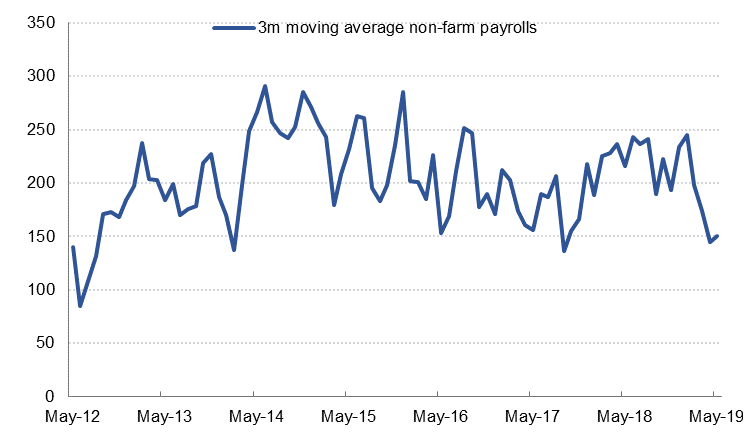

US employment data for May was much weaker than expected, with just 75k new jobs added against a forecast of 175k. Moreover, the payrolls figures for March and April were revised down by a combined 75k. The non-farm payrolls data was the latest indicator of slowing growth in the US, coming on the heels of soft manufacturing survey data and disappointing ADP employment figures for May. The unemployment rate remained at a record low of 3.6% and average hourly earnings rose 0.2% m/m (3.1% y/y), slightly weaker than forecast.

Financial markets have largely priced in at least 2 rate cuts by the Fed this year, with one priced in by July. The FOMC meets next week and while we expect an adjustment to the “dot plot” to reflect no change over the forecast horizon (the last “dot plot” indicated a rate hike in 2020), we think the market has overestimated the likelihood of a near term rate cut. However, the decline in US bond yields helped equities recover some of their recent losses last week.

The agreement reached between the US and Mexico late on Friday to avert tariffs which were due to come into effect today resolved one of the uncertainties weighing on markets, at least for the time being. However as the G20 finance ministers noted over the weekend, worsening trade tensions continue to pose a threat to global growth. In response to greater downside risks on growth, central banks around the world have become more dovish. The Reserve Banks of India and Australia both cut benchmark interest rates last week, and both have indicated a more accommodative stance going forward. The ECB also said last week that interest rates are unlikely to rise before mid-2020, longer than the end-2019 previously communicated.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Fixed Income

Treasuries continued their rally as weak non-farm payrolls data further strengthened the view that the Federal Reserve may cut rates this year. In fact, the market is pricing in a 25 bps cut as soon as the July meeting. The agreement between the US and Mexico on tariffs did little to assuage those expectations. The curve steepened as yields on the 2y UST, 5y UST and 10y UST ended the week at 1.84% (-8 bps w-o-w), 1.85% (-6 bps w-o-w) and 2.08% (-4 bps w-o-w) respectively.

The move in benchmark yields helped regional bonds to rally sharply. The YTW on Bloomberg Barclays GCC Credit and High Yield index dropped 16 bps w-o-w to 3.73% and credit spreads tightened 11 bps to 174 bps.

FX

Last week’s 1.49% rise took the EURUSD to 1.1344, the highest weekly close since March 2019. The price had traded as high as 1.1348 during the week, briefly breaking the 200-week moving average (1.1347), before encountering resistance. In the medium term, a break and weekly close above this key level is likely to trigger further gains towards the 50% one-year Fibonacci retracement (1.1479).

USDJPY posted a third week of declines, the 0.1% fall taking the price down to 109.19 on Friday. Over the course of the week, the cross had attempted to overcome the 38.2% one-year Fibonacci retracement (108.57) but failed to sustain its break of this former support-turned-resistance level. While the price continues to trade below this level, we may see a retracement down to 107.15, the 23.6% one-year Fibonacci retracement.

Equities

Most regional markets started the week on a positive note helped by positive global backdrop. The DFM index and the KWSE PM index added +1.2% and +1.5% respectively. Gains were broadbased across sectors.

In Qatar, the exercise to split the nominal value of shares to QAR 1 has begun. Commercial Bank of Qatar and Qatar First Bank were the first stocks to have prices changed. Full implementation is expected to finish by 7 July 2019.

Commodities

Oil markets managed to rally at the end of last week, cutting some of the recent plunge in spot prices. Brent futures ended the week at USD 63.29/b, down 1.9% on the week, while WTI closed just short of USD 54/b. Investors continued to close long positions in both Brent and WTI while the drilling rig count in the US fell by 11 rigs.

Saudi Arabia’s energy minister has given signals that OPEC+ will extend their current production cuts into the second half of the year but maintain them at current levels. Saudi Arabia is publishing well under its target of 10.3m b/d and hitting its target could entrench bearish sentiment toward oil for a longer period.

Click here to download the full report.