The BOJ made a few small technical changes to its monetary policy today. While it kept its 10-year JGB yield target at 0.0% and left its policy balance rate at -0.1%, the BOJ will allow greater flexibility in its bond operations allowing for upward and downward movement in 10-year yields. The announcements were less than the markets were anticipating, especially with the BOJ pledging to keep very low rates for an ‘extended period of time’. In reality it is hard to see what more the BOJ could do in view of the downward revisions to its inflation forecasts, and the markets are already reacting by selling the JPY after it rose last week.

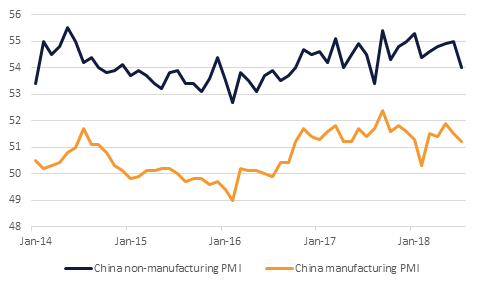

The European Commission Economic Sentiment Indicator showed a decline in July to 112.1 from 112.3 in June. The drop was a little better than the consensus forecast and the breakdown showed a dip in manufacturing confidence, while services sector confidence rose to 15.3 from 14.4 in the previous month. However, despite this small fall the index remains consistent with steady growth across the Eurozone, as it is still above its long-run average. The data is in line with the ECB's central scenarios, and re-affirms last week’s caution from ECB President Draghi that protectionism poses a ‘risk to otherwise healthy global growth’. Eurozone Q2 GDP is released today and is expected to have expanded by 0.4%. China’s manufacturing PMI meanwhile slipped to 51.2 in July from 51.5 in June, while the non-manufacturing PMI stood at 54 down from 55. The weaker performance helps explains the government’s raft of fiscal and monetary policy support measures announced last week which is having the effect of softening the CNY.

Turkey’s economic confidence index rose for the first time in 2018 in July, climbing to 92.2 from June’s 90.4. The improvement in the headline index was broad based, with consumer, service sector, retail trade and construction confidence all posting improvements, and only real sector confidence slipping. That being said, the index has fallen markedly since the 104.9 recorded in January.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

U.S. Treasuries extended their declines on Monday following market expectations that the Bank of Japan may announce tweaks in its monetary stimulus, with U.S. 10 year yields rising to session highs and six-week highs just shy of 3% (2.99%).

This morning treasuries have gained as the curve has experienced flattening after the BOJ maintained monetary policy (see macro). As we go to print 2 year yields sit at 2.65%, while 5 year yields and 10 year yields sit at 2.83% and 2.95% respectively.

JPY has weakened in the aftermath of the Bank of Japan meeting, USDJPY trading 0.25% higher at 111.34. We expect support at the 110.85 level (61.8% one year Fibonacci retracement) and resistance at 112.33 (76.4% one year Fibonacci retracement).

Yuan weakness remains a theme at the start of the week after hitting one year lows last week. Its softness reminds markets that the trade spat is far from over and is a negative factor for other regional currencies. Soft PMI activity data from China overnight also underscores the Chinese authorities’ effort to provide an offsetting fiscal and monetary stimulus seen last week.

Developed global equity markets closed in the red yesterday following a lack of risk appetite in the market. In the U.S. the S&P 500 closed 0.58% lower, while Nasdaq fell by 1.39%. Equities in the Eurozone shared similar fates with the DAX declining by 0.48% and Euro Stoxx 50 losing 0.38%.

This morning, Asian equity markets are having mixed performances and the Nikkei is currently down 0.21% while the Shanghai composite is unchanged.

Brent futures closed at USD74.78/b overnight, a 0.9% gain on Friday’s close, and the highest level in two weeks. WTI also gained, rising 2.1% on Friday’s close and narrowing some of the wider spread that had emerged last week. There are a number of upside pressures currently in play, including industrial action planned at three North Sea fields, the suspension of Saudi Arabian crude shipments through the Bab el-Mandeb following an attack on oil tankers last week, and the ongoing threat to Iranian volumes owing to pressure from the US.

Click here to download publication