In an unexpected move, the speaker of the UK’s house of commons announced yesterday that he would not allow a third vote on the EU withdrawal agreement unless it was materially different to what has been voted on before. PM May had been expected to put the deal before the house today, in a bid to get it approved before the EU meets later this week. Sterling initially weakened on the news, but has since recovered as the PM is now expected to seek a longer extension - perhaps up to a year - to the UK’s EU membership on Thursday. However, it may still be possible for the government to find a way to put the existing deal before the House before the end of March, and legal advice is reportedly being sought by Downing Street.

OPEC has decided to skip its next meeting which had been scheduled for April as there is consensus within the producers’ bloc to maintain the production cuts that have been in place since January. Inventories globally appear to be flattening out rather than drawing down significantly, compelling OPEC and its partners to maintain or deepen their production cuts, even as several large producers like Iran and Venezuela face substantial unanticipated outages thanks to sanctions and economic unrest. Saudi Arabia’s energy minister, Khalid al Falih, refuted that OPEC was under pressure from the US to raise output although we would expect US president Donald Trump to maintain criticism of OPEC as oil prices maintain their upward move.

The UAE central bank has announced a program to ease the personal debt burden of UAE nationals, which is due to come into effect in April. The program is open to those nationals whose debt repayments exceed 50% of their monthly income and involves consolidating debt and capping the repayments over four years. Separately, the minister of Human Resources and Emiratisation indicated that the ministry would step up efforts to create more private sector jobs for nationals.

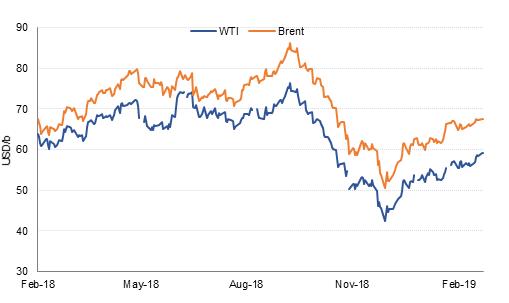

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

All eyes remain on the FOMC meeting this week and as a result activity in the treasury market has been muted. Yields on 10yr USTs closed above 2.6%, an 8bps increase on the end of last week. Markets have nearly entirely priced out any chance of a hike this week while most scrutiny will fall on whether the Fed cuts its rate projections to just one hike this year.

GBP was yesterday’s softest performing major currency, GBPUSD closing 0.26% lower at 1.3255. This morning, the cross has rebounded and risen 0.15% and is currently trading at 1.3276. It is noteworthy that thus far in the week, support has been found at the 100-week moving average (1.3221) a level that was breached with a firm weekly close the previous week.

This morning’s strongest performer is JPY which has strengthened due to the negative performance of Asian equity markets. As we go to print, USDJPY is trading 0.18% lower at 111.22 and appears to have found resistance at the 200-day moving average (111.45) this morning. Its current level sits close to the 100-day moving average (111.28) and should the price close below this level, there may be further selling pressure, especially in the build up to this week’s FOMC meeting.

Equity markets were generally higher to start the week. Both the S&P and FTSE gained while the Shanghai Composite rose nearly 2.5%. Local markets also received a boost with the DFM gaining 1.6%, the Abu Dhabi exchange up 1.8% and the Tadawul rising 1.05%.

Oil markets continued to march higher overnight, buoyed by comments from Saudi Arabia that the existing output cuts would remain in place and would likely do so until H2 2019. Brent futures rose nearly 0.6% to end the day at USD 67.54/b while WTI is above USD 59/b.

The EIA expects shale output to rise by 85k b/d in April to account for 8.59m b/d of US production. The monthly gains have been slowing as the base of shale production increases and the drilling rig count in the US has plateaued.

Iron ore may be at risk of lurching higher once again as a court in Brazil has ordered the closing of two more tailing dams in the country, backing up production. At USD 86.28/tonne, iron ore is up more than 17% ytd.

Click here to Download Full article