Brexit has been delayed until at least mid April after the EU granted the UK an extension. The EU will let the UK leave on May 22nd if parliament votes in favour of prime minister Theresa May’s exit deal but will only delay Brexit until April 12th if parliament again rejects the deal. While the exit date has changed the manner of that exit has not changed materially and the risks of no deal, a parliamentary election or revocation of Article 50, among other options, all remain roughly the same as they did prior to the extension. The PM may try to bring her deal to parliament for a third vote this week but there are few signs political conditions have changed to allow it to pass. Parliament will also hold indicative votes this week to try and identify alternatives to the PM’s deal but it remains difficult to find any scenario that a majority in parliament would support.

With the outcome of Brexit still highly uncertain, the Bank of England voted unanimously to keep rates at 0.75% at the MPC meeting last week. The UK’s economy continues to show underlying strength and the BoE revised its projections for Q1 growth up to 0.3% from 0.2% earlier. However, should Brexit unravel in a disorderly fashion, the blow to investment and consumer confidence in the UK could derail growth and force the Bank to keep rates on hold or lower them later this year.

The US attorney general, William Barr, has released a summary of the two-year long Mueller investigation into whether Donald Trump’s 2016 presidential campaigned colluded with Russia in Trump’s elections. The investigation has concluded that the campaign did not work with Russia but it was inconclusive over whether Trump had tried to obstruct justice by interfering with the investigation. Nevertheless, Republicans in the US have been quick to pounce on the ‘no collusion’ conclusion and the outcome clears one challenge the president would have had to contend with in the run up to the 2020 election.

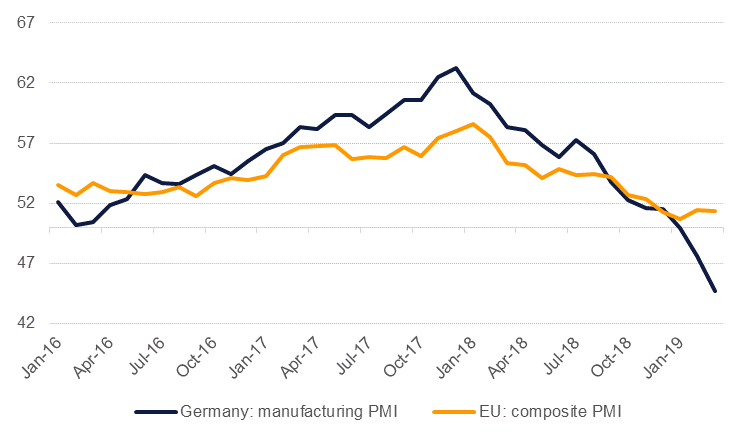

PMI data out of major European economies reinforced the trend of slowing growth. The flash composite PMI for March dipped to 51.3 from 51.9 a month earlier and was below market expectations. On a country-breakdown, the composite PMI data for France fell to 48.7, implying the economy is contracting, while in Germany manufacturing continues to sink (44.7) even as services managed to hold up reasonably well.

Source: Haver, Emirates NBD Research

Source: Haver, Emirates NBD Research

US Treasuries surged on heavy volumes last week with yields dropping by 12-15 bps across the curve in response to the unexpectedly dovish statement and the revised dot plot that followed the last week’s FOMC meeting. Yields on 2yr, 5yr, 10yr and 30yr USTs closed the week at 2.32% (-12bps, w/w), 2.24% (-16bps, w/w), 2.44% (-15bps, w/w) and 2.87% (-14bps, w/w) respectively. Weak economic data out of the Euro area supported a similar decline in yields on sovereign bonds in Europe with 10yr Bund yields turning negative to close at -0.017%. Fears of slowing global economic growth kept pressure on risk assets. CDS levels on US IG and Euro Main increased circa 10bps to 69bps and 70bps respectively.

Regionally, GCC bonds rallied mainly on the back of the downward shift in benchmark yields. Though credit spreads were range-bound at 172bps (-1bp w/w), yield on Bloomberg Barclays GCC bond index dropped 13bps to 4.09%. Fitch downgraded several banks in Oman including Bank Muscat and Bank Sohar last week to BB+ and BB respectively. Fitch also upgraded Egypt’s rating by one notch to B+/stable citing satisfactory progress on economic and fiscal reforms in the country.

In the primary market, after the successful placement by QIB early in the week, QNB raised USD 1bn in 5yr Reg S bond that priced at MS + 130 bps, circa 20 bps tighter than the initial guidance.

A significant decline on Friday resulted in EURUSD closing 0.21% lower last week at 1.1301. As a result, the price moved back below the 50 and 100-day moving averages (1.1352 and 1.1367 respectively) as well as the 200-week moving average (1.1339). This is the third consecutive week EURUSD has closed below the 200-week moving average which has a bearish short term outlook for the cross. While the price remains below this level, there is a risk of a retest of the 2019 lows of 1.1177.

A 1.39% decline resulted in a close of 109.93 for USDJPY on Friday, the first weekly close below 110 in six weeks. The move is also technically significant as it resulted in a break below both the formerly supportive 50-week moving average (110.97) and the 100-week moving average (110.83). In the week ahead if the 50% one-year Fibonacci retracement (109.56) fails to provide support, a larger decline towards 108.50 cannot be ruled out.

GBPUSD fell by 0.61% last week, closing at 1.3209 on Friday. The price had broken below the 50-day moving average (1.3066) and traded as low as 1.3004 before recouping some of the losses. Analysis of the weekly candle chart reveals that the price has closed below the 100-week moving average (13220). This was a former resistance level that was breached last week and while the price remains below this level, risks remain to the downside.

The Turkish central bank took decisive action on Friday as the lira endured substantial losses against the dollar, part of a wider EM currency sell-off. According to a statement from the TCMB, one-week repo auctions would be suspended ‘for a period of time’. The bank has two other rates still in use for emergency lending, the overnight lending rate (25.5%) and the late liquidity window (27.0%), both higher than the current one-week repo rate (24.0%). The move is a reversal of the simplification of interest rate policy heralded last year, but does signal that the bank is prepared to act immediately to protect the lira where necessary.

Equity markets sank at the end of the week as disappointing data out of the US and Eurozone compounded fears of a broad economic slowdown. The S&P 500 fell almost 2% while in Europe the FTSE and Dax were down by 2% and 1.6% respectively. Asian markets are selling off to begin this trading week.

In regional markets, it was all negative overnight. The DFM fell by 0.4% while the Abu Dhabi and Tadawul indices gave up 0.6% and 0.7% respectively.

The rally in oil prices took a breather last week as more negative data reinforced the soft outlook for growth this year and there were few oil-specific catalysts to shift markets. Brent fell marginally over the week after touching 2019 highs of USD 68.69/b. The international benchmark ended the week at USD 67.03/b, down 0.2%. WTI fared better, closing the week up just shy of a gain of 0.9% at USD 59.04/b after earlier rising above USD 60/b. WTI failed to close above the USD 60/b handle which would appear to be the next psychological barrier for the US grade to push through.