- Another Brexit deadline has been averted, as UK Prime Minister Boris Johnson and European Commission President Ursula von der Leyen agreed yesterday to ‘go the extra mile’ and allow some more days to negotiate a free trade deal between the UK and the EU. The pound strengthened modestly in early morning trading this morning. No new date by which a trade deal must be reached was given, but December 31 seemingly remains a hard deadline as it marks the end of the transition period and any extension would require legislation.

- The ECB expanded its PEPP spending programme by a further EUR 500bn until at least March 2022 – or when it judges the pandemic crisis to be over – at its meeting on Thursday, as it recognised the economic threat from renewed Covid-19 related shutdowns over recent months. This takes the size of its primary pandemic support mechanism to EUR 1,850bn. Key interest rates were left unchanged once more, with quantitative easing having been the primary tool of the bank throughout the pandemic crisis.

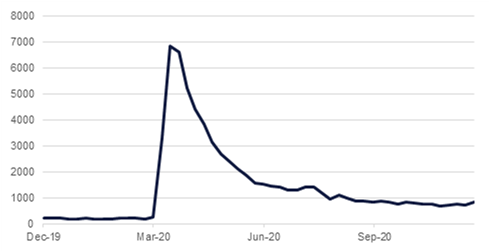

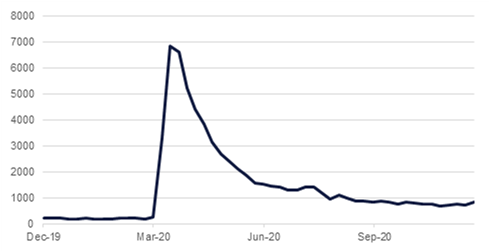

- Initial jobless claims in the US came in above expectations in the week ending December 5, hitting 853,000 compared to consensus of 725,000 and the previous month’s (upward revised) 716,000. This was the highest number since mid-September, and is indicative of the renewed stresses placed on the US economy by a resurgent virus.

- More positively, new jobs openings in October came in higher than expected in data released last week, with the JOLTS figure rising from 5.5mn in September to 6.7mn, beating consensus of 6.3mn. This is a more backward reading than the jobless claims data, however, and largely preceded the worst of the recent surge in cases and renewed shutdowns.

- Egyptian CPI inflation ticked up to 5.7% in November, from 4.5% in October. This was the fastest rate since April, and while it remains below the CBE’s target range of 9% +/- 3pp, we now expect that the central bank will hold its benchmark interest rates steady at its upcoming December 24 meeting.

- The UAE government has announced a strategy to double the value of domestic tourism, as it looks to shore up the industry in the face of an ongoing pandemic-related hit to international travel.

US initial jobless claims ticking up again ('000)

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Fixed Income

- US treasuries rallied last week, snapping two weeks of declines, as continued political horse trading holds up agreement on a new support package while the economy suffers from the latest round of Covid-19 shutdowns. Yields were lower across the curve with the 2yr UST seeing some notable movement—sinking 4bps over the week—with most of the action taking place at the end of the trading week. The 10yr UST yield fell 7bps to close back below 0.9%.

- Bond markets globally had a solid week with gains across Europe, high-yield and emerging market bonds. Beyond the risks associated with the pandemic, the anxiety over a rapidly approaching hard Brexit is weighing on markets along with an element of rebalancing as investors shift out of risk assets in favour of bonds.

- Markets will be watching for the US Federal Reserve later this week. While we don’t expect any substantial change in policy—such as raising the level of monthly asset purchases—commentary surrounding the outlook for the economy in the absence of a fiscal deal will be highly scrutinized. The Fed will also release new economic projections at its FOMC with expectation they could revise up their outlook given the resilience of the US economy and prospects for a Covid-19 vaccine.

FX

- The dollar managed to end the week higher after several choppy sessions. Persistent failure to reach a new fiscal deal in the US Congress is seemingly being counterweighed at the moment by the pending collapse in Brexit negotiations with sterling the main loser against the greenback last week. Sterling fell 1.6% to close out the week at 1.3224, its lowest level since mid-November. More downside risk for sterling could become apparent in the coming days if talks between the EU and UK break down further.

- The Euro and yen were broadly stable over the course of the week although there were some wide intraday moves. Additional stimulus from the ECB revealed at the end of last week helped to support the Euro while approval of the EU budget will also help sentiment.

Equities

- It was a poor week for global equity indices, as political risk weighed on sentiment and drove investors away from risk assets as the end of the year nears. Concerns over a hard Brexit are particularly to the fore, although a weaker pound served to cushion the FTSE 100’s decline, as the index fell only -0.5% w/w. Other European stocks were hit harder, as the DAX (-1.4%) and the CAC (-1.8%) both declined.

- Ongoing Covid-19 worries also weighed on sentiment, particularly in the US where new restrictions have been announced and a fiscal boost remains unrealised. All three major indices ended the week lower, as the Dow Jones, NASDAQ and S&P 500 lost -0.6%, -0.7% and -1.0% respectively.

- Equities were more positive in the region, as the DFM ended the week 2.6% higher and the Tadawul gained 0.9% w/w.

Commodities

- Oil prices posted some moderate gains last week after managing to hit their highest levels since March. Brent settled up 2.2% at 49.97/b after having closed above USD 50/b mid-week while WTI closed at USD 46.57/b, a w/w gain of 1.6%.

- Oil markets will be watching for the monthly updates from the IEA and OPEC this week as the institutions assess the impact of OPEC+ choosing to raise their production levels only marginally for the start of 2021.

Click here to Download Full article

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research