Equity indices and futures are sharply lower this morning in Asia, after the US announced 10% tariffs on another USD 200bn of imports from China by end-August which, if implemented, would effectively mean around half of total US imports from China would be hit by tariffs. The expanded list includes more consumer goods including apparel, furniture and electronics. Chinese officials have indicated that they will take counter measures but there is no further detail on what these might be yet. The Chinese yuan is around 0.5% weaker this morning at 6.6631/USD.

Economic data released yesterday in the US was largely positive, with the JOLTS “quits rate” – measuring the number of people voluntarily leaving work to seek new opportunities - rising to 2.4% in May, the highest reading since February 2001. The number of job openings reported in May was also higher than forecast at 6638. Small business optimism remained near record highs in June.

Data released in Europe was more disappointing, with the German ZEW investor survey showing worse than expected readings for both the current situation index and the expectations index in July, reflecting worries about a trade war. French and UK industrial production were both weaker than forecast in May at -0.9% y/y and 0.8% y/y respectively, although the first release of UK monthly GDP was in line with forecasts at 0.3% (May), and construction output was much higher than expected at 2.9% m/m. Japanese data released this morning show core machine orders declining by less than forecast in May, suggesting that business investment is relatively solid in Q2.

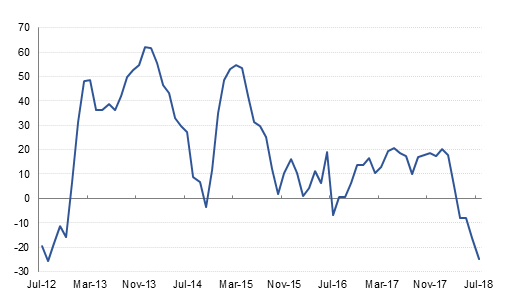

Egyptian CPI inflation rose to 14.4% in June, compared to 11.4% in May, the first time the measure has climbed in 11 months. Higher inflation was widely anticipated as further subsidy cuts were implemented, raising the cost of electricity, petrol and cooking gas. The CBE held rates steady at its latest MPC meeting on June 28, citing the inflationary pressures the new cuts would bring, and we expect that the pick-up in price growth will lead to another hold at the next meeting on August 16.

Treasuries closed lower with the curve flattening as risk assets sustained strength and the market lacked catalysts. Yields on the 2y UST, 5y UST and 10y UST closed at 2.56% (+1 bp), 2.74% (flat) and 2.85% (flat) respectively.

Regional bonds gave up some of their recent gains as investors locked in profits. The YTW on the Bloomberg Barclays GCC Credit and High Yield index rose +2 bps to 4.48% and credit spreads remained flat 177 bps.

According to reports in Bloomberg, Saudi Arabia is asking banks to pitch for roles on a potential USD-denominated sukuk sale.

The AUD has softened against the other major currencies as trade disputes between the U.S. and China escalate, with the U.S. announcing that it would impose tariffs on a further USD 200bn of Chinese imports. The resulting investor concern has seen AUDUSD fall from yesterday’s multi-week high to 0.7414 in the Asia session.

This evening, markets will turn their focus towards Canada, where the Bank of Canada is expected to raise the interest rates by 25bps to 1.50%. While the rate hike is widely expected, investors will scrutinize the monetary policy statement for hints on the pace of normalization of monetary policy. Should the communication show more hawkish language, it could be constructive towards CAD strength.

Developed market equities closed higher as the focus of investors’ shifted to earnings season. The S&P 500 index added +0.3% and the Euro Stoxx 600 index gained +0.4%.

Turkey’s BIST 100 index was a notable exception with losses of -3.0% as investors reacted negatively to the new cabinet in Turkey.

Regional equities closed largely positive with the Tadawul and the DFM index adding +1.1% and +0.7% respectively. Kuwaiti equities continued its positive run as the index closed above the 5,300 level. The day also saw notable companies announcing zero or very limited exposure to Abraaj.

The gain in oil prices overnight has been completely unwound in early trade this morning. The escalation of a trade war between the US and China along with the US walking back its extreme posture on Iranian crude exports are weighing down on prices today, helping bring Brent back to a low USD 78/b handle from levels closer to USD 80/b yesterday.

Forward market curves are still reflecting a disruption to Canadian supplies and the 1-2 month spread in WTI remains wider than USD 1.5/b. A strike in the North Sea has so far affected only one small field so the Brent curve remains relatively stable. Even if the disruption to Norway’s output is small it threatens to tighten an already quite short market.