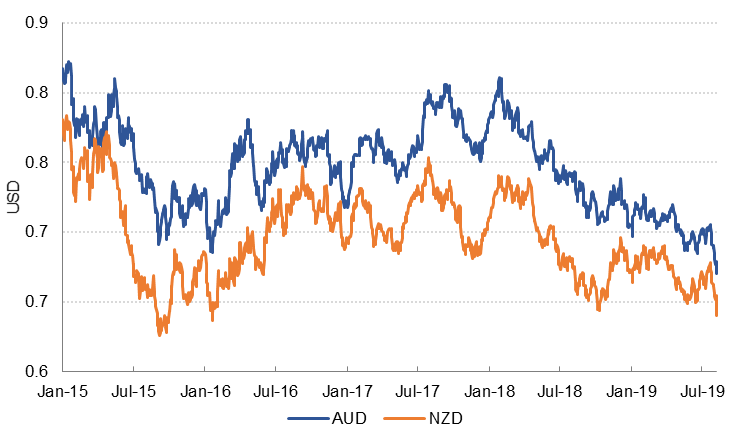

The Reserve Bank of New Zealand (RBNZ) cut its benchmark interest rate by a larger than expected 50bp this morning to 1%, citing slowing growth and rising headwinds to growth. Economists had expected a 25bp rate cut. NZD fell to the lowest level since 2016, while AUD fell to a 10-year low following the RBNZ decision. The RBA had kept rates on hold as expected yesterday but signalled a willingness to ease monetary policy further if necessary. The RBA highlighted spare capacity in the labour market, and still-soft conditions in the housing market. The focus on central banks continues today, with the Reserve Bank of India expected to cut interest rates by another 25bp to 5.5%, which would be its fourth rate cut this year.

While markets were relatively calm overnight following Tuesday’s sell-off in equities and yields, trade tensions remain in the spotlight. The Chinese renminbi traded above the 7/USD level again this morning, althought he official PBOC fixing was just shy of the psychological level at 6.9996/USD. Brent oil is now in a bear market despite a drop in US crude stockpiles last week and declining OPEC production, as concerns about slower global growth and softer demand outweighs lower supply. Gold prices have risen 1.4% in early trading.

Economic data was mixed yesterday. German factory orders rose by a bigger than expected 2.5% m/m in June while in the UK, BRC like-for-like retail sales data disappointed again in July, rising just 0.1% m/m following a -1.6% m/m contraction in June. The US JOLTS survey showed a 36k drop in job openings in June, another (small) sign of softer labour market conditions in the US.

In the GCC, Bahrain reported a smaller budget deficit of -BHD 404mn (USD 1.1bn) in H1 2019, down -37% y/y, citing the implementation of its fiscal reform plan. We expect a full year budget deficit of -BHD 902mn, or -6.2% GDP.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Fixed Income

Benchmark government bond markets remain in thrall to the vicissitudes of the US-China trade conflict as an apparent easing of China’s position failed to materially boost long-dated yields. A slight upward move in yields overnight (almost 3bps on the 2yr UST) has been given back in early trading this morning with yields on 2yr USTs down almost 5bps to 1.56% and down 7bps on 10yr USTs at 1.67%.

In Europe, yields on 10yr bunds and French government bonds also sank by around 3bps each. Bund yields fell to -0.54%, a new record low level.

FX

Aussie and Kiwi were the biggest movers overnight following a larger than expected rate cut by the RBNZ this morning, which in turn raised expectations of further monetary policy easing in Australia.

There was little change in the major currency pairs overnight, with no major economic data released. In Asia, focus remains on the renminbi, which is once again trading above 7/USD.

Equities

Equity markets were mixed overnight as the impact of new higher US tariffs on Chinese goods and a weaker RMB remains uncertain. Nevertheless, US equities managed to regain some footing with the S&P 500 closing up 1.3% while in Europe major equity indices also closed lower (the EuroStoxx index ended the day down 0.5%).

Regional markets remain under pressure with the Tadawul, DFM and ADX all closing lower. The Tadawul and ADX have now closed lower five days in a row.

Commodities

Oil markets extended their recent losses overnight as the US-China trade dispute weighs on commodities. Brent futures fell 1.4% overnight and ended the day below USD 59/b while WTI closed down almost 2% at USD 53.63/b.

The API reported a draw in crude stocks of 3.4m bbl, larger than the market had been expecting, but not enough to shift the focus of the market away from the trade war. Elsewhere, the EIA cut its 2019 supply growth forecast to 1.28m b/d from 1.4m b/d previously as the impact of Hurricane Barry on production in the Gulf of Mexico becomes clear. For 2020, the EIA revised up its supply growth forecast to 990k b/d from 900k b/d previously.

Gold prices continue to push higher, closing up 0.7% overnight at USD 1,473.87/troy oz. Gold has currently pushed higher than USD 1,475/troy oz, its highest level since 2013. There are few technical barriers for gold to move even higher at this point.