Coronavirus remains in the spotlight at the start of the week, with a death toll of 910 already surpassing the SARS fatalities in 2003, and with reported cases in excess of 40,000 in China. With little evidence of an end in sight, markets are preferring the safety of bonds over other asset classes, with regional equities starting the week on a negative note. Meanwhile in the FX markets the safety bias is causing the USD to strengthen.

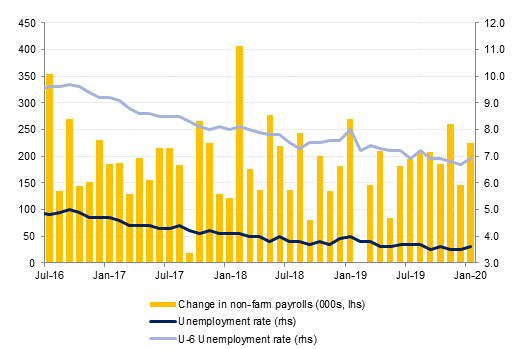

The January U.S. jobs report, was a strong one carrying on the positive data trend of much of last week. Nonfarm payrolls increased 225k, twice the amount expectated, after December and November were revised up as well. Wages rose by 0.2% m/m taking the y/y rate to 3.1% and the unemployment rate also edged up to 3.6%. Despite this improvement, uncertainties over coronavirus were still able to dominate sentiment, as markets preferried a risk-off approach going into the weekend.

On this basis commodities continue to underperform, with oil in particular under pressure. Oil markets moved back into bear territory over last week as concern over how badly demand will be affected by the coronavirus outbreak widened. A technical committee for the OPEC+ group recommended a 600k b/d cut to current production targets as a way to offset the negative demand impact of the coronavirus, but the overall impact of the cut proposal was muted as Russia gave only an acknowledgement and said they would notify the rest of the producers’ bloc soon if they agreed in principle for further cuts to output. Reports this morning suggest that OPEC ministers are unlikely to hold an emergency meeting this month to decide if anything needs to be done.

The headline Dubai PMI declined to 50.6 in January from 52.3 in December, signaling the softest growth in Dubai’s non-oil private sector since February 2016. However, the Dubai index remained in expansion territory despite the whole UAE PMI falling below 50.0 in January, suggesting that the weak-spot in the UAE’s non-oil growth story may be Abu Dhabi.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

It was a week of two halves for treasuries. While return in risk appetite drove yields higher in the first half, investors turned cautious in the second half owing to worries over spread of coronavirus. This despite better than expected non-farm payrolls data towards the end of the week. Overall yields on the 2y UST and 10y UST ended the week higher at 1.40% (+9 bps w-o-w) and 1.58% (+8 bps w-o-w) respectively.

Regional bonds drifted higher tracking moves in benchmark yields at a slower pace. The YTW on Bloomberg Barclays GCC Credit and High Yield index closed below 3% for the first time since October 2016. Credit spreads tightened 8 bps w-o-w to 145 bps.

A 1.33% decline over the last week took EURUSD to 1.0946. This is the first time the price has seen a weekly close below the 1.10 level since October 2019 and is the lowest weekly close since September 2019. After failing to advance beyond the resistive 61.8% one-year Fibonacci retracement (1.1096), the price broke below the support at the 50-day moving average (1.1069). Following this, the price continued to decline for five days. This move also took the price below 23.6% one-year Fibonacci retracement (1.1013) which acted as a resistance level on Thursday. While the price remains below this key level, further declines cannot be ruled out. The probability of this is made more apparent by analysis of the 14-day RSI (Relative Strength Index) which is bearish in momentum and reveals that EURUSD remains under significant selling pressure.

Over the last five trading days, GBPUSD fell by 2.41% to close at 1.2888, the lowest weekly close since November 2019. This decline saw the price break below the 50-day moving average (1.3079) which then acted as a resistance level on Wednesday. After failing to break above this new resistance level, the price declined for the next three days and even closed below the 100-day moving average (1.2899) on Friday. In addition to this analysis of the weekly candle chart shows that the price shattered the 100-week and 200-week moving averages (1.2976) and (1.3051) which failed as support levels. This is noteworthy as the 100-week moving average had provided weekly support since the start of the year. Finally, Friday’s daily close was below the 61.8% one-year Fibonacci retracement (1.2920). All of these developments are technically bearish for the price in the short-term, and in order to reverse this vulnerability and prevent further losses, there needs to be a weekly close back above the 100-week moving average.

Regional equities started the week on a negative note. The DFM index lost -0.6% to move into negative territory for the year. The Tadawul and the Qatar Exchange were other notable losers.

DXB Entertainments gained +5.0% after the company reported FY 2019 adjusted loss of AED 855mn compared to AED 1bn (excluding one-offs)a year ago. The company further said that it expects profitability in Q1 and Q4 and losses in Q2 and Q3 of this year.

Oil markets moved back into bear territory last week as concern over how badly demand will be affected by the coronavirus outbreak widened. Brent futures settled the week at USD 54.47/b, down 6.3% over the five days and a fifth consecutive weekly decline. WTI fell 2.4% over the week to close at USD 50.32/b having moved below USD 50/b earlier in the week. Both contracts have fallen more than 20% from their 2020 highs and are hovering close to their lowest levels in the past year.

A technical committee for OPEC+ recommended a 600k b/d cut to current production targets as a way to offset the negative demand impact of the coronavirus. The proposal is non-binding and only OPEC+ ministers can actually agree on the cuts and choose how to allocate and enforce them. The overall impact of the cut proposal was muted as Russia gave only an acknowledgement and said they would notify the rest of the producers’ bloc soon if they agreed in principle for further cuts to output. The lack of clarity over OPEC’s position—including whether to also extend the current cuts—means that markets appear poised to take downside views on oil in the short term until there is greater conviction that OPEC producers are ready to endure substantial production cuts to support prices.