The release of the minutes from the Fed’s January meeting affirmed the central bank’s patient approach to further rate hikes this year. Specifically, policymakers pointed to weak inflation and tightening financial conditions in both the US and other economies as factors in support of keeping rates on hold for now. According to the minutes, ‘several’ members of the FOMC thought the economy could absorb more rate rises later this year while others specifically needed to see inflation ‘unexpectedly surge’ to support higher rates. With economic data out of the US now starting to show signs of slowdown the prospect of inflation rising unexpectedly appears limited. The Fed also seems to be leaning toward an end to its balance sheet drawdown in H2 2018, leaving as much as USD 3.5trn on the Fed’s balance sheet. The minutes were not as dovish as the market had been expecting and reaction was relatively limited.

China and the US are reportedly close to presenting the outlines of a trade deal between the two countries. High level talks are ongoing in Washington this week and have come close to six memorandums of understanding on structural issues in dispute: among them are forced technology transfer, currency, non-tariff barriers to trade.

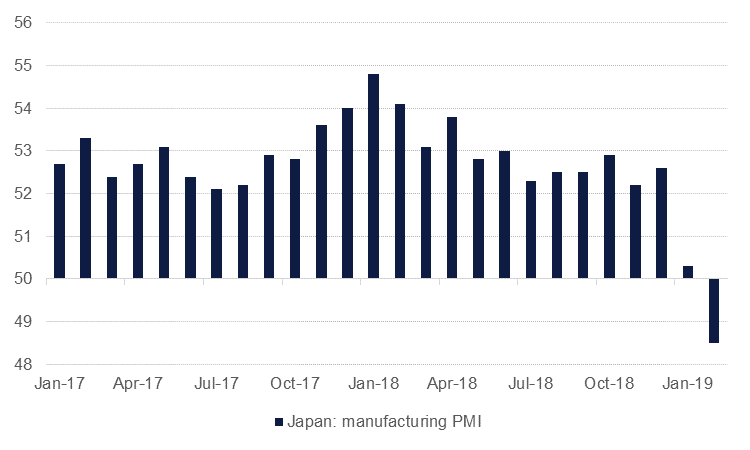

Weak data continues to emerge out of Japan after soft business confidence surveys and export figures released earlier this week. The manufacturing PMI for February fell to 48.3, in contractionary territory, from 50.3 in January. New orders and exports were also in negative territory suggesting more weakness ahead for Japan’s economy.

Saudi Arabia’s crown prince Mohammed bin Salman visited India as part of a tour of Asian nations. Securing a relationship with India is crucial for Saudi Arabia as Aramco sees oil consumption in India growing to 8.2m b/d by 2014. Aramco is planning to build an oil refinery with processing capacity of 1.2m b/d in India. The crown prince alluded to Saudi investment into India of as much as USD 100bn over the next two years, particularly in sectors beyond energy.

Source: EIKON, Emirates NBD Research

Source: EIKON, Emirates NBD Research

US treasury yields were marginally higher after the release of the FOMC minutes. Yields on 10yr USTs closed at 2.652% and are up nearly 1bp this morning while the 2yr-10yr spread is holding at around 15bps. The minutes affirmed the Fed’s patient stance and set a heady but not impossible challenge for future rate hikes later this year.

Fitch has cautioned that it may downgrade the UK’s ‘AA’ rating thanks to the persistent uncertainty surrounding Brexit.

Mumtalakat, Bahrain’s sovereign wealth fund, has begun to market a new USD-denominated sukuk with initial yield guidance of 6.25%.

EURUSD’s gains over the last two days have taken the price back above the 200-week moving average. Currently trading at 1.1343, should the cross close the week above the 1.3330 level, it would mean that this technical level is still providing weekly support and that a reversal in price can be expected. However, despite the price hitting 1.1370 in the aftermath of the release of January’s FOMC minutes, these initial gains were not sustained and a weekly close above the 200-week MA is needed for EURUSD to advance further towards the 1.15 level.

Equity markets ended the day higher across most developed markets. The S&P 500 ended up nearly 0.2% while the Dow gained slightly more. The FTSE rose almost 0.7% helped along by weaker sterling.

Regional equities were mixed. The DFM rose 2.6%, its strongest performance since June 2017 after several real estate companies reported good earnings. The Tadawul also gained, with the TASI up 0.6%.

Oil markets pushed higher overnight with Brent futures ending up 0.9% at USD 67.08/b and WTI up 0.3% at USD 56.27/b. The API reported a build in crude stocks of 1.3m bbl in the last week, lower than market expectations. EIA data will be released later today, a day later than usual thanks to a public holiday at the start of the week in the US.

Palladium continues to push higher, having trading above USD 1,500/oz yesterday. The pause in rate hikes by the Fed will provide more fodder for price gains across precious metals with gold now hitting its highest level in 10 months.