China’s PMI data improved this month hinting at a reversal of fortunes for the Chinese economy. Both the official manufacturing PMI increased from 49.5 in August to 49.8 this month, and the Caixin manufacturing PMI increased from 50.4 in August to 51.4. US personal income rose 0.4% in August, but with spending just 0.1% higher the savings rate increased to 8.1% versus a revised 7.8%. The PCE chain price index, the Fed’s favoured measure of inflation, was unchanged with the core rate up 0.1%. On a y/y basis, the headline rate was steady at 1.4%, while the core rate rose to 1.8% y/y from 1.7% y/y previously. The data was a little bit softer than expected but in other news consumer confidence rose 3.4 points to 93.2 in the final September estimate.

Saudi Arabia has launched new tourist visas and relaxed dress codes for foreign women in a bid to boost the tourism sector and create more jobs in the kingdom. Previously, tourism was limited to domestic and religious visits. The Vision 2030 plan aims to have the tourism contribute 10% of GDP. The Saudi Arabian General Investment Authority and Saudi Commission for Tourism and National Heritage have agreed investment deals and MoUs worth SAR 100bn aimed at developing the sector in the coming years. These include the development of luxury hotels and resorts, entertainment destinations, retail and theme park developments.

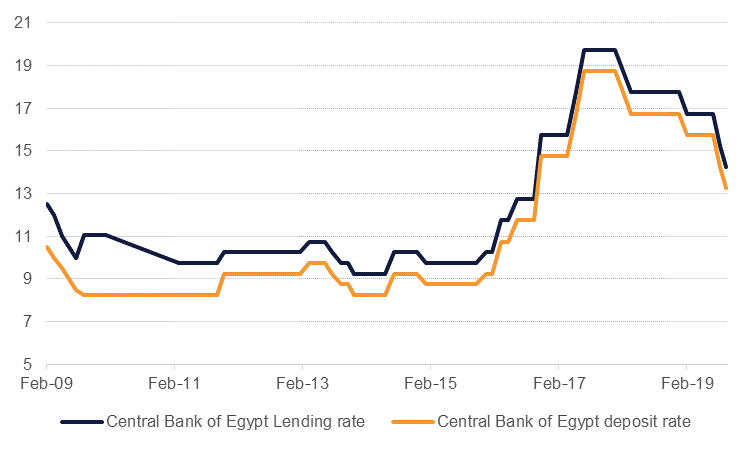

The Egypt Central bank cut interest rates a further 100bps last week, taking the lending rate and the deposit rate to 14.25% and 13.25% respectively. The cuts were in line with expectations and follows the recent decline in inflation to 7.5% in August, the lowest in 6 years. The cut follow a 150bps rate cut seen in July.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Fixed Income

Treasuries closed higher as the start of a formal impeachment enquiry by Democrats heightened the political risk. Further reports that the US government might consider limiting investments into Chinese companies also weighed on investor sentiment. The move was later denied by the Treasury Department. Overall, yields on the 2y UST, 5y UST and 10y UST closed at 1.63% (-5 bps w-o-w), 1.56% (-4 bps w-o-w) and 1.68% (-4 bps w-o-w) respectively.

Regional bonds closed in a tight range even as it ended the week marginally lower. The spate of new issues also weighed on prices. The YTW on Bloomberg Barclays GCC Credit and High Yield index rose +3 bps w-o-w to 3.25% and credit spreads widened 9 bps w-o-w to 159 bps.

S&P affirmed Saudi Arabia’s credit rating at A- with stable outlook. The rating agency said that it ‘expects Saudi Arabia to redouble its efforts to secure key oil production and processing facilities and increase storage capacity’.

Taqa raised USD 500mn in a 30y paper which was priced to yield 4%.

The dollar received a double boost from the news the opposition Democrats were commencing a formal impeachment inquiry against President Trump and reports that the US might limit investments into Chinese companies. The DXY index added +0.6% to close at its highest level since mid-2017.

Among G7 peers, the GBP dropped -1.5% over the week as political risk in the UK increased and little clarity emerged on Brexit prospects. While a no-deal Brexit is seemingly ruled out by markets, the uncertainty was weighing on the UK economy. Further, comments from Saunders that the BoE may need to cut even if there is a deal on Brexit also weighed on the currency.

Regional equities traded mixed at the start of the new week. Egyptian equities outperformed their regional peers with the EGX 30 index rallying in excess of +3.0%. The decision of the Egyptian Central Bank to cut interest rates by 100 bps and lack of protests over the weekend boosted investor sentiment.

Elsewhere, the DFM index dropped -0.6% on the back of weakness in Emaar-related names. Emaar Properties, Emaar Development and Emaar Malls dropped -0.6%, -1.5% and -2.1% respectively.

Macroeconomic concerns returned to the paramount position in determining oil prices last week as both benchmark contracts recorded losses. Brent futures fell 3.69% to settle at USD 61.91/b while WTI ended the week at USD 55.91/b, down almost 3.8%. The impact of the attacks on Saudi Aramco facilities earlier this month has largely faded with Brent now only USD 1.69/b higher than it was prior to the attacks and WTI up slightly more than USD 1/b.

Forward curves weakened in sympathy with the downward move in spot prices. Brent 1-2 month spreads settled in a backwardation of USD 0.87/b at the end of the week compared with USD 1.08/b a week earlier while long-dated spreads also compressed. The front of the WTI curve ended the week barely in backwardation and looks at risk of moving back into contango. Dubai time spreads did weaken along with Brent and WTI but by a far more muted degree. We expect that regional time spreads or grade differentials will be the more explicit expression of geopolitical risk in the oil market, rather than spot Brent or WTI which are more susceptible to factors outside of regional geopolitics.