In the UK, the consensus that seemed to have been reached on a Brexit strategy over the weekend has already started to unravel, with Brexit Secretary David Davis tendering his resignation last night. Davis’ deputy Steve Baker, as well as Junior Brexit Minister Suella Braverman also resigned. The plan proposed by Prime Minister May allows for a “free trade area” for goods and food (but not services), whereby the UK would mirror EU rules for these items. In theory, the arrangement would still allow the UK to negotiate free trade agreements outside the EU, although as the UK’s rules would be tied to the EU’s, it’s hard to see how this could be achieved. The UK proposal would resolve the Irish border issue, while still allowing for some control over immigration. The EU has officially reserved judgement on the UK’s proposal, with further details awaited this week in a government white paper. GBP is broadly unchanged this morning on the resignation news.

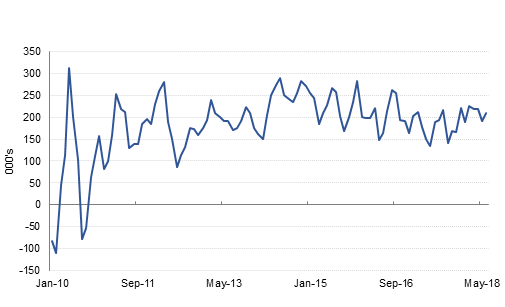

The US economy added 213k new non-farm jobs in June, more than the 195k expected. The May jobs number was also revised higher to 244k from 223 previously. Despite the sharp increase in jobs, the unemployment rate increased from 3.8% to 4.0% as 601k individuals entered the labour market, pushing up the labour force participation rate to 62.9% in June. Average hourly earnings rose by a less than expected 0.2% m/m (2.7% y/y). There were 36k new manufacturing jobs in June, and over the last 12 months, the growth in manufacturing jobs in the US has been the fastest since 1998, showing that so far, the increased US protectionism is not affecting employment in this sector.

Markets largely shrugged off the imposition of 25% tariffs on USD 34bn of Chinese imports to the US, and the reciprocal tariffs imposed by China on Friday, as these had been priced in. Equity markets closed higher in most major markets from Asia to the US on Friday and the dollar index was around 0.5% weaker. It remains unclear at this stage whether the second round of US tariffs on another USD 16bn of Chinese imports will be imposed in a fortnight, as President Trump had indicated.

Notwithstanding a strong non-farm payrolls data in the US, treasuries traded in a tight range. The trend of short-end underperforming the long-end of the curve continued. Yields on the 2y USTs, 5y USTs and 10y USTs closed at 2.53% (+1 bp w-o-w), 2.71% (-2 bps w-o-w) and 2.82% (-4 bps w-o-w) respectively.

Regional bonds closed higher with the YTW on the Bloomberg Barclays GCC Credit and High Yield index dropping -10 bps to 4.49% and credit spreads tightened 8 bps to 183 bps.

According to reports, Saudi Arabia is said to consider selling dollar Formosa bond. However, the report added that no deal has been decided so far.

The AUD is trading firmer this morning in the Asia session, AUDUSD trading 0.40% higher at 0.74602 and reaching levels last seen on June 15. The AUD was supported by bids following a slowdown in escalation of U.S.-China trade disputes which has encouraged risk appetite. We expect resistance to be encountered near the 0.75 level, not far from the 50 day moving average (0.7497) and the 23.6% one year Fibonacci retracement (0.7506). The CNY has also received a boost from this lack of further escalation and as we go to print, USDCNY is trading 0.28% lower at 6.6241.

Regional equities started the week on a positive note. Kuwaiti equities continued to outperform with the Kuwait Premier Markets index adding +1.4%. National Bank of Kuwait and Zain Kuwait added +1.0% and +2.1% respectively.

Oil markets ended the week on a softer footing as fears of a global trade war hit markets following the imposition of bilateral tariffs by the US and China. Inventory data from the US showed a draw at Cushing related to disruptions to Canadian exports to the US while the drilling rig count in the US rose for the first time in three weeks, by five rigs. Brent futures settled the week down 2.9% at USD 77.11/b and WTI was down around 0.5% at USD 73.8/b.

Click here to Download Full article