China’s August exports increased 9.5% y/y customs data showed, marking the strongest gain since March 2019. Imports however slipped 2.1%, suggesting softer domestic demand. China's exports were boosted by record shipments of medical supplies and strong demand for electronic products. The robust exports picture suggests a faster and more balanced recovery for the Chinese economy, especially as it rebounds from a record first-quarter slump on the back of government domestic stimulus measures.

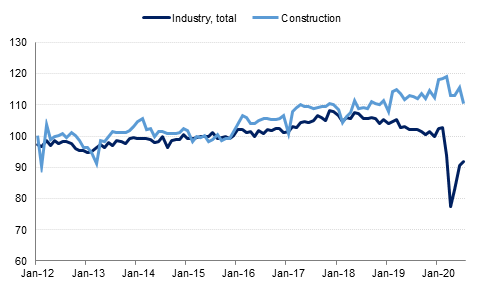

Figures released the Federal Statistical Office of Germany, showed Industrial output in Europe’s largest economy rose by 1.2% m/m, lower than expected, however marking the third successive increase after record drops during the months of March and April. The automotive sector, which was facing headwinds before the pandemic, saw activity expand by 7% m/m, however production levels are still almost 15% lower than in February. The construction sector was a drag on the headline figures, shrinking by 4.3%. Even excluding the volatile construction and energy sectors, output rose by 2.8%, still lower than the forecast.

UK house prices jumped 5.2% y/y (1.6% m/m), mortgage lender Halifax said, marking the biggest increase since August 2016, amid growing fears over rising unemployment as the government winds down its job retention scheme. Halifax pointed to temporary tax cut on purchases, pent-up demand and some buyers wanting to move to bigger properties after the lockdown as key factors behind the surge in activity.

US markets re-open today after the Labour Day holiday, and legislators return from their summer recess. Negotiations on another fiscal stimulus package are likely to resume, and congress also has to pass budget legislation to avert a partial government shutdown at the end of September. Treasury secretary Mnuchin said on Sunday that he and House Speaker Nancy Pelosi have agreed to work on a spending bill that would allow the government to run through the election and into December.

Source: Federal Statistical Office, Emirates NBD Researchn

Source: Federal Statistical Office, Emirates NBD Researchn

US treasuries were unmoved yesterday owing to the Labor Day holiday, and in early morning trading this morning yields are broadly flat, with the 10-year down 1 basis point. In the UK, 10-year gilts closed down 2bps.

GBP weakened significantly on Monday, dropping by -1% to reach 1.3150 after it was reported that British PM Boris Johnson was prepared to walk away from Brexit trade talks. The NZD also fell after the RBNZ reaffirmed that negative interest rates were amongst their policy options. The currency declined by -0.50% and currently trades at 0.6690.

The USD breached the 93 handle and has held firm into this morning, with the DXY index sitting at 93.140. This has done little to influence the JPY which remains largely unchanged at 106.30. The same can be said for the AUD at 0.7280. The EUR experienced a moderate decline of -0.27%, undermined by disappointing industrial production data out of Germany, and currently trades at 1.1805.

US equity markets were closed for Labor Day yesterday, offering them some respite from the tech-driven sell-off seen at the close of last week. S&P 500 futures were up modestly early on Tuesday morning. Elsewhere, the performance was mixed to start the week. Equities got off to a strong start in Europe, as the FTSE 100 – one of the worst-performing equity indices this year – climbed 2.4% yesterday. The gains were largely driven by the deflationary effect of renewed Brexit worries on the pound but the positive Chinese exports data yesterday provided also provided a boost to miners. Elsewhere in Europe the DAX added 2.0% on the day while the CAC gained 1.8%. In Asia, however, the Shanghai Composite closed down 1.9% amidst ongoing tensions with the US.

Fears over demand strength continue to weigh on oil markets, with both primary benchmarks under pressure. Brent futures closed down 2.0% to USD 42.0/b, and are now trading at levels last seen in June. While US markets were closed yesterday, WTI has fallen further below the benchmark USD 40.0/b level in early morning trading today, and is now at USD 38.98/b. Despite Saudi Arabia announcing it was cutting its pricing for October, only four out of 10 Asian refiners stated that they would buy more crude as a result, according to Bloomberg reports. Other factors likely weighing on the oil price include US-China tensions, rising coronavirus cases in key markets and the end of the US driving season, which all raise questions regarding demand.