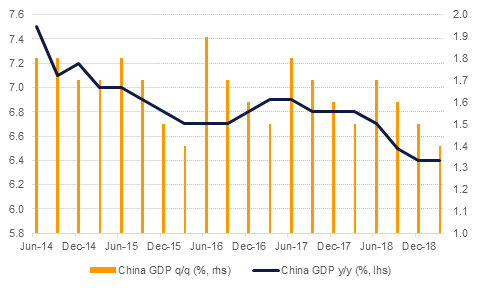

China’s economy expanded by 6.4% y/y in Q1 compared with market estimates of 6.3%. The annual pace of growth was level with Q4 2018 but on a q/q basis the economy cooled to growth of 1.4% compared with 1.5% in the prior three months. While estimates were for a moderation in growth, markets had seemingly been expecting a major slowdown in Chinese output this year. The government is trying to accommodate a slowdown in growth through indirect stimulus (lower tax rates for certain sectors, encouraging lending) but has yet to follow through with a major fiscal stimulus package. Other data out from China showed an improvement in industrial production which rose 8.5% y/y in March, its fastest pace since 2014, while fixed asset investment (related to construction) also improved.

The UK’s labour market continues to show signs of strength even as Brexit uncertainty has gripped financial markets. In the three months to February 179k jobs were added, in line with market expectations, and a slowdown from the very strong 220k reported a month earlier. The headline unemployment rate remains at 3.9% while wage growth ex-bonuses slowed marginally to 3.4% from 3.5% y/y. The steady level of wage growth may provide room for the Bank of England to actually raise rates once the uncertainty over Brexit passes although a clear outcome for the UK’s exit from the EU remains highly uncertain.

Turkish industrial production surprised to the upside on a m/m basis yesterday, in a rare piece of good news for the embattled economy. Growth was 1.3% in February, compared to expectations of just 0.3% and a m/m expansion of 1.0% recorded in January. However, on an annualised basis the results were less positive at -5.1%, reaffirming our expectation that the economy will contract in 2019. Elsewhere, industrial production in the US fell in March, declining by 0.1% m/m, dragged down by lower vehicle manufacturing.

Germany’s ZEW index showed an improvement in investor morale from -3.6 to 3.1 in April, beating market expectations. Assessment of the economy’s current conditions, however, fell to 5.5 from 11 a month earlier. The improvement in morale comes despite the potential of protracted trade negotiations between the EU and US, in particular focusing on how tariffs on German cars can be avoided.

Source: EIKON,Emirates NBD Research

Source: EIKON,Emirates NBD Research

A risk-on attitude took hold of markets overnight at the expense of US treasuries. Yields rose steadily across the curve with the 2yr up 2bps to 2.42% and the 10yr adding 4bps to regain a 2.5% handle. With no negative surprises out of the Chinese GDP data yields are continuing to rise this morning. Bund yields oscillated overnight as a report that ECB officials doubted the regional economy would rebound. In response to the news 10yr bund yields moved to as low as 0.037% before recovering to close at 0.07% at the end of the day.

GCC bonds generally moved in sync with their global counterparts. Average yield on Barclays GCC bond index increased a bp to 4.06% even though credit spreads tightened by 2bps to 157bps.

In the primary market, QNB is on the road with a 3yr FRN offering and Majid Al Futtaim is believed to have mandated banks for a benchmark dollar denominated deal to refinance upcoming maturities.

The dollar index edged higher overnight as Euro and Sterling weakened. Reports that ECB officials doubted that an economic recovery would take hold in the Eurozone weighed on the single currency which closed 0.24% lower overnight.

Sterling fell in response to reports that negotiations between the ruling Conservative party and Labour over Brexit were failing to move forward. Cable weakend 0.37% despite reasonably good labour market data.

The Kiwi dollar is off sharply this morning as inflation data came in softer than expected and the market looks for a cut at the next RBNZ meeting while the Aussie dollar has gained thanks to the positive China GDP figures.

Equity markets were bid up nearly across the board overnight with gains in the FTSE, DAX, CAC and Shanghai more than making up for relatively flat performance in the S&P (0.05%). With earnings not throwing up any major negative surprises, equities continue to benefit from the good underlying performance in the US economy.

Regional markets were more mixed, however. The Tadawul gained 0.6% while the DFM and Abu Dhabi exchanges both closed lower (0.47% and 0.16% respectively).

Oil prices gained overnight as positive risk sentiment gripped markets and the API reported a draw in crude stocks. Brent added 0.8% and did push above USD 72/b this morning while WTI rose more than 1% and is trading around USD 64.50/b today.

The API reported a drop in crude stocks of 3m bbl last week, against market expectations for an increase. Official EIA data is out later today.

On the political front, the Conservative party in the Canadian oil producing province of Alberta looks likely to have won provincial elections, setting the scene for easing regulations on producing oil and gas, and crucially, moving it out of the province. A decline in Canadian oil production has helped to accelerate the market rebalancing so far in 2019.