Carbon markets are in the early stages of development across the major GCC economies of the UAE and Saudi Arabia. Both countries have made commitments to achieve net-zero carbon emissions by 2050 and 2060 respectively and making use of carbon markets, along with other emissions reductions strategies, will help the journey toward those targets.

Carbon credits are financial instruments that permit emissions from a company’s operations under a set national limit, usually reducing on an annual basis. A carbon offset is a certificate generated by a project that draws carbon out of the atmosphere, through development of a natural resource like a forest, or a project that doesn’t add carbon - a renewable energy facility for instance. Carbon trading can take place under mandatory rules, such as the EU’s Emissions Trading System (ETS), in which credits are auctioned or allocated to participating companies who then make use of the credits to cover their emissions and then buy or sell more if needed or they have too many. Voluntary carbon trading markets exist as well in which companies buy offsets from qualifying projects to offset their carbon emissions. Etihad in the UAE has made use of voluntary offsets to help reduce some of its carbon emissions.

The 2021 UN Climate Change Conference, COP 26 held in Glasgow last year, achieved a global breakthrough on carbon market operations to avoid double counting any reduction in emissions. It also allowed for voluntary carbon trading to be counted toward a nation’s Nationally Determined Contribution (NDC), the carbon reduction plans submitted to the UN as part of the Paris Agreement on climate change. That should help to empower the development of domestic or regional carbon markets and channel investment toward more offsetting projects.

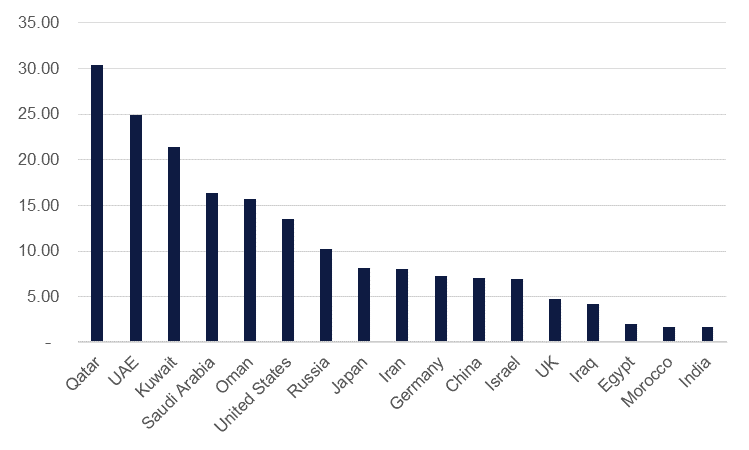

There is a compelling need for economies in the Middle East, and in particular the GCC, to lower their carbon emissions. Compared against peer economies, carbon emissions on a per capita basis are substantially higher. The UAE’s carbon emissions per capita was nearly 25 metric tonnes CO2 in 2020 compared with around 14 metric tonnes in the US or 7 metric tonnes in Germany.

Source: BP Statistical Review of World Energy 2021, World Bank, Emirates NBD Research

Source: BP Statistical Review of World Energy 2021, World Bank, Emirates NBD Research

Apart from helping the GCC economies meet their nationally determined contributions by offsetting the impact of domestic emissions, the development of carbon markets in the GCC economies could also help to cycle investment domestically toward carbon abatement projects themselves. Carbon capture and storage (CCUS) are major parts of the climate change mitigation plans in both the UAE and Saudi Arabia and a market for the carbon offsetting capacity of CCUS projects could help to ensure their economic viability. A deep market for carbon could also help to offset the impact of Scope 3 emissions from regionally sourced oil and gas exports.

In the UAE, Abu Dhabi Global Market (ADGM) announced this week that it would establish a regulated carbon exchange and clearing house to allow for trade in carbon credits and offsets and eventually develop a derivatives market for carbon assets. ADGM will host the exchange though the carbon trading could relate to projects and companies operating outside of the UAE. In the terms of the UAE’s second NDC, submitted in December 2020, the country supported the “development and operationalization of market mechanisms aimed at emissions reduction” which would likely entail the development of a domestic carbon market.

In Saudi Arabia, sovereign wealth fund PIF has announced it will establish a carbon credit trading platform with cooperation from Saudi Aramco, ACWA Power, Saudi Arabian Airlines, Maaden and Enowa. The first auction of carbon credits is meant to begin in Q4 this year. Like the UAE, Saudi Arabia is committed to the development of carbon markets as part of its NDC that was revised in October 2021.