Equities have responded positively to increased optimism over trade talks between the US and China, with President Trump sounding upbeat after his meeting with Vice Premier Liu He on Friday, and the Chinese delegation extending their visit through the weekend to continue with talks. Overnight, President Trump has announced that the additional tariffs on Chinese imports that were due to come into effect this Friday have been delayed indefinitely. A meeting between Presidents Xi and Trump to finalise an agreement towards the end of March is being discussed.

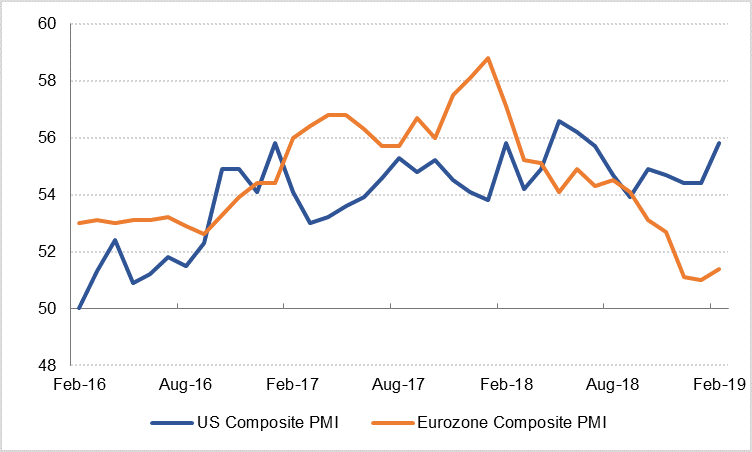

US durable goods data released on Thursday was disappointing, with non-defence capital goods orders shrinking -0.7% m/m in December. Existing home sales in January missed forecasts and the manufacturing PMI declined to 53.7 in February (below expectations). However, services PMI beat expectations in February, rising to 56.2 from 54.2 in January.

Eurozone data released on Friday was also disappointing, with the German IFO survey showing a deterioration in the business climate in February. Both the current assessment and expectations indices came in below consensus forecasts. Furthermore, while the composite German PMI rose to a four month high, this was entirely due to growth in the services sector – the manufacturing PMI declined to 47.6 in February from 49.7 in January, signalling contraction in the sector. The story was similar for the whole Eurozone PMI surveys, with a weak manufacturing PMI offset by better than expected services PMI. Meanwhile, EU leaders currently at a summit in Cairo are reportedly considering a long extension to Article 50, keeping the UK in the EU until 2021, if parliament does not approve a deal before 29 March. PM May has delayed the next vote on a Brexit deal to 12 March.

Saudi Arabia’s crown prince continued his Asian tour over the weekend with a stop in China, where USD 28bn worth of deals were signed. This reportedly did not include USD 10bn to build a joint venture refining and petrochemical complex in northeast China. Much of the Saudi investment into India and Pakistan announced earlier in the crown prince’s tour of the region focused on refineries and energy sector investments, which should help to secure the Kingdom’s market share in supplying crude oil to these economies over the long term.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Fixed Income

Treasuries ended the week higher as comments from Fed officials reinforced the dovish shift of the central bank. This was despite minutes from the last meeting indicating that the Federal Reserve actually remains firmly data dependent. Overall, yields on the 2y USTs, 5y USTs and 10y USTs closed at 2.49% (-2 bps w-o-w), 2.47% (-2 bps w-o-w) and 2.65% (-1 bps w-o-w).

Regional bonds continued to trade in a reasonably tight range. The YTW on the Bloomberg Barclays GCC Credit and High Yield index dropped -3 bps w-o-w to 4.31% and credit spreads hovered around 178 bps.

According to reports, Oman plans to slash its borrowing requirements for 2019 by as much as 70% and rely on asset sales to fund its fiscal deficit. The country plans to raise USD 2bn to USD 3bn relative to USD 6.2bn outlined in the budget. Oman’s 28s gained sharply to end the week at USD 94 compared to USD 92 at the end of last week. The 5y CDS spread has narrowed over the course of this month to 257 bps from 282 bps at the start. A sharp rise in oil prices has also helped sentiment.

FX

Last week’s 0.35% gain was enough to take EURUSD back to 1.1335. Although the price did reach a high of 1.1371 on Wednesday 20th February, the cross was unable to hold onto these gains and finished the week below the 200-week moving average (1.1338) for a third week. While the price closes the week below these levels, EURUSD remains technically vulnerable to losses.

A 1.27% gain saw GBPUSD rise for the first time in four weeks, finishing at 1.3053 on Friday. Of technical significance is that the price rose above the resistive 200-day moving average (1.2994) on Tuesday 19th February, sustaining the break. This was confirmed when this level provided resistance and halted declines on Friday. However, despite these gains, it is too early to declare a reversal in GBPUSD’s fortunes. Analysis of the weekly candle charts reveals that these gains have not completely annulled the losses of the previous fortnight. In addition, the price remains below the resistive 50 and 100-week moving averages (1.3169 and 1.3196 respectively).

USDJPY ended the week 0.19% firmer last week, closing at 110.69. This resulted in a third week of gains and is technically significant as it resulted in a close above the 50-week moving average (110.56) for the first time since December 2018. It is also noteworthy that for a second week, the 100-week moving average (110.79) was briefly broken, but the break could not be sustained. Over the week ahead, a break and daily close above the 61.8% one-year Fibonacci retracement (110.73) is likely to be followed in quick succession by a test of this level. Should the price break above the resistance level on its third attempt, we can expect a test of the 200-day moving average (111.31) to be the next outcome.

Equities

Regional equities started the week on a mixed note. UAE equities continued their positive run with the DFM index adding +1.3% and the ADX index gaining +0.8%. Gains on the DFM index were broad based with all but four stocks closing in positive territory. Major movers included Emaar Properties (+3.2%) and Aldar Properties (+1.7%).

Commodities

Crude prices extended their gains last week and managed to hit new closing highs for 2019. Brent ended the week up 1.3% at USD 67.12/b while WTI added 3% over the week to finish at USD 57.26/b. Oil markets are balancing an increasingly volatile political environment in large producer nations (Venezuela, Iran, Nigeria) with an unrelenting oil production story from the US.

US oil production hit 12m b/d last week, up 1.73m b/d on the same period last year. Exports hit 3.6m b/d, more than the UAE currently producers, and helping to narrow the country’s net crude and product imports to 1.1m b/d, compared with an average of around 3m b/d last year. The US drilling rig count fell back last week by four rigs.

The front end of the Brent curve flattened last week into a small contango of USD 0.13/b while in WTI it remains wide at nearly USD 0.5/b. Investors continued to add long positions in Brent last week, extending net length by 9.4m bbl.

Click here to download the full report.