With the FOMC meeting concluding later today, and the market largely not expecting any change to interest rates, the consistent theme yesterday was the pressure seemingly being put on the Fed by President Trump to cut rates through a variety of tweets, comments and reports. The most notable and direct pressure came from reports that the White House counsel looked into whether Trump could remove Powell as Fed chair in February, according to Bloomberg. Trump apparently started asking advisers whether he could fire Powell after markets fell at the start of the year on fears of the escalating trade war with China and the Fed's plans for more rate hikes in 2019. ‘Let's see what he does,’ Trump said yesterday when asked whether Powell should be removed as chair, which is tantamount to an implicit threat if not an explicit one – an unprecedented intervention on Fed neutrality on the eve of a Fed rate decision.

More indirectly Trump also took a swipe at the Fed by accusing the ECB of currency manipulation following President Draghi’s speech yesterday in which said that further cuts in interest rates could be on their way along with a relaunch of the asset purchase program. By tweeting that the ECB cutting rates would amount to ‘unfair’ currency manipulation, Trump implied that the Fed should be doing the same thing to lower the value of the USD. On a more positive note President Trump also affirmed he plans to meet with President Xi at the G20 to discuss trade, and President Xi said he was also willing to meet in order to try to resolve differences. Markets have responded favourably to this news, with a big week of event risk approaching starting with tonight’s FOMC decision.

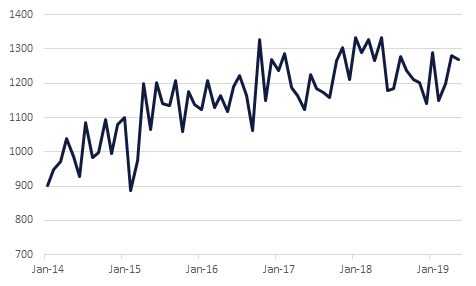

Turkish industrial production posted poor results in April data released yesterday, reigniting fears that the economy could be on the verge of a double-dip recession. Output fell 1.0% m/m, while on an annualised basis it was down 4.0%, with both figures coming in worse than consensus expectations. Concerning for future growth prospects, intermediate goods and capital goods output declined by 8.5% and 7.6% respectively y/y.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

US 10y yields rose yesterday on news that President Trumps and Xi would meet at the G20 to discuss a trade deal. However, the focus today will be on the FOMC. While the market is not expecting a rate cut today, they are looking for the Fed to signal its willingness to ease monetary policy in the coming months.

EURUSD fell below the 1.13 handle yesterday in the aftermath of economic data which showed inflationary pressures still remain absent in the Eurozone. This coupled with a decline in German investor sentiment over the next 6 months, revealed by the ZEW surveys lead to increased expectations of further stimulus from the ECB. In particular, this is significant as earlier in the day, ECB President Mario Draghi had started that the central bank still has the option of easing monetary policy if inflation stagnates and there is evidence of slowing growth. As we go to print, EURUSD is trading at 1.1193.

This evening markets will turn their attention to the outcome of the FOMC meeting. While no change in policy is expected, careful attention will be paid towards the language used and any revisions in economic projections or the “DOT plot”. Further shifts to an even more dovish tone from policy makers could result in a USD sell off.

Expectations for a dovish federal reserves and hope of an easing in U.S.-China Trade tensions helped developed equity markets post positive gains yesterday. The Nasdaq posted a 1.39% rise, while the S&P500 was able to gain 0.97%. On the other side of the Atlantic, European equity markets also fared well and while Euro Stoxx climbed 2.06%, the Dax rose by 2.03%

This morning Asian equity markets have opened in the green and at present, the Nikkei is trading 1.66% higher while the Shanghai Composite has risen by 1.50%

Following a 2% rise on Tuesday, Brent crude futures extended their gains this morning with the August 19 contract trading at USD 62.13/bbl while WTI futures currently trade at USD 54.21/bbl. The increase in prices come following a tweet from U.S. President Trump that said preparations were being made for a meeting Chinese President Xi Jinping at next week’sG20 summit in Osaka, Japan.