The Central Bank of Egypt (CBE) kept its benchmark overnight deposit and lending rates on hold on Thursday, at 9.25% and 10.25% respectively, in line with expectations. While the multigenerational upheaval caused by the coronavirus pandemic currently seen around the world, and in Egypt, makes it more difficult to predict where rates may end up this year, our expectation would be that the bank will keep them steady for the next several meetings.

At the start of the year, prior to the outbreak of the pandemic, we had anticipated that the overnight deposit rate would end 2020 at 10.75%, implying a cumulative 150bps of cuts over the 12 months, as the CBE had seemingly become more cautious once again. The bank has been walking a tightrope between supporting economic growth and the government’s budget balance (debt servicing costs are a major fiscal outlay), or keeping foreign exchange flowing in to local debt since it began its IMF-sponsored reform programme in late 2016, but it has tended to err on the side of supporting portfolio investment. Maintaining a healthy real interest rate - especially when compared to its carry trade peers, with Turkey having fallen into negative rates - has made the country one of the most attractive local debt stories in the world, especially when combined with the EGP’s strong performance.

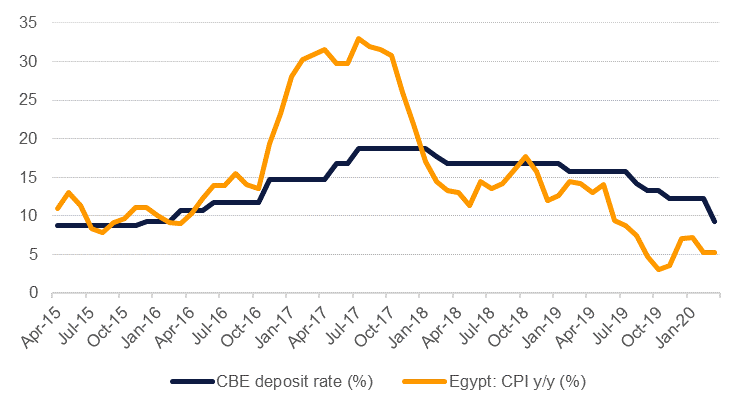

Given that the 300bps cut enacted in an unscheduled move earlie in March takes the overnight deposit rate some way lower than our previous year-end forecast, we are inclined to believe that the bank will remain on hold for the next several meetings, and this was supported by the bank’s MPC statement which did not give the impression of a dovish pause. Real rates remain positive at 3.95% as inflation came in at 5.3% in February, down from 7.2% the previous month, but further interest rate cuts could see this margin narrow, making Egypt less attractive to foreign portfolio investment. It is certain that the risk-off sentiment that has taken hold across all asset classes will have dampened sentiment towards Egypt, and outflows from local debt are inevitable. This can be mitigated to a degree, however, by maintaining a comparatively attractive return. As other FX inflows, from tourism especially given that all flights have been cancelled, but also remittances and exports, will have fallen off a cliff, maintaining some portfolio inflows will become ever more important for Egypt's balance of payments. Diminished imports will help in this, but the modest sell-off in the pound over the past month is indicative of greater strain.

Should the disinflationary trend continue, there could be scope for the bank to enact further cuts in order to support the economy at this trying time. The PMI survey result of 44.2 for March was the fastest deterioration in the non-oil private sector for years, and April will likely be even weaker, and the bank might look to further ‘support economic activity, especially businesses and households’, as it did with its extraordinary 300bps cut. However, there will likely be significant volatility in prices in the coming months, owing to virus-related disruptions. Petrol prices may well come lower given the oil price crash, but this could be significantly offset by food - the largest component of the basket - as supply chains are disrupted and people engage in panic buying. As such, we maintain that a hold will be maintained over the next several meetings.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.