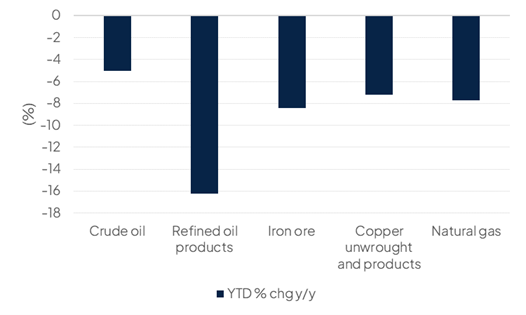

China’s commodity imports have had a muted start to the year, showing few signs of a wider turnaround in activity since the government began to implement support measures in the final months of 2024. The volume of crude oil imports dropped 5% in the first two months of 2025 compared with the same period last year while refined product imports were lower by 16%. In industrial metals, iron ore imports dropped by 8% while copper (unwrought and products) flows dropped 7% ytd.

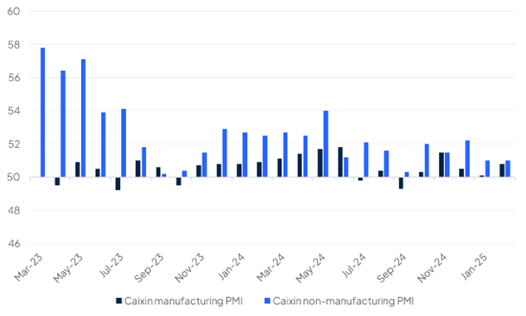

Imports overall showed an 8% drop in US dollar terms in the first two months of the year, disappointing markets and a considerable slowdown from a 1% rise in imports in December 2024. Signs of manufacturing activity have remained soft: the official manufacturing PMI for February improved to 50.2, barely above neutral and it has been holding either side of the 50 level since Q1 2023. Measures from the private sector have been similarly soft with the Caixin manufacturing PMI barely holding above the neutral 50 mark for both January and February.

China’s government has set a fiscal deficit target of 4% of GDP according to a “work report” presented to the country’s parliament in early March, compared with a 3% target set for 2024. That would imply substantial fiscal stimulus to help achieve China’s 5% growth target for 2025.

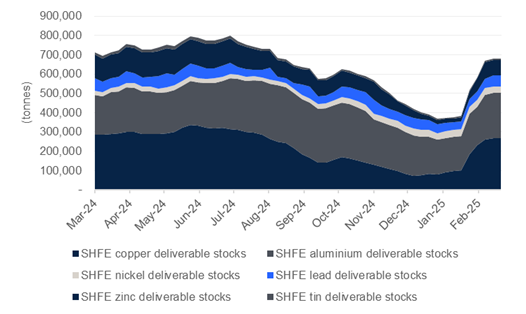

Base metal inventories in Shanghai Futures Exchange inventories have risen substantially since the start of the year, with copper stockpiles in particularly rising to their highest levels since August 2024.

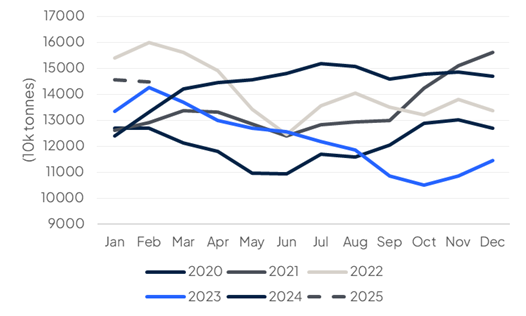

Port inventories of iron ore appear tighter, having drawn down substantially since the start of the year although on a historic basis they still remain above average levels of the last five years.

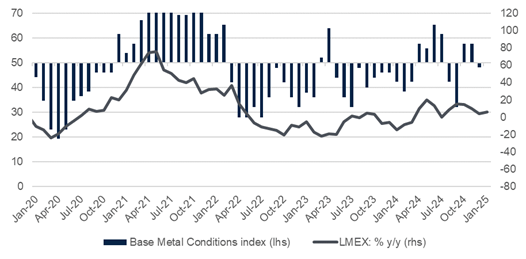

Our measure of base metal conditions is at neutral with gains in the LMEX index limited to less than 10% y/y though gains for copper since the start of the year have been more robust, affected by uncertainty as to whether the metal will also fall under tariffs from the US government.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.Click here to download the full report