Economic data beat expectations across the board yesterday, with UK GDP, German IFO index, US durable goods and new home sales all coming in higher than forecast and providing further evidence of solid growth in the major economies. UK preliminary Q3 GDP expanded 0.4% q/q (forecast of 0.3% q/q and up from Q2’s 0.3% q/q). Annual growth was unchanged from Q2 at at 1.5% y/y. The service sector grew by 0.4% q/q, while manufacturing rose by 1.0% and the construction sector contracted for a second consecutive quarter. The pound rallied on the unexpected pickup in the q/q growth rate, which comes as something of a relief for the UK government, although it is likely that the Bank of England will see the data as providing justification for them to raise interest rates next month.

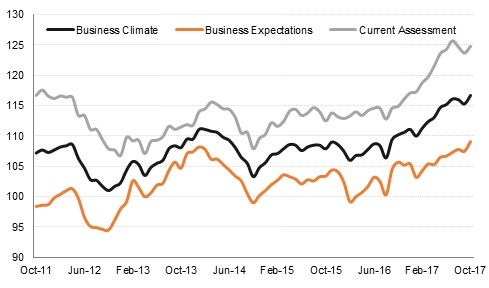

The October German Ifo index rose to a new record high, as expectations surged. The future expectations reading climbed to 109.1 from 107.5, while the current conditions index rose to 124.8 from 123.7. The breakdown showed sentiment improving across the board with capacity utilisation also increasing sharply, thus adding upside risks to prices. The Bundesbank is likely to see the data as adding to the case for bringing QE to an end, with the ECB meeting today to decide how far into 2018 they will let asset purchases be extended for and on what scale. The market expects a further QE program with reduced purchase levels from the current EUR60bn per month.

In the US, durable goods orders were boosted by Boeing aircraft orders, but even excluding the volatile transport component, core durable goods orders were up 0.7% m/m in September, up from August and better than forecast. The main driver appears to have been continued investment in business equipment. New home sales in September also surged 18.9% m/m, although the prior two months readings were relatively soft. The rise in activity in September may have been due to post-hurricane home purchases. Finally, the Bank of Canada kept its benchmark rate on hold yesterday as expected, and adopted a more dovish tone on the prospect of further hikes.

Solid economic data out of the US left UST yield curve on its rising path. Yields on 2yr, 10yr and 30yr treasuries closed up by a bp each to 1.59%, 2.43% and 2.94% respectively. 10yr Gilt yields rose 5bps to 1.40% as market expectations of a rate hike in the UK at next week’s BoE meeting reached circa 90%. 10yr Bund yields were marginally up and investors await outcome fo the key ECB meeting today. Global credit spreads were slightly wider with CDS levels on US IG and Euro Main rising by a bp each to 54bps and 56bps in response to mixed corporate result announcements and concerns about hurdles to Trump’s proposed tax cuts.

Regional GCC markets had slight sell bias with yields on Barclays GCC index rising by 3bps to 3.46% albeit with stable credit spreads at 128bps. High yield names such as EA Partners had yield widening while corporate perpetual bonds from likes of Gems Education and Majid Al Futtaim remained in favour. CDS levels on GCC sovereigns were also under slight pressure with the exception of 5yr CDS on Dubai that tightened 3bps to 121bps.

In the primary market APICORP priced $500 million 5yr sukuk at MS+100bps against an order book of $3.6 billion. Also China is believed to have begun marketing its first sovereign dollar bonds since 2004.

GBP outperformed yesterday to gain against all of its peers. Over the course of the day GBPUSD rose 0.98% to close at 1.3262, breaking back above the 50 day moving average (1.3187). As we go to print, cable sits at 1.3264 just above the 76.4% one year Fibonacci retracement of 1.3263. A close daily above this leve willl increase the risks of further rises.

CAD was yesterday’s underperformer following the Bank of Canada statement (see above). USDCAD rose 0.95% to 1.2796 on Wednesday, a movement that took the cross firmly above its 100 day moving average (1.2649) for a second consecutive day and reaffirmed the reversal we identified in our Monthly Insights publication. While the spot rate stays above the 38.2% one year Fibonacci retracement of 1.2723, the risks for further gains towards 1.30 remain a realistic scenario.

Uneven corporate earnings dented investors’ confidence in the ongoing equity rally. Profit taking saw Dow Jones and S&P 500 close down by -0.48% and 0.47% respectively yesterday. Stocks across the Atlantic were also subdued with FTSE 100 and DAX closing in red by -1.05% and -0.46% respectively. Asia has opened mixed. Hang Seng and Nikkei are trailing at +0.26% and -0.13% respectively.

GCC equities were buoyed by rising oil prices. Dubai index benefited from further gains in property and bank shares closing up by +0.66% and Abu Dhabi gained marginally at +0.07%. Qatar closed up by +0.18% while Tadawul was almost flat at +0.06%

Oil futures were split yesterday thanks to a mixed report from the EIA and the international market responding to constructive commentary from Saudi Arabia’s energy minister. Brent futures edged up nearly 0.2% while WTI closed 0.55% lower. The EIA reported a small increase in overall crude stocks but declines across most of the rest of the barrel. However, production jumped back quickly (over 1m b/d) last week as output was restored following the latest hurricane disruptions. Exports also ticked higher with the US now exporting more than 1.7m b/d on a four-week average. There was relatively little market reaction to commentary from Russia’s energy minister that the country would raise production by up to 4m tonnes if there was no extension to the current production cut deal.

Oil curves were little changed taking the latest fundamental data into account with Brent’s backwardation and WTI contango at around USD 0.22/b each.