Bond markets started the year on a cautious note as positive economic data across the developed world caused benchmark yields to widen. Yields on 2yr and 10yr UST rose 7bps each to 1.96% and 2.48% respectively in the first week of trading and those on 10yr Gilts and Bunds closed at 1.24% (+6bps) and 0.43% (+1bp) respectively.

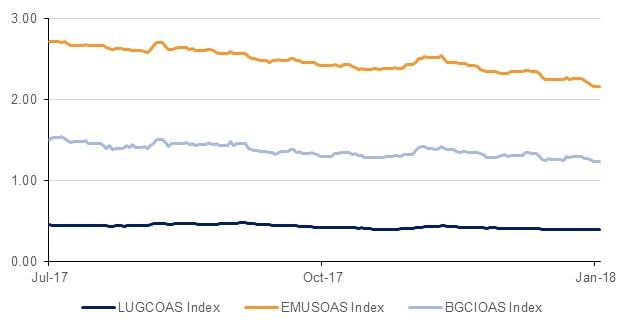

MiFID II went live earlier last week and may have disrupted trading volumes somewhat. Nevertheless, with no material cause for concern for the corporate sector, credit spreads continued their tightening bias. CDS levels on US IG and Euro Main recorded tightening by 3bps and 2bps to 46bps and 44bps respectively. Also OAS on global credit index of cash bonds narrowed by a bp to 86bps.

Regionally, GCC bonds had stable start to the year as benchmark yield widening was counter balanced by an average 7bps tightening in credit spreads on the Barclays GCC bond index from 130bps to 123bps thereby leaving the average yield on the index unchanged at 3.57%. Investors effectively shrugged off concerns about geopolitical events including the protests in Iran.

The week also marked the introduction of VAT in the region. To smoothen the transition, the KSA government is offering an extra 1000- riyals a month to Saudi workers as ‘cost of living’ allowance for an year. KSA announced plans to push the timeline for balancing the budget to 2023 instead of 2019. KSA curve has remained resilient in the face of varied news. Yield on KSA 26s closed at 3.43%, 6bps tighter than last week and nearly 30 bps tighter than where they were an year ago.

Bonds from the banking sector were largely unaffected by the expectations of slower growth in fee and commission based income which will be impacted by VAT as majority of the core lending remains VAT exempt.

In preparation for a public IPO later this year, Saudi Arabian Oil Co., as Aramco is formally known, will become a joint-stock company with 200 billion ordinary shares and 60 billion riyals of paid-up capital ($16 billion). The KSA government stressed that the state will retain direct ownership of the majority of Aramco shares in the foreseeable future. Aramco currently only has SAR denominated bonds and is expected to engage in dollar denominated bonds or sukuk soon.

On the ongoing Dana Gas case, the hearing relating to illegality of its $700 million sukuk debt in Sharjah Court on Dec. 25 was adjourned.

In the primary market, Sultanate of Oman rated Baa2 by Moodys has mandated banks for a triple tranche dollar bond as it looks to fund its OMR 3bn ($7.8bn) budget deficit for 2018. In another development, Oman is believed to have accepted a $210 million grant from the KSA government to fund development of its Duqm port where a fishing facility and oil refinery are underway.

Also Qatar International Islamic Bank has mandated banks for a benchmark sized dollar denominated sukuk in mid January.

Source: Emirates NBD Research

Source: Emirates NBD Research