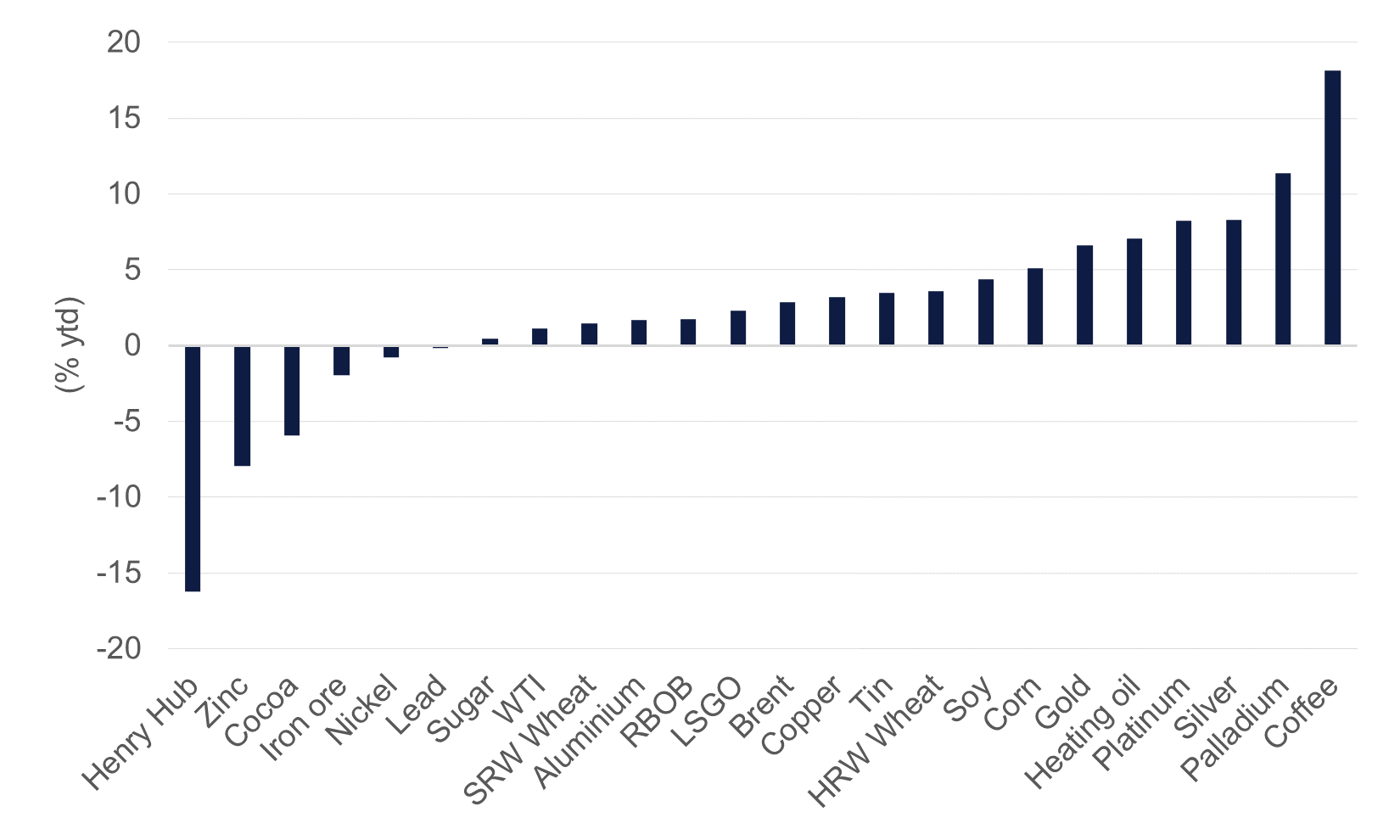

Commodity markets had a positive January with nearly all major markets gaining. The Commodity Research Bureau spot index gained 1% year-to-date by the end of January even amid uncertainty around global demand for industrial raw materials this year. Leading the way were precious metals markets with spot gold prices up 6.6% ytd at USD 2,798/troy oz by the end of January, a new record high level. The rest of the precious metals complex performed better than gold with palladium recording the strongest gains since the start of the year. The uncertainty for the global outlook this year is arguably a positive for gold markets (and the rest of precious metals) though the prospect of a higher path for US rates will impose a drag effect.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

Crude oil markets gained in January, rising initially on geopolitical anxieties over sanctions from the outgoing Biden administration in the US on Russian oil exports. Brent futures gained 2.8% in January to close the month at USD 76.63/b, having hit a ytd high closing prices of USD 82.03/b midway through the month. WTI futures added 1.1% at USD 72.53/b.

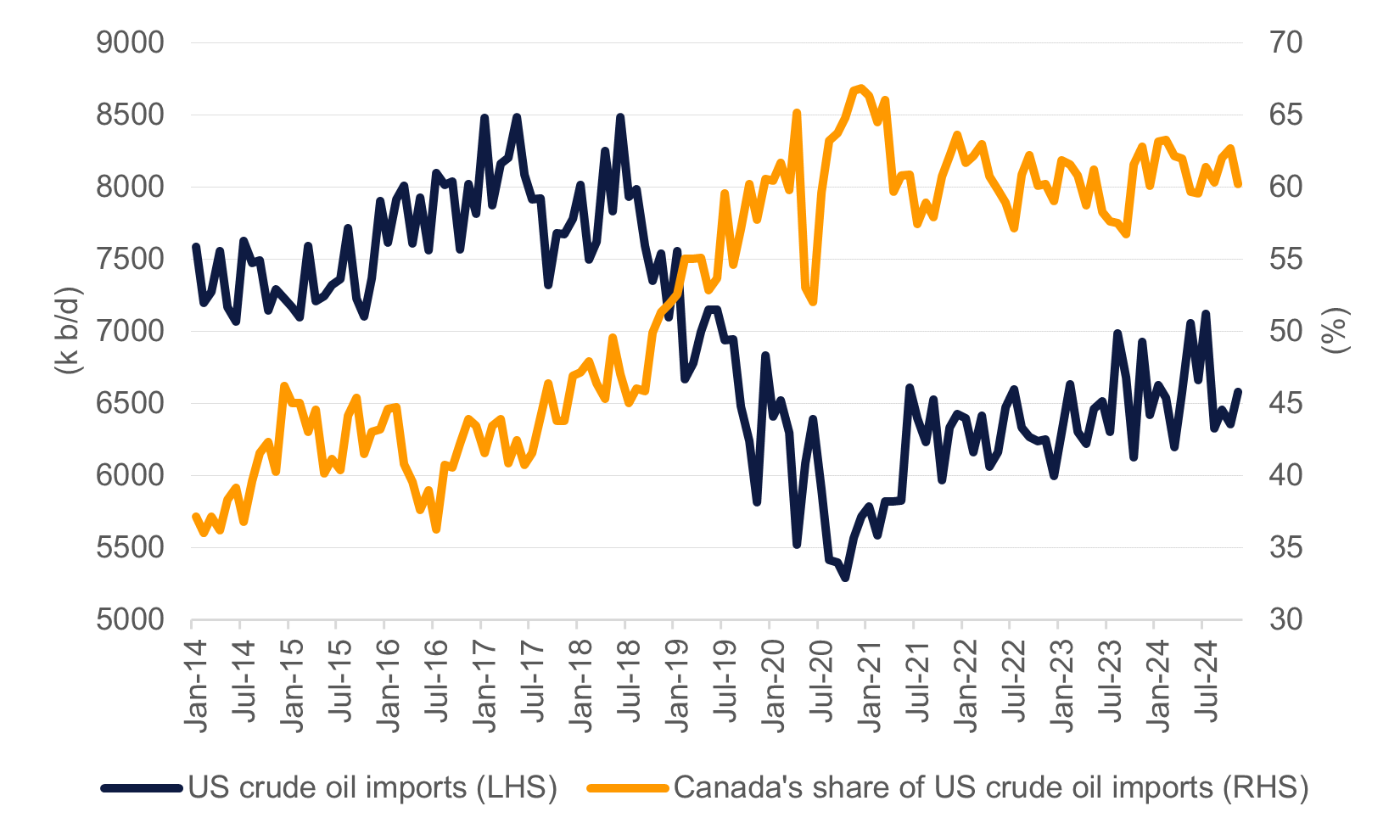

The near-term outlook for oil markets will be set by market reaction to US President Donald Trump’s imposition of tariffs on the key US trading partners of Canada, Mexico and China. Canadian energy exports to the US received a lower tariff rate of 10% (compared with 25% for all other goods) to soften the blow of the new, higher cost to trade. As of November 2024, Canada accounted for 60% of total crude oil imports into the US and represents nearly 100% of total imports in some parts of the US (the Mid-West and Rocky Mountain PADs).

Source: EIA, Emirates NBD Research.

Source: EIA, Emirates NBD Research.

OPEC+ will hold a joint ministerial monitoring committee meeting on February 3rd where they are likely to endorse the exporters’ alliance’s plan to incrementally add oil back to the market from April onward. US President Trump has called out for more oil production from OPEC members, which fits with their announced plans, though the US government and OPEC+ will differ on what levels are appropriate for prices.

Industrial metals have shown a mixed performance since the start of the year. Iron ore futures came off by roughly 2% ytd at USD 101.59/tonne while LME aluminium and copper forwards were both stronger, up 1.7% at USD 2,594/tonne and 3.2% at USD 9,048/tonne respectively. Iron ore inventories in China were roughly steady for the month while SHFE base metal inventories either levelled off from recent draws or were moderately higher.