Canada’s wholesale trade sales for May were released yesterday, showing a m-o-m expansion of 1.2%, compared to expectations of 0.7% and just 1.2% growth the previous month. That took the total to a record-breaking CAD63.7bn. Miscellaneous goods which were up 7.8%, building supplies up 7.3% and there was a 25.5% gain in farm products. The motor vehicle and parts subsector posted the largest decline at 2.5%, perhaps an indication that firms are becoming increasingly affected by the ongoing trade spat with the US, and the risk of further tariffs to be imposed on autos imports.

US existing home sales data for June were released yesterday, surprising to the downside. Consensus expectation had been for 5.44mn, which would have represented m-o-m growth of 0.2%, but in actual fact sales declined by 0.6% m-o-m, a third consecutive month of declines. A number of factors are holding back demand, crucial amongst them is the general lack of a supply – the US housing inventory rose y/y in June for the first time in three years. Sellers are being lured back to the market by high prices, but prices are currently too high for many first time buyers, given that they have risen considerably faster than wages. Further, rising borrowing costs will further dampen demand.

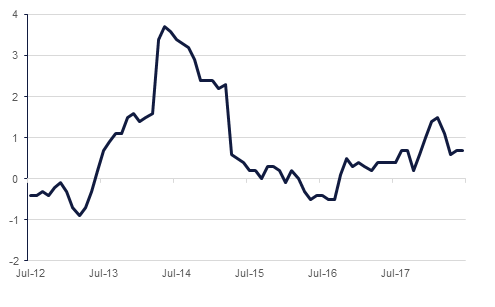

A newswire report yesterday suggested that the Bank of Japan (BoJ) is in ‘preliminary’ discussions to change its stimulus program to make it more sustainable. This comes in the lead-up to the central bank's July 30-31 policy meeting, where the BoJ is widely anticipated to downgrade inflation forecasts. Japan's June core CPI lifted to a rate of 0.8% y/y, up from 0.7% y/y in May, but is still far short of the central bank's 2% target. The BoJ’s main measure of inflation, excluding fresh food and energy, fell back to 0.2% from 0.3%. The report cited potential tweaks to the yield-curve control mechanism to allow for a more natural rise in long-term interest rates, and operational changes to the way the BoJ buys government bonds and ETFs with the aim of increasing market liquidity and reducing distortions to price action. The details are still unclear, and the BoJ will be wary of tightening its policy just when inflation projections are being revised lower. However, the central bank faces pressure to alleviate the strain on bank profits stemming from its unprecedented stimulus measures.

Treasuries closed lower as the curve continued its steepening from the end of last week. The steepening appears to be driven in part by technicals and sharp moves in the JGB curve. Yields on the 2y UST, 5y UST and 10y UST closed at 2.63% (+3 bps), 2.81% (+5 bps) and 2.95% (+6 bps).

Yields on the 10y Japan Government bond rose to 0.08% from 0.03% amid speculation over a shift in monetary policy by Bank of Japan.

Regional bonds closed lower with the YTW on the Bloomberg Barclays GCC Credit and High Yield index rising +2 bps to 4.48% even as credit spreads tightened 5 bps to 170 bps.

The focus remains on the JPY in the run up to next week’s BOJ meeting at which an adjustment in the central bank’s ultra-easy monetary policy is anticipated. Elsewhere the Bloomberg dollar spot index was a little firmer overall as yields rose slightly ahead of an expected strong Q2 GDP reading and ahead of a possible Fed policy tightening next week. Rumors of a 4.8% advance Q2 GDP print have been circulating following a Fox News tweet citing White House sources and suggesting a near 5% growth rate on Friday.

Cable has resumed its softer tone after recovering a little yesterday. The EU Brexit negotiator Michel Barnier yesterday warned that the UK government’s proposals to exclude services from any trade deal would not be acceptable and have added to recent indications that a ‘hard’ Brexit may be almost unavoidable.

Developed market equities closed mixed as concerns over geopolitics were offset by strong earnings. The S&P 500 index added +0.2% while the Euro Stoxx 600 index declined -0.2%.

Regional equities closed mixed with the DFM index adding +0.4% and the Tadawul losing -0.2%. Saudi Kayan gained +6.3% after the company reported a strong set of Q2 2018 earnings.

Brent crude closed flat overnight, as markets shrugged off sabre-rattling by the Iranian and US presidents, Hassan Rouhani and Donald Trump. Brent futures closed at USD 73.06/b, compared to USD 73.07/b at close on Friday. WTI saw a more meaningful 3.7% decline to USD 67.89/b. The stronger dollar likely contributed to the decline.