In a positive development, China announced that its trade officials will travel to the US early next month for talks. The US Trade Representative’s office confirmed the same without specifying the date. The news comes even as the Fed’s Beige Book showed that the US economy grew at a modest pace in the last two months with businesses remaining optimistic about the near-term outlook. The report, which is based on anecdotal information, described consumer spending as mixed.

US trade data released yesterday showed that the overall trade deficit narrowed to USD 54.0bn in July as exports rose 0.6% m/m and imports dropped 0.1% m/m. The goods trade deficit with China increased 9.4% to USD 32.8bn on an unadjusted basis, the highest since January 2019. However, once adjusted the deficit declined 1.7% in July with both exports and imports dropping.

UK lawmakers took another step towards delaying Brexit to end-January 2020 as they were able to pass a bill which would force UK Prime Minister Boris Johnson to either seek a deal or ask for an extension from the European Union. However, the bill needs to be passed in the House of Lords as well before it becomes a law. Simultaneously, the UK Parliament also turned down the request of the Prime Minister to call a snap election. The votes overnight effectively leaves the UK Prime Minister with no control over his Brexit strategy. However, some clarity should emerge once the bill is passed in the House of Lords over the next couple of days. The UK Parliament is scheduled to be prorogued on 12 September 2019.

The Bank of Canada left interest rates unchanged at 1.75% for a seventh straight meeting. In contrast to other central banks, the Bank of Canada also indicated that it remains comfortable with the current level of monetary stimulus. The central bank added that ‘the economy is operating close to potential and inflation is on target’.

Source: Emirates NBD Research, Bloomberg

Source: Emirates NBD Research, Bloomberg

Treasuries closed mixed amid a revival in risk sentiment and comments from various Fed officials. While the front end of the curve moved lower, the long end held steady. Yields on the 2y UST, 5y UST and 10y UST closed at 1.43% (-2 bps), 1.31% (-1 bp) and 1.46% (+1 bp) respectively.

Gilts dropped sharply as chances of a no-deal Brexit receded after the House of Commons passed a legislation which could force UK Prime Minister Boris Johnson to seek an extension from the EU. Yields on the 10y Gilts rose +9 bps to 0.49%.

Regional bonds continue to trade positive. The YTW on Bloomberg Barclays GCC Credit and High Yield index dropped -1bp to 3.02% and credit spreads remained flat at 158 bps.

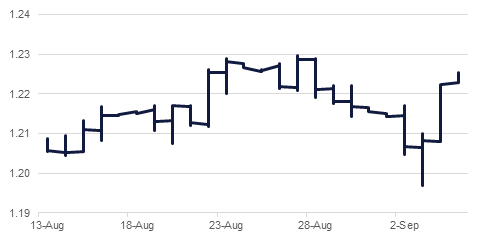

GBP was the top performing major currency on Wednesday as concerns over a no-deal Brexit eased. Over the course of the day, GBPUSD climbed 1.42% to close at 1.2253. Currently trading at 1.2238, the cross needs to achieve a close above the 50-day moving average, 1.2307, and the 23.6% one-year Fibonacci retracement in order to hold onto these gains. A break of these levels would likely result in further gains towards the 1.25 level in the medium term.

Developed market equities closed higher amid easing of tensions around several issues. The S&P 500 index and the Euro Stoxx 600 index added +1.1% and +0.9% respectively.

Most regional indices also rebounded. The DFM index and the Tadawul added +0.1% and +1.7% respectively. Gains were mainly led by banking sector stocks with Al Rajhi Bank gaining +2.7%, National Commercial Bank adding +4.7% and Emirates NBD rallying +0.7%. Arabtec closed +1.3% higher after the company said it is willing to enter into a cooperation agreement with Trojan Holdings.

Elsewhere, stocks dropped in Egypt as investors locked in recent gains. The EGX 30 index ended the day -1.1% lower.

Oil prices jumped higher overnight as risk-on sentiment took hold of markets. News that the US and China would resume trade talks in October will help to keep sentiment positive in the near term. Brent futures closed up 4.2% and ended the back above USD 60/b while WTI closed at 56.26/b, up 4.3%. The API reported a small build in US crude stocks but official EIA data will be released later today.