Two of 2019’s most critical issues for financial markets came to a head over the week with the outcome of the general election in the UK pointing to a swifter end to the Brexit saga and the US and China finally coming to agreement on a phase one deal.

In the UK, the Conservative Party won the general election with a substantial majority, allowing Prime Minister Boris Johnson to begin the process of the UK leaving the European Union as early as this week and making the departure date of January 31st 2020 highly likely. The vote clearly came down on issues related to Brexit as the Conservatives were able to win in areas that traditionally supported Labour but voted Leave in the 2016 referendum.

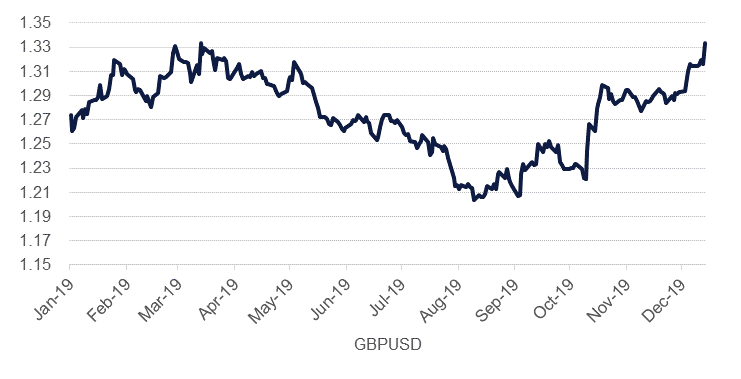

What the vote offers financial markets is at least some near term certainty over the relationship between the UK and EU and markets rallied in response. Sterling moved up to 1.35 against the dollar before calming down and holding on to levels in a range around 1.33. The prospects for the UK economy in 2020 look a little brighter thanks to the certainty that Brexit will happen and also pledges from the Conservatives to spend on infrastructure. However, now the UK will embark on negotiating a new trading relationship with the EU which the Conservatives aim to have finalized and end the post-Brexit transition period by the end of 2020. Past EU trade agreements have taken years to negotiate so the risk that the UK ends up trading on WTO terms with the EU from 2021 onward remains high and may dampen the investment impact of a more certain political landscape.

China and the US managed to agree a Phase One trade deal covering goods trade between the two countries and addresses some of the US’ concerns over intellectual property and state interference in China’s economy. China has reportedly agreed to increase its imports of goods and services from the US to USD 200bn, a significant boost on pre-trade war levels of closer to USD 180bn. There is little new to the phase one agreement and is a first step in a broader transformation of the US-China trading relationship. But the tempering of hostilities, and news that no new tariffs will be imposed this week, should help to spur an improvement in risk assets. Elsewhere, new ECB president Christine Lagarde kept policy unchanged with rates at -0.5% and EUR 20bn of asset purchases each month.

Recent data out of China showed a bit of improvement in November even ahead of the US and China managing to agree their Phase One trade deal. Industrial production rose 6.2% y/y compared with market expectations of around 5% and a healthy acceleration from the 4.7% growth recorded in October. Retail sales rose by 8%, also outperforming and beating the past month’s read. The only area of stagnation was in fixed asset investment, related to construction, which has held steady at 5.2% up in the first 11 months of the year.

The TCMB exceeded expectations at its final meeting of 2019, cutting the one-week repo rate by 200 bps to 12.00% on Thursday. This makes a cumulative 1,200 basis points of cuts in the second half of 2019, putting the bank on track to meet President Erdogan’s desired single-digit interest rates in 2020. Whether single-digit inflation will also be realised is less certain however. CPI inflation ticked up to 10.6% y/y in in November, from 8.6% the previous month. The central bank’s task will be to ensure that it does not cut rates so quickly as to scare the markets and prompt another rapid depreciation of the lira similar to that seen in 2018.

Source: Emirates NBD Research

Source: Emirates NBD Research

Treasuries closed higher in a week dominated by the last Federal Reserve meeting of 2019 and partial resolution of the US-China trade war. Despite a risk-on mood and intra-day volatility, yields were largely unchanged over the week. Yields on the 2y UST and 10y UST ended the week at 1.60% (-1 bp w-o-w) and 1.82% (-1 bp w-o-w) respectively.

In UK, bonds had a mixed week as well. The aftereffects of the UK election results faded quickly. Overall 10y Gilts ended the week at 0.79% (+2 bps w-o-w).

Regional bonds had a good week following resolution of some key headwinds. The YTW on Bloomberg Barclays GCC Credit and High Yield index dropped 6 bps w-o-w to 3.18% and credit spreads tightened 4 bps to 143 bps.

Over the last week, EURUSD gained 0.58% to reach 1.1121. This was the second week that the price was able to gain ground, importantly finishing above the 100-day moving average (1.1065) which it failed to take the previous week. The next level of resistance can be expected at the 200-day moving average (1.1154), which prevented further gains on Wednesday, Thursday and Friday of last week. A daily close above this level may trigger further appreciation in EURUSD towards the 50% one-year Fibonacci retracement (1.12224).

GBPUSD climbed for a third week, with gains of 1.47% which took the price to 1.3331, the highest weekly close since June 2018. As well as closing far above the 100-week and 200-week moving averages (1.3048 and 1.3098 respectively) for a second week, the price has now closed above the 50-month moving average for the first time since September 2014. In addition, the price briefly reached a new 2019 high of 1.3514. Further gains may initially be hampered due to profit taking from investors closing longs, as the 14-day Relative Strength Index (RSI) shows that at 76.94, GBPUSD is currently overbought. However, the current technical indicators are very bullish for the price and a re-test of Friday’s high of 1.3514 cannot be ruled out over the next month.

Regional equities closed largely positive. The DFM index added +0.2% while the KWSE PM index gained +0.9%. MSCI is scheduled to announce a decision on inclusion of Kuwaiti stocks in its EM index on 18 December 2019. Elsewhere, Saudi Aramco continued its positive run since last week’s listing on the Tadawul.

Oil prices gained a second week running thanks to optimism that a US-China trade deal could be within reach. Brent added 1.3% over the week to settle at USD 65.22/b while WTI rose 1.5% to close at USD 60.07/b, its first close above USD 60/b since mid September.

Forward curves in both contracts remain in backwardation with 1-2 month spreads in Brent closing just shy of USD 1/b while in WTI they closed the week at less than USD 0.10/b. Long dated contracts are moving higher, largely on the trade optimism while investors have piled into new long positions in both Brent and WTI.