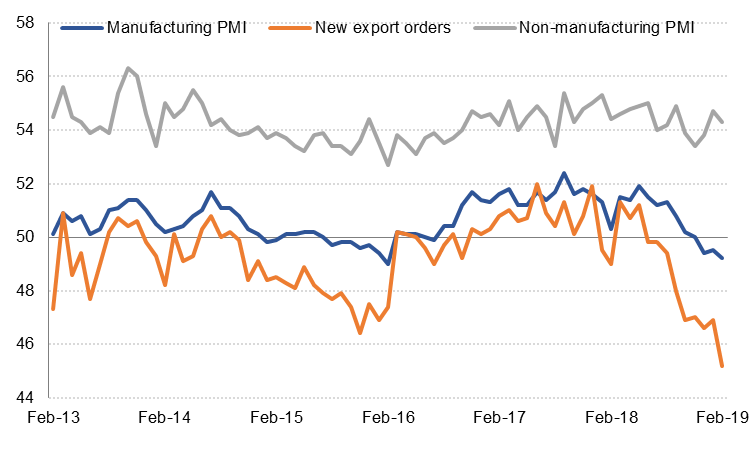

Chinese flash PMI data for February, released this morning, was slightly softer than expected with the manufacturing PMI declining further to 49.2 (49.5 in January). New export orders declined at the fastest rate since 2009. The non-manufacturing PMI fell to 54.3 from 54.7 in January, signalling slower growth in the services sector as well. In Japan, industrial production contracted by a bigger than expected -3.7% m/m in January but was flat y/y. Retail sales also disappointed, declining -2.3% m/m in January.

Weaker than expected US economic data released yesterday was largely overshadowed by former Trump attorney Michael Cohen’s explosive testimony to Congress, but we will restrict our comments this morning to the former. The US trade deficit widened to a record -USD 79.5bn in December as exports declined -2.8% m/m (-0.3% y/y) while imports rose 2.4% m/m (3.2% y/y). Factory orders rose by less than forecast in December, while core capital goods orders declined by more than had been estimated in the advance report last week. Both wholesale & retail inventories rose by more than forecast in December as well, likely due to weaker exports. The only positive note was bigger than expected rise in pending home sales in January. The delayed US GDP data for Q4 will be the key data release today, with the market expecting 2.2% q/q annualised, down from 3.4% in Q3 2018.

The market reaction to escalating tension between India and Pakistan remains relatively muted. INR is just 2% weaker against the dollar year to date, although equities have missed out on the broad rally in equities since January. The KSE100 index is up just 4.4% ytd, underperforming other Asian equity markets. The US has called for restraint from both sides, and Pakistan’s PM Imran Khan has said the two countries should engage in dialogue.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Fixed Income

Fed Chair Jerome Powell’s testimony to the House financial services committee largely repeated messaging that other Fed speakers have given in recent weeks. Powell indicated that the Fed would stop its balance sheet reduction later this year with the market expecting the central bank would hold on to around USD 3.2-3.5trn on its balance sheet.

Treasury yields were higher across the board with the 10yr up nearly 6bps overnight and the 2yr adding 2bps. Fourth quarter GDP data for the US will be released later today and the gain in yields may be a little premature given some of the lackluster data that has emerged out of the US in recent releases.

EDB set final price guidance of a USD 750m issue at 98bps over midswaps, considerably tighter than initial guidance of as wide as 130bps.

FX

GBPUSD continued its rally overnight as the prospect of a no-deal Brexit receded, despite 20 Tory MPs abstaining from yesterday’s vote in protest at PM May’s concession. Some pro-Brexit MPs appear to be more willing to support an “imperfect deal” than risk potentially indefinite delays or no Brexit at all.

Equities

Developed market equities closed mostly lower yesterday, but not by much. US trade representative Robert Lighthizer sounded very cautious in his comments about ongoing trade negotiations with China to a congressional committee and the large US trade deficit causing some early weakness in the US session.

Regional equities had a mixed session yesterday, although again the extent of the moves were relatively small.

Commodities

Oil futures gained sharply overnight with Brent adding 1.8% to push back above USD 66/b while WTI gained nearly 2.6% to close just short of USD 57/b. Markets appear to have rallied on the back of commentary from Saudi Arabia’s energy minister who issued a rebuttal to US President Trump’s call for OPEC to ‘relax’ on oil production cuts. Khalid al Falih said that OPEC and its partners were ‘taking it easy’ and were taking a ‘slow and measured’ approach. Falih indicated that cuts would likely remain in place in the second half of the year although he did not that there was considerable uncertainty on the outlook for supply from Venezuela, Iran and Libya.

EIA data showed a large drop in crude stocks last week—8.6m bbl—as imports fell by 1.6m b/d. Crude production has hit another new record high of 12.1m b/d while exports are still holding above 3m b/d.

Metals prices are on the back foot this morning after a third consecutive manufacturing PMI print from China below 50. LME copper is back below USD 6,500/tonne, a level it has struggled to break through in the last few days.