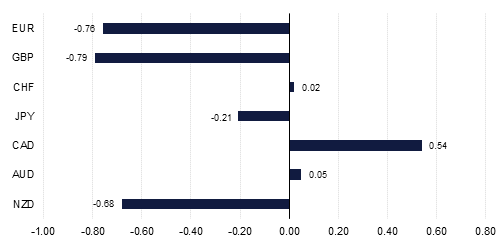

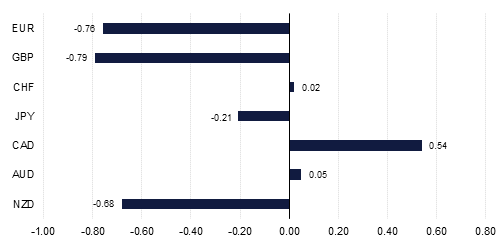

- EURUSD: Despite softer than expected U.S. employment data, EURUSD has broken below the 50-day moving average and looks vulnerable to further declines. In the week ahead, the one-year low of 1.1509 will be a key level to watch, with a weekly close below this level causing more significant short term declines.

- USDJPY: Safe haven bids amid growing concerns over protectionism helped reverse the JPY weakness induced by BOJ tweaks last week. Looking forward, the fate of JPY will continue to be linked to risk appetite which is likely to remain volatile.

- GBPUSD: In contrast to the Bank of England unanimously raising interest rates 25bps, taking the rate to the highest level since 2009, the pound has continued to feel the pain of Brexit uncertainties.

- USDCAD: With the Canadian economy continuing to show resilient growth, the CAD has outperformed the other G-10 currencies over the previous week, with not even a decline in hydrocarbon prices able to hinder its advance.

Weekly currency movement vs USD (%)

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Click here to download the full FX Week publication

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research