China announced it would increase tariffs on USD 60bn worth of imports from the US from 1 June, in retaliation for the US tariff hike last Friday. Chinese tariffs on some goods including computers, agricultural products and LNG would be as high as 25%. The US also released a list of goods that could see tariffs of up to 25% imposed by the end of June if no deal is reached with China before then. This would effectively cover all remaining Chinese exports to the US that are currently not being taxed and is likely to push up the cost of many household items for American consumers. President Trump said he would meet with President Xi at the G20 summit in Japan in late June. Markets reacted negatively to the tariff escalation with the S&P 500 index down -2.4% and 10y treasury yields falling below 2.40% during yesterday’s session. Asian equity markets opened lower this morning, but US equity futures appear to have stabilised for now.

India’s CPI for April 2019 accelerated to 2.92% y/y. This was the highest reading in six months but still well below the Reserve Bank of India’s median target of 4%. The uptick was driven by sharp increase in food prices of +0.9% m/m. Importantly, core inflation (excluding food and fuel) eased to a 18-month low of 4.55% y/y. With high frequency data indicating a slowdown in growth, the inflation reading provides further room for the RBI to continue to prioritize growth. We expect the RBI to cut rates by another 50 bps over the next six months.

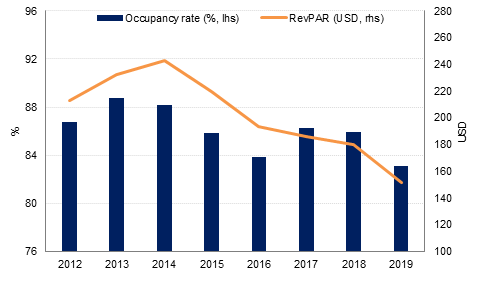

The total number of international visitors to Dubai increased 2% y/y in Q1 2019, a similar growth rate to Q1 2018. Visitors from the two largest source markets - India and Saudi Arabia - declined -8.4% and -5.1% respectively. There were also fewer visitors from Russia, Iran, Kuwait and Jordan in the first quarter of this year, relative to Q1 2018. However, strong growth was recorded in visitor numbers from Oman, Philippines, France and China, according to data from Dubai Department of Tourism & Commerce Marketing. The report also showed an 8% increase in the room supply in Dubai compared with Q1 2018, while the average revenue per available room (RevPAR) declined -14.5% y/y over the same period.

Source: STR Global, Emirates NBD Research

Source: STR Global, Emirates NBD Research

Fixed Income

Treasuries closed higher as the US-China trade war escalated. The curve bull-steepened with yields on the 2y UST, 5y UST and 10y UST closing at 2.18% (-8 bps), 2.18% (-8 bps) and 2.40% (-6 bps) respectively.

Regional bonds lost some of its recent gains amid a reversal in risk sentiment and renewed focus on geopolitical tensions. The YTW on Bloomberg Barclays GCC Credit and High Yield index rose 3 bps to 3.98% and credit spreads widened 7 bps to 168 bps.

In terms of rating action, Fitch affirmed Taqa at A with stable outlook. The rating agency also rated MAF’s green sukuk at BBB.

FX

USDJPY has seen some relief and bounced off the lows of 109.14 earlier this morning to reach the current trading price of 109.61. The main driver behind this reversal has been the softening of JPY following the reappearance of risk appetite catalyzed by the positive performance of U.S. equity market futures. In addition, the yen has weakened after BOJ Governor Kuroda reiterated his easing the continued need for ultra-loose monetary policy.

However, this rebound in USDJPY may be short lived following China’s retaliatory tariffs. Any further escalation in trade tensions is likely to result in a risk averse environment, strengthening the yen and sending USDJPY back towards the 109 level.

Equities

Developed market equities closed lower as China retaliated against US tariffs with its own set of tariffs on US goods. The S&P 500 index and the Euro Stoxx 600 index dropped -2.4% and -1.2% respectively.

All regional markets closed sharply lower amid escalation in geopolitical tensions. The DFM index and the Tadawul dropped -4.0% and -3.6% respectively. The sell-off was broad-based across indices.

Commodities

Commodity prices declined further yesterday as the US-China trade issue escalated with retaliatory tariffs announced by China. The Bloomberg industrial metal index fell nearly -1.5% yesterday.

Oil prices also declined as global growth concerns outweighted increased geopolitical tension in the Gulf. Both brent and WTI are trading slightly higher this morning however.

Gold rallied on the overall risk-off tone yesterday, and is currently just shy of USD1300 /troy ounce.

Click here to Download Full article