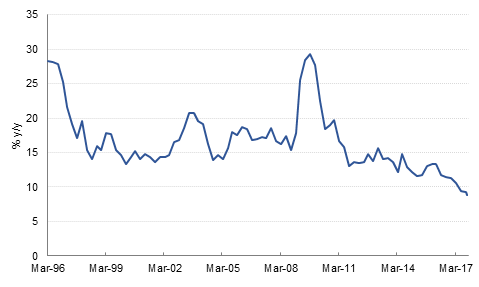

Industrial production and retail sales in China came in slightly lower than expected in October at 6.2% y/y and 10.0% y/y respectively. Both readings were also lower than in September, pointing to a slower rate of growth last month. However, fixed asset investment (excluding rural households) was in line with forecasts (although also weaker than September) at 7.3% y/y. Perhaps of greater concern was the sharp slowdown in new yuan loans, down more than 40% m/m in October, and M2 growth which at 8.8% y/y was the slowest since at least 1996.

There are important data releases today across Europe, starting with UK inflation, which is forecast to have accelerated in October. The German ZEW Economic Sentiment Indicator is likely to show a greater degree of optimism this month, as equity markets have performed well and with the ECB set to continue with asset purchases at least until next September. The first (flash) estimate of Eurozone Q3 GDP is due this afternoon, with analysts expecting growth of 2.5%, the same as in Q2.

The EU Withdrawal Bill goes back to the UK parliament today for the committee stage, where MPs debate and can amend various aspects of the legislation. The government has agreed to include an amendment allowing MPs a vote on the final deal reached with the EU in what is a significant concession, but this is unlikely to satisfy many opponents as it wouldn’t allow time to renegotiate aspects of the deal if the House of Commons rejects it. More than 400 amendments and new clauses have been tabled.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

US Treasuries closed mixed amid lack of catalysts. While yields on the short end of the curve rose with 2y USTs yielding 1.68% (+3 bps) and 5y USTs yielding 2.07% (+2 bps), the long end of the curve saw yielding dropping with 30y USTs yielding 2.87% (-1 bps).

The pressure on region bonds continued amid geopolitical tensions. The YTW on the Bloomberg Barclays GCC Credit and High Yield index rose 1 bps to 3.73% even as spread remained flat at 163 bps.

Ezdan Holdings was downgraded to BB from BBB- by S&P. The rating agency attributed the downgrade to weakening financial performance as a consequence of the blockade on Qatar by other GCC countries. Elsewhere, Bank Muscat’s rating was changed to BB/ Stable from BB+/Negative by S&P.

The USD rose against most major G-10 and emerging market currencies ahead of a data-laden week. The Bloomberg Spot Index rose 0.2%. The GBP (-0.6%) came under pressure following reports that a no-confidence motion can be moved against Prime Minister May.

Developed market equities closed mixed with the S&P 500 index adding +0.1% and the Euro Stoxx 600 index losing -0.7%. It does appear that a sense of fatigue is setting in global markets with investors increasingly turning cautious.

For regional markets, trading was more nuanced than it has been in the recent past. The DFM index and the Tadawul added +0.4% each. In case of the Tadawul, it was against government related stocks which led the gains in the final hour of trading.

In terms of stocks, Emaar Properties added +1.5% after reporting strong set of Q3 2017 earnings. In other corporate development, six current shareholders in ZAIN are reported to have sold 218.6mn shares in an auction at 440 per share to Al Nuhood for Public Trading & Contracting.

Oil markets struggled to start the week with Brent futures giving up nearly 0.6% to close at USD 63.16/b and have now pushed below the USD 63/b handle. WTI opened the week flat, holding on to levels close to USD 56.75/b. In OPEC’s monthly oil market review, the producers’ bloc revised up its 2018 demand growth forecast by 360k b/d (1.5m b/d in total) and cut its forecast for non-OPEC supply growth. This view contrasts with a near complete opposite from the IEA but would allow OPEC to raise output to as much as 33.4m b/d to balance demand and supply. Secondary source data reported OPEC production of 32.59m b/d in October, a drop m/m thanks to interruptions to supply in Iraq.