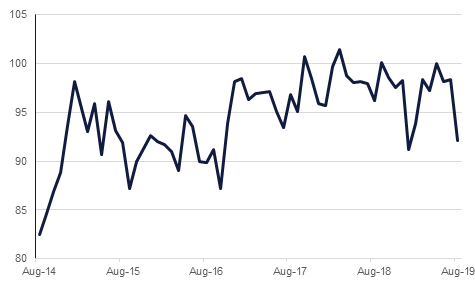

Markets were in turmoil last week, as the inversion of the US yield curve for the first time since 2007 on Wednesday raised worries that a recession was upcoming. Equities sold off and President Donald Trump renewed his criticism of Fed Chair Jerome Powell. Fears were allayed somewhat by retail sales data released Thursday, which showed that the US consumer continues to underpin the economy; sales expanded 0.7% m/m, exceeding expectations of 0.3%. However, the University of Michigan consumer sentiment index fell to a seven-month low in August, suggesting that US shoppers cannot be relied upon to support growth forever. The index slumped to 92.1, down from 98.4 in July and missing expectations of 97.0. President Trump last week delayed the imposition of new tariffs on China until December in a bid to avert any negative impact on consumers until after the Christmas period.

A number of other economies around the globe are also showing the strain, in part owing to trade war-related pressures, and are looking at ways to support domestic demand. In Germany, GDP contracted 0.1% m/m in the second quarter, prompting the government to consider running a budget deficit, according to reports in Der Spiegel. The European powerhouse has pursued a balanced budget since 2014. In China, meanwhile, the PBOC announced on Saturday that it would improve the mechanism used to set the loan prime rate, thereby bringing real interest rates lower and helping to support domestic businesses.

In Europe, UK Prime Minister Boris Johnson is set to visit Germany and France this week, with the prospect of a Brexit deal being reached by October 31 looking increasingly dim. The Prime Minister is expected to reiterate his position that the Irish backstop must be dropped, while EU leaders appear equally committed to their stance that there will be no renegotiation of the withdrawal agreement reached under Johnson’s predecessor, Theresa May. Lawmakers opposed to a no-deal Brexit continue to manoeuvre, but have as yet failed to reach common ground with regards who should lead any unity government.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasuries ended the week higher as concerns remain over economic growth. Some optimism over trade talks between US and China had a limited impact. The long end of the curve led the gains with yields on the 2y UST, 5y UST and 10y UST ending the week at 1.47% (-17 bps w-o-w), 1.41% (-16 bps w-o-w) and 1.55% (-19 bps w-o-w) respectively.

With the yields on the 30y UST dipping below the 2.0% mark during the week, there were reports that the US government is considering whether to start selling 50y and 100y USTs. The idea was first mooted in 2017 but was shelved after receiving lukewarm interest from investors.

Eurozone sovereign bonds continued to rally as well. Yields on the 10y German bunds fell further in negative territory to -0.68%. Reports that Germany is considering deficit spending had a more limited impact than anticipated.

Regional bonds continued to benefit from move in benchmark yields. The YTW on Bloomberg Barclays GCC Credit and High Yield index dropped to 3.21% (-9 bps w-o-w) to close at its lowest level since late 2016. However, credit spreads widened slightly to 170 bps (-7 bps w-o-w).

In terms of new issuance, Bank of Sharjah plans to issue USD-denominated bonds later this year to repay existing debt. The issue could take place either in September or October and proceeds will be used to repay notes maturing in June next year.

Last week saw the USD turn stronger against most G-10 currencies. The DXY index ended the week with gains of +0.7%. The GBP was a notable exception with gains of +1.0%. This was primarily on the back of growing resistance among UK politicians to a no-deal Brexit. Gains in sterling accelerated following short-covering.

Regional equities started the week on a mixed note. While the DFM index closed largely unchanged, the Qatar Exchange added +1.7%. In terms of stocks, du was a notable outperformer with a gain of +1.3%. Gains on the Qatar Exchange were led by market heavyweights with Qatar National Bank and Industries Qatar gaining +1.4% and +3.5% respectively.

Oil markets managed to record modest gains last week as signs of stimulus from governments and central banks balanced against persistent concerns over conditions for demand. Brent rose 0.19% over the week to close at USD 58.64/b while WTI ended the week at USD 54.87/b, up 0.68%. Forward curves strengthened last week for longer-dated contracts with 1-6 month and 1-12 month spreads in both WTI and Brent recording a wider backwardation. However, investor positioning toward the contracts was mixed with net length falling a second week running in WTI futures and gaining for a second week in a row in Brent futures.