Currency markets endured some sharp moves overnight as expectations of a recession hitting the global economy in the near-term rise. While economic indicators still point to growth expanding, it is at a much slower pace than the past 18 months and the headwinds to sustained growth look substantial. High inflation—now effectively a global issue—and the lingering effects of the Covid-19 pandemic on incomes, supply chains and governments’ resolve to support their economies will all be negatives for currency markets across the rest of H2 2022.

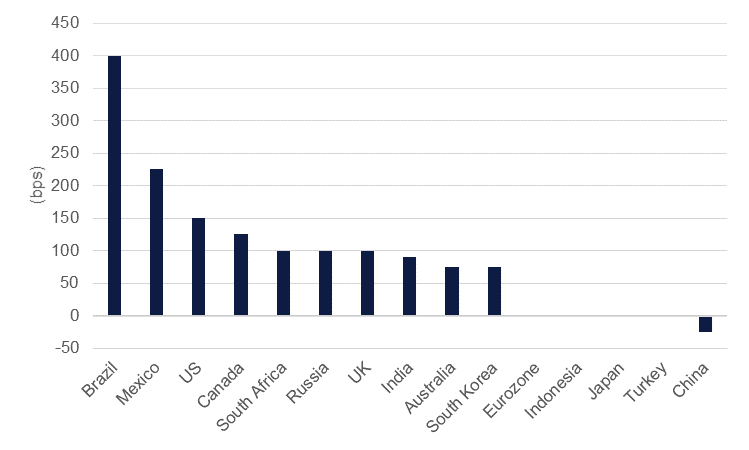

It is now a challenge to find a central bank that is not stepping up to the challenge of higher inflation via tighter monetary policy. Since the start of the year, central banks of the G20 have hiked policy rates by 1,415bps (stripping out Argentina given the country’s idiosyncratic inflation dynamics) with the Fed leading the large developed markets with 150bps since the start of the year. Japan and China remain relative outliers in either keeping policy unchanged or actually easing conditions (as the PBoC has done).

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

But with the threat of a recession looming on the horizon—the inversion of the US 2s10s curve serving as a market proxy—markets are now doubting the commitment of central banks to continue with aggressive tightening to combat inflation. The ECB had lined up a 25bps hike for its meeting on July 21 but conviction that they will pull the trigger has lessened in recent weeks, not to mention the downgrade in expectations for the September ECB meeting where the market had been expecting a 50bps hike only as recently as mid-June. Current pricing would suggest another 25bps hike in September, a far shallower pace of policy tightening than ECB officials have overtly been signalling.

For the US, markets are now pricing in a peak in the Fed funds rate as early as February next year before rate cuts or policy easing bring borrowing costs lower in the face of a recession. Minutes from the June FOMC meeting will be released later this evening with focus on how much the Fed is targeting inflation at the expense of other economic indicators. We maintain they will take an aggressive stance on inflation to avoid it becoming entrenched in the economy even as markets price in a sharp drop in activity.

In the UK, the outlook for the economy remains particularly grim, with the Bank of England seeming to act as doomsayer-in-chief. The BoE has hiked five times since the start of the year but with the net result being inflation at more than 9% and likely to peak at over 11%, according to the BoE’s own estimates, and sterling down almost 12% year-to-date as of early July.

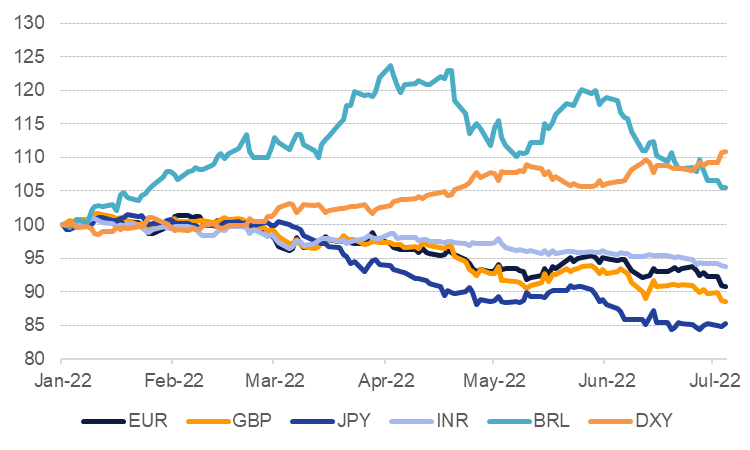

We had cautioned a few weeks ago that our Q3 targets for GBPUSD at 1.20 and EURUSD at 1.05 would be upside caps on prices and the disorderly sell-off in currency markets overnight in markets with limited policy responses shores up our view. We expect that the US dollar will remain a relative outperformer thanks to policy differentials favouring the greenback as well as investors seeking it as a haven asset.

Source: Bloomberg, Emirates NBD Research. Note: Jan 1 2022 = 100

Source: Bloomberg, Emirates NBD Research. Note: Jan 1 2022 = 100

With that in mind, though, there is room for some currencies to manage to push back against the dollar. Relative early movers on inflation have seen their currencies weather the storm somewhat better. This has been the case for commodity-oriented emerging market currencies in particular with the Brazilian real actually up more than 3% against the USD ytd, the South African rand holding its losses to about 4% ytd, and the Indonesian rupiah capping losses at around 5% ytd. Whether they can withstand a withdrawal of capital should a full-borne investor retreat from risk emerge is more questionable but commodity-exposed currencies seem likely to withstand the selling to a better degree. This is partly true in developed markets as well, with CAD the best performer among G7 currencies, losing just 3% ytd against the dollar.