSD is trading 0.28% lower at 0.68338 and is on course for a fifth day of declines. This morning’s move takes the price further below the 23.6% one-year Fibonacci retracement (0.6916) which is bearish for the price. Should there be a daily close below the 0.68 level, it will create the risk of a further decline towards the January 3rd 2019 low of 0.6741.

Developed market equities continued to drift as investors remained cautious ahead of the Fed meeting which is starting later today.

Regional markets recouped some of its recent losses. The Tadawul rallied +1.0% as investors positioned themselves ahead of the next phase of FTSE index inclusion later this week. Banking sector stocks led the gains with Samba and NCB adding +1.0% each. Dar Al Arkan was another notable mover with gains of +6.0%.

Elevated geopolitical tension in the Gulf region failed to give any further boost to crude prices to begin the trading week. Brent futures closed down 1.7% at USD 60.94/b while WTI lost more than 1% to close at USD 51.93/b. Soft number out of China along with poor business conditions reported by the New York Federal Reserve continued the onslaught of weak underlying economic data that is dragging commodity prices lower.

The EIA estimates that shale production will increase in July to 8.52m b/d, up 70k b/d m/m thanks to consistent growth from the Permian in Texas. Last week the EIA had revised its growth forecast for US supply downward to a still elevated 1.36m b/d.

OPEC+ has still failed to set a date for its next meeting even as the Russian and Iranian energy ministers met. Failure to agree on a date suggests that reaching a consensus on output levels may be harder than markets are currently expecting with a Russian departure from the cuts seeming likely.

Click here to Download Full article