The spread of the Covid-19 Delta variant presents some near-term downside for growth in Q3 and consequently for currency markets and risk assets. Several major economies are reimposing lockdown measures—as we’ve seen in Australia in recent days—while others are keeping restrictions in place. In the EU, several economies have introduced travel restrictions on intra-EU travel, including imposing two-week quarantines.

The risk that outbreaks of the Delta variant cause more hospitalizations and governments adopt lockdown measures to prevent it spreading could undermine bullish expectations for growth in Q3. The Eurozone economy is expected to record a stabilization in activity in Q3 with growth of 2.6% after a strong, re-opening related 12.9% growth expected for Q2. Likewise, the UK is expected to spring back into activity strongly after a Q1 contraction—the economy shrank 6.1% y/y in the final estimate for Q1 GDP. Japan’s economy is forecast to growth by more than 3% in Q3 although the expected uptick in consumption thanks to spectators attending the Olympic games is likely to be muted.

While vaccine rollout in most developed markets has been good, governments don’t seem willing to risk outbreaks getting out of control. Policy stances from the Bank of England and European Central Bank remain accommodative while the market has interpreted the June FOMC meeting from the Federal Reserve in the US as relatively hawkish thanks to a revision to the dots plot which pins two interest rate hikes for 2023.

We had been expecting the strong bounce back in activity in H2 2021 to help support EURUSD and GBPUSD and are maintaining that view for now until the implications of the spreading delta variant become clearer. EURUSD is currently holding at a resistance level of around 1.19 and a downside move could take the pair down closer to the mid 1.17 level in short order. For sterling, we see GBPUSD still well supported at around the 1.38 level the pair is currently trading at but a more substantial deterioration in Covid-19 conditions—not what we are currently expecting—could open up a move to around 1.35. If vaccines do prove effective in providing a firebreak to the spread of the Delta variant then the prospect for currency pairs against the dollar to bounce out of their post-FOMC slump looks clearer.

The Yen may receive a safe haven bid in response to market anxiety over the spread of this new variant but we find there are fewer positive macro impulses in Japan’s economy at present that would allow a downward move in USDJPY to be significant. Our projections for USDJPY in Q3 were for the pair to trade around the 110 level.

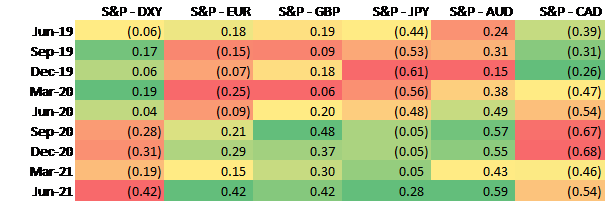

A salient risk is also the apparent reversal of major currency pairs’ correlation to risk assets. The positive correlation between single-day performance in the Euro and the S&P 500 is at its strongest level in the past five years while a similar measure for GBPUSD shows a similarly strong link to the performance of equities. Should a major correction take place in global equity markets—prompted by either an uncontrolled spread of the Delta variant or a substantially more hawkish turn from the Fed—then a deterioration in risk appetite could add further uncertainty to our currency outlook.

Source: Bloomberg, Emirates NBD Research. Note: 90-day single day percentage change correlation

Source: Bloomberg, Emirates NBD Research. Note: 90-day single day percentage change correlation