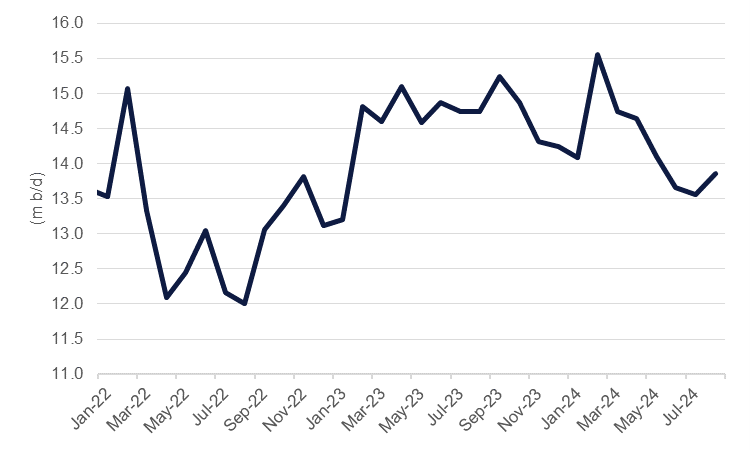

Apparent oil demand in China remained weak in August according to the latest data from the National Bureau of Statistics. China consumed 13.9m b/d in August, a modest increase month/month but still down by 6% year/year on an apparent demand basis. The August demand numbers represent five months in a row of declining year/year oil demand and a drop of almost 1.7m b/d from a post-pandemic peak of 15.5m b/d hit in February this year.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

Oil markets are failing to find any positive signals from China at present. China’s industrial demand data have consistently disappointed markets and it is unclear what scale of support the government is prepared to use to help turn the near-term trajectory for China’s economy around. Refinery throughput was essentially flat in August at just under 14m b/d and while the series can be a little noisy, the moving average trend is clearly on a downward path. Inventory data in China is not as transparent as other markets but on an apparent demand basis stockpiles have been steadily moving higher this year.

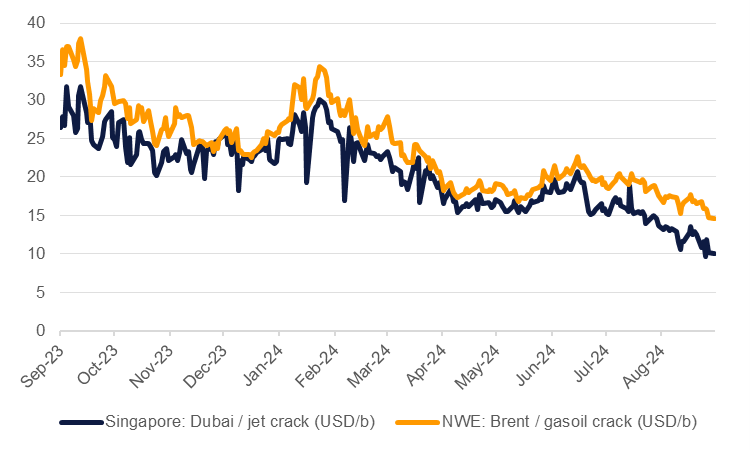

The negative impact of China’s data is not just being felt on crude markets but also impacting products. Crack spreads for gasoil and jet have been tracking the move in crude lower as product prices also sell off. Spreads for Singapore jet fuel over Dubai crude have dropped more than 27% in the last month alone while the spread for gasoil over Brent futures has fallen by 17%.

Source: Bloomberg, Emirates NBD Research. Note: Bloomberg fair values.

Source: Bloomberg, Emirates NBD Research. Note: Bloomberg fair values.

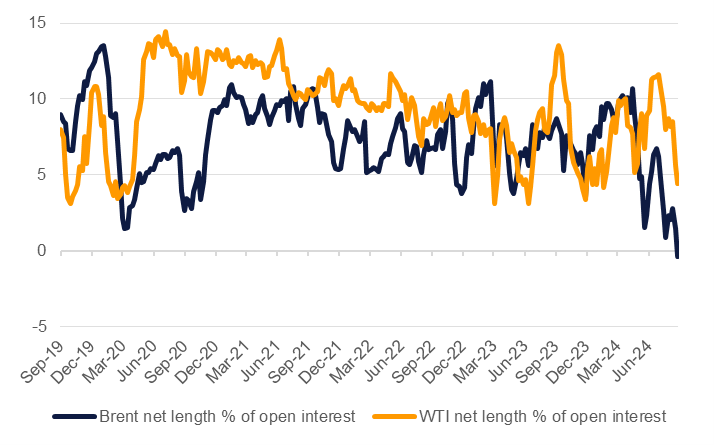

Investors have been responding to the negativity around oil and have cut their net length positions in Brent markets in seven of the last 10 weeks and are now positioned for a net short for the first time since Commitment of Traders data began on the contract in 2011. Positions in WTI are more optimistic with net length still positive at 4.4% of total open interest but nevertheless speculative positioning has crumbled in the last few months.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.