.jpg?h=457&w=800&la=en&hash=163F21AA7102EB9B5398ECA40896ECBC)

In the UK, parliament will hold indicatives votes today on alternatives to the government’s Brexit deal. Prime Minister Theresa May is likely to try and get her deal put to parliament again with a possible provision that she will resign in exchange for it passing. Certainly the prime minister is in an increasingly weak position with opposition both from the Labour party and her own Conservatives. However, whether or not May will actually publicly commit to resigning and accept that she may not have followed through on her pledge to deliver Brexit remains a risk. Whatever emerges from today’s indicative votes is likely to be a compromise position as none of the options available—no deal Brexit, second referendum, revocation of Article 50—appears likely to gain a majority of support in parliament. Moreover, the government is not obligated to follow through on any proposal from today’s votes and they may highlight to the EU just how divided the UK’s parliament remains on Brexit.

There were more signs of slowing growth in the US, particularly at the consumer level in Q1. Housebuilding declined 8.7% m/m, its largest drop in eight months according to Commerce Department figures. Consumer confidence for March also declined by 7.3pts with consumers growing more pessimistic on current conditions and the labour market, despite persistent strong signs from the US payrolls.

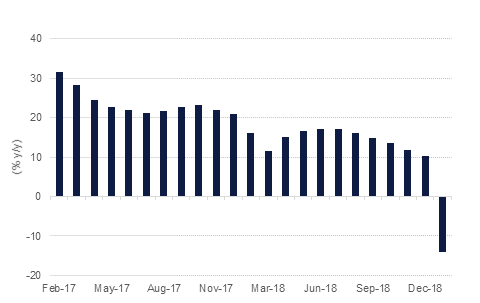

Profits at Chinese corporates fell 14% y/y over January-February compared with a 1.9% decline in December. Part of the dip will have been attributed to lower activity over the Chinese New Year holidays but all main industries—car manufacturing, steel, chemicals among others—saw weaker profits. The consistency of disappointing data out of China will heap more pressure on authorities there to step up stimulus in a more direct fashion, beyond the indirect measures such as tax cuts and lowering government involvement in industry.

German consumer morale declined leading into April according to the GfK survey. The consumer sentiment index fell to 10.4 from 10.7 a month earlier and was below market expectations. Nevertheless, sentiment still remains in positive territory, albeit much lower than year ago levels. Consumers did note a sharp drop in business cycle expectations, again at odds with the IFO survey of corporate confidence.

Source: EIKON,Emirates NBD Research

Source: EIKON,Emirates NBD Research

Treasury yields drifted lower as some soft consumer data out of the US weighed against a general risk-on market trend. Yields on 10yr USTs slipped marginally while the front end of the curve was roughly flat. US president Donald Trump’s latest pick to sit on the Fed board, Stephen Moore, has said the Fed should cut rates immediately and has been a persistent critic of Fed chair Jay Powell.

GCC bonds had a range-bound day with yield on Bloomberg Barclays GCC bond index closing a bp higher at 4.09% on the back of a similar increase in credit spreads to 177 bps.

Moody’s affirmed UAE’s rating at Aa2/stable. It also affirmed Abu Dhabi’s rating at Aa2/stable citing the Emirate’s strong balance sheet and Moody's estimates that ADIA’s asset under management are more than $590 billion as of Dec 2018 and far exceed the Emirate’s total liabilities in the wider public sector.

In the primary market, Emirate of Sharjah priced its 7yr Reg S sukuk at MS+ 155bps, circa 25bps tighter than the initial guidance. Also in the local currency space, Saudi Arabia extended its domestic debt curve with new sukuk issue of SAR 2.395 bn in 10 yr and SAR3.680 in 15yr tranches.

The NZD is underperforming this morning in the aftermath of the RBNZ’s monetary policy meeting. While the central bank held interest rates unchanged at the record low of 1.75%, policy makers took a dovish stance, stating that their next move in interest rates is likely to be a cut. As we go to print, NZDUSD is trading 1.61% lower at 0.67980 and is currently trading below the formerly supportive 50-day and 100-day moving averages (0.6827 and 0.6811 respectively). A daily close below these levels exposes the price to further declines towards 0.6737, the 200-day moving average.

Equity markets snapped few days of losses with gains across most developed markets. The FTSE closed up 0.26% while the Eurostoxx 600 added almost 0.8% overnight. In the US the S&P 500 gained 0.7% despite some soft data out on consumer sentiment.

Regional equities were more mixed with the Tadawul and Abu Dhabi exchange gaining slightly while the DFM was down 0.7%.

Crude markets were up strongly overnight as markets returned to a risk-on footing. WTI added 1.9% while Brent gained 1.1%. The API reported a build in US crude stocks of 1.9m bbl last week, against market expectations. EIA data will be released later today.

OPEC+ will hold its next market committee meeting in May when they will assess how much impact the production cuts have had in lowering inventories and bringing crude markets into balance. The meeting will closely track the White House’s stance on whether to extend waivers on importing Iranian crude when they are set to expire that month.

Click here to Download Full article