As was widely expected, the Central Bank of Egypt cut its key policy rates on Thursday, reducing its overnight lending rate and its overnight deposit rate by 100bps. This takes the benchmark rates to 18.75% and 17.75% respectively. The move marks the beginning of what we expect will be a modest easing over the coming year – we envisage a cumulative 400bps of cuts over 2018 following a period of very tight monetary policy previously.

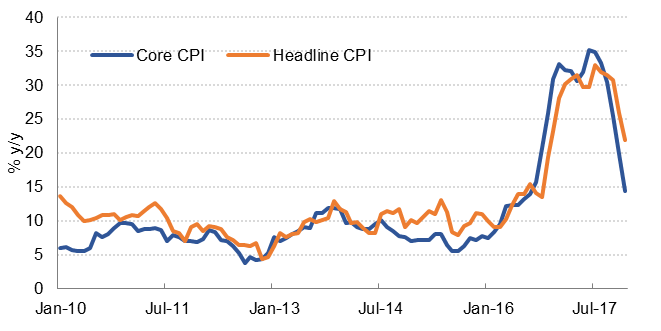

As inflation soared to over 30.0% following a November 2016 currency devaluation, the CBE enacted a cumulative 700bps of hikes in order to curb expectations, and has remained cautious to date even as inflation has begun to slow.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

After inflation data released the week before the MPC meeting showed a fall from 21.9% y/y in December to 17.1% in January, a cut on Thursday – already likely – was rendered all-but-inevitable. January’s print marked the slowest inflation since October 2016, just prior to the removal of the Egyptian pound’s peg to the US dollar. Core inflation fell from 19.9% to 14.4%, the lowest level since September 2016. With the 2016 devaluation now in the base, price growth should continue to ease off over the coming months – though pressures from subsidy removals and tax hikes remain in play, and we anticipate that inflation will remain in double digits over the year.

Higher interest rates in Egypt have been a boon for portfolio investors, spurring a massive inflow of foreign portfolio investment into Egyptian treasury bills, but at the same time they have weighed on consumption and domestic credit growth has slowed. With inflation falling we expect the bank will look to alleviate some of this pressure. Nevertheless, the caution shown to date supports our forecast of only 400bps of cuts over the year, with a chance of a further 100bps if inflation slows more markedly than we expect. Such an outlook is likely to be supported by the IMF, which stated in its recent review that it urged the CBE to ‘consider a gradual easing of policy interest rates only once the authorities are confident that demand pressures and inflation expectations remain contained.’

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

The bank will be wary of cutting too sharply and seeing the strong portfolio investment enjoyed of late drop off. Yields on 91-day t-bills fell to 17.635% this week, their lowest levels in over 12 months. We expect strong international interest to remain at these levels, but the bank will wish to avoid capital flight of ‘hot money.’

Easing monetary policy would support the ongoing real GDP growth recovery in Egypt, which registered at 5.3% y/y in Q2 FY2017/18, marking the fifth consecutive quarter of stronger growth. Real GDP growth in calendar 2017 was 5.0%, the strongest since 2010, just prior to the ouster of long-serving President Hosni Mubarak. Unemployment, at 11.3% in December, is also at the lowest levels since 2010. According to the MPC’s communiqué, this growth recovery has up to now been driven by greater external demand, owing to the more competitive currency, and public domestic demand, while private domestic demand has lagged. As monetary policy eases and inflation falls, we would expect this to pick up also.